Innotek – [ Continuation Of The Uptrend? Too Late To Chase? ]

Chart Source: Poemsview 30th June 2021

Innotek was a stock that we spotted since early April when it was just trading at $0.77. Since then it has rocketed over 30% and gradually retraced. It has been good to us as we have been alerting our EXCLUSIVE CLIENT several times over the last 2 months and all have seen positive results.

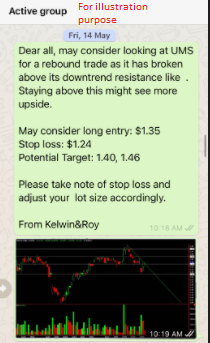

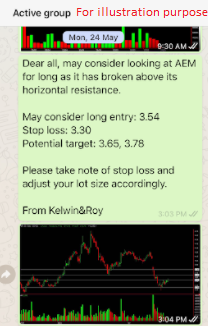

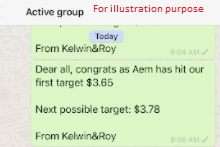

And over the last week, we have seen how Innotek held up well despite the weaker sentiments in the overall market. As such, we decided to alert our EXCLUSIVE CLIENT as in the text above. We’re glad that our first target has been met and it does look like momentum is building up. Volume is increasing but it has to overcome that downtrend line that we drew and we might be able to see $0.98. Our upside target is at $1.01 and there could be some meat left for this trade.

Want to be alerted earlier and not miss out on our next trade alert? Be our EXCLUSIVE CLIENT and find out how you can be included in our next alert. Or simply click the whatsapp logo at the bottom of the page to drop us a message.

Yours

Humbly

Kelwin&Roy