Sembcorp Marine – [ Might Be Worth Looking Again, Here’s Why]

Chart Source: Poemsview 30th June 2019

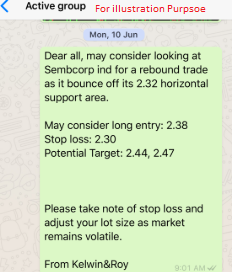

Sembcorp Marine had a nice upswing of about 5% since the last time we blogged and we’re looking at it again.

Here’s some of the reason why Sembcorp Marine is on our watchlist again.

- Recent News of sembcorp industries to provide 2 Billion loan facility to Sembcorp Marine

- If we re draw an uptrend line Sembcorp Marine is currently sitting on it and with a horizontal support of $1.45. A break below that might cancel our view of Sembcorp Marine

- Russia agrees with Saudi Arabia to extend OPEC oil output deal

- The risk reward for this set up is not bad hence its on our watchlist

What is your trade plan for Sembcorp Marine? Do you have a trade plan whenever you enter the market?

Want to know more about our plans for Sembcorp Marine?

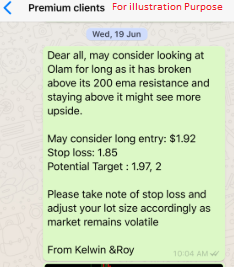

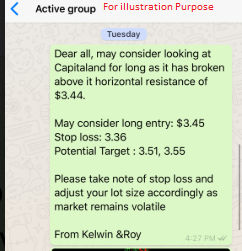

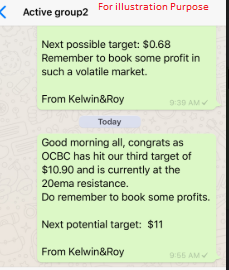

CLICK HERE to see how you can learn how to plan a sound and actionable trade plan and to be part of this EXCLUSIVE COMMUNITY to enjoy such value added services.

Yours

Humbly

Kelwin&Roy