Breadtalk – [ Are You Listening Carefully? Here’s What We Heard]

Chart Source: Poemsview 20th Nov 2019

Breadtalk has been the talk of the town recently as there was a huge surge in volume which was never seen before in the last 8 years. As such it garnered quite a bit of attention from the public.

Breadtalk caught our attention as the volume was screaming to us. Such huge volume would warrant some attention. On Further investigation, there was some change in interest for the substantial shareholders for breadtalk which sparked our interest too. More details can be found here. Also after that burst last Friday, price retraced to the 50ema support which gave us another reason to look at it.

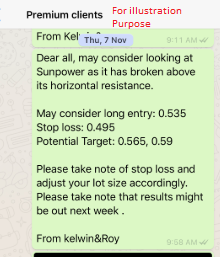

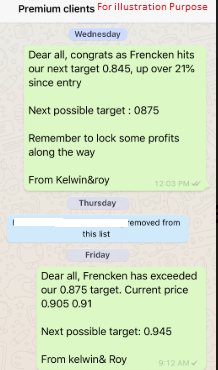

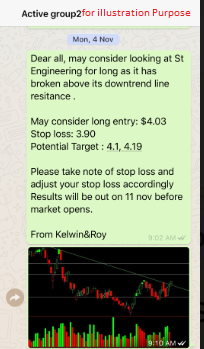

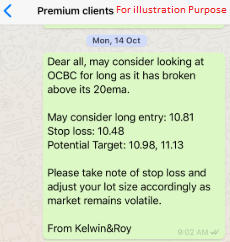

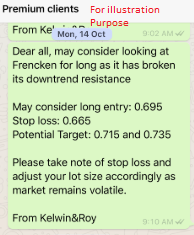

As such, we decided to alert our EXCLUSIVE CLIENTS on 19th Nov for them to plan, prepare and proceed. With that we saw breadtalk moving up to our second target of 0.66 an upside of 7% in two days since our entry

Breadtalk’s closing candle doesn’t look that good to us and might be expecting some pullback in the coming days before we take a look at it again.

Want to be informed of future development of breadtalk?

Want to be part of this EXCLUSIVE GROUP that were alerted of such a trade analysis?

Wait no more! CONTACT US NOW to see how you can be part of this group to receive value added service sent straight to your handphone.

Yours

Humbly

Kelwin&Roy