What a week! What a comeback! Despite the stronger than expected NFP data on Friday night markets reversed their loss with the S&P closing up over 1%! This is an encouraging sign that market could be done with bad news and could even be a sign of more upside to come!

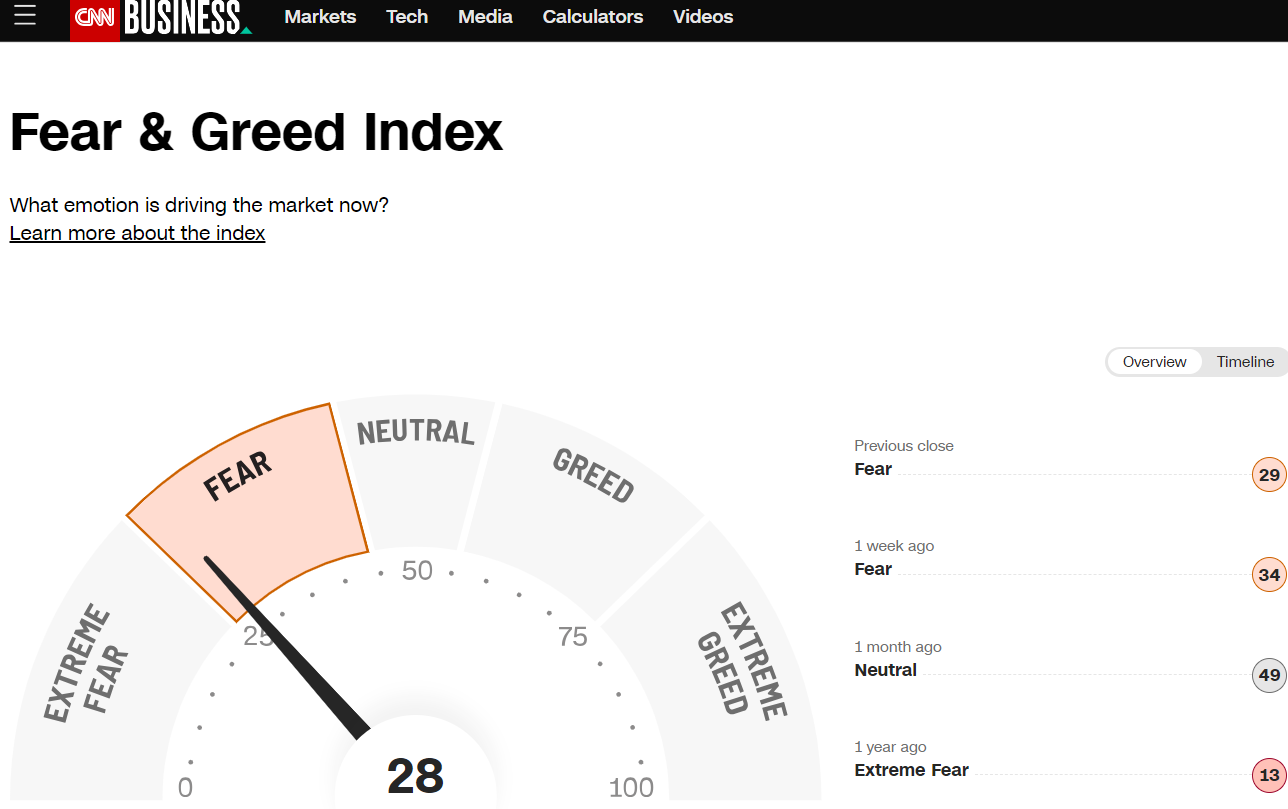

The CNN greed and fear index tipped into extreme fear during the week which was something that we were looking for! Are you fearful? Or are you taking advantage of this pullback to add more quality shares?

For this week, two key events to look out for. 1) Fed meeting minutes, this continues to give guidance on where the Fed stands with interest rates. Take note of the tone and choice of words. 2) Core CPI coming out this Thursday will be something that market will be keeping a close eyes on. Expect some volatility to set in then.

STI

Our Straits Times Index started the week weak slamming down close to our support before bouncing off. Cut loss were triggered and as a trader we got to follow our trade plan and be disciplined about it. Recover from this some setback and grow stronger! For this week, we do see STI moving higher to break above that downtrend. Resistance at 3180 could be broken and we could first see a test to 3200 then 3230. Banks once again looks good for recovery.

HSI

The Hang Seng Index also tried to hold on despite breaking Aug low. A fake breakdown could have happen as it managed to regain its footing towards the end of the week. The hang seng index is above its 5ema and could be looking to test its 20ema of around 17731 this week. This resistance is significant as it hasn’t broke past it for the last month or so. A break above this could signal a change in trend for the HSI. Fingers crossed and our first upside level we could see is 18552.

To know more about where the S&P500 & Nasdaq is heading to, do head over to our Facebook Page.

Yours

Humbly

Kelwin & Roy