Sembcorp Industries – [Multiple Downside Targets Hit, Is Upcoming Results Bad?]

Chart Source: Poemsview 30th Oct 2018

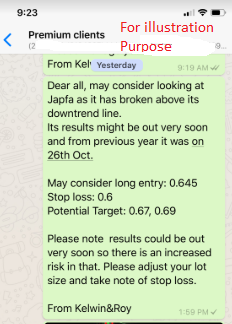

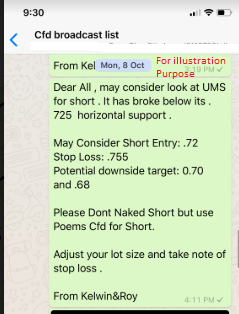

Sembcorp Industries part of the STI component stock could not withstand the selling pressure over the last few days. It was down 5% since our short alert to our EXCLUSIVE CLIENTS last Wednesday. A nice downside ensued after our alert at $2.87. It went to a low of $2.71 before some rebound came. Currently Sembcorp Industries is sitting on some support at the horizontal and uptrend line. A break below that and staying below it might signal more downside.

Sembcorp Industries results will be out this Friday before market hours.

What will your trade plan be? Could Sembcorp Industries break that downtrend resistance line or will it continue to slide? Is the recent fall a sign of what the results might be?

Need an extra pair of eyes to help watch the with?

Have many questions that you’ll like some answers to?

Want to be part of this EXCLUSIVE COMMUNITY to help guide and prepare for market.

Don’t wait and CLICK HERE to see how you can join this community and all the exciting perks of being a Client of Kelwin&Roy

Yours

Humbly

Kelwin&Roy