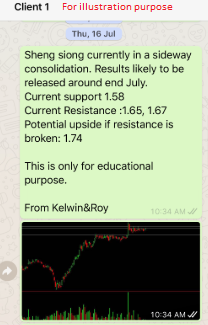

Sheng Siong – See Our New Value Added Service For Our Clients

Chart Source: Poemsview 30th July 2020

Sheng Siong just reported its results last night and it was an amazing set of results mainly driven by the elevated demand arising from Covid-19. Its net profit grew 150% and it declared an interim dividend of 3.5 cents per share.

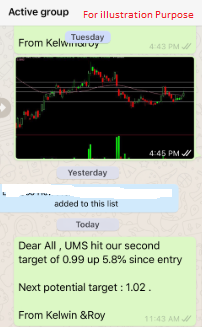

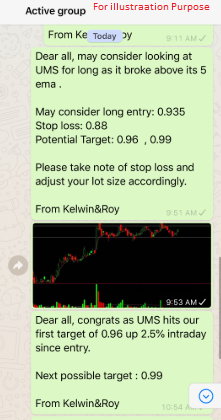

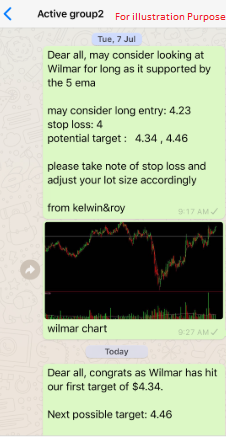

In our bid to continue to value add to our clients, we have sent out charts which our clients have been asking so that the community as a whole can benefit. As you can see, Sheng Siong was one such stock which we shared with our community just two weeks back. We pointed out the various support and resistance for our clients to learn and understand. This enable a client to understand better and watch out for potential turning points too.

As for Sheng Siong now, immediate resistance is at $1.74 which might be reached today due to the good set of results. The next upside level might be $1.80.

Want to receive such educational information ?

Contact Us now to see how you can be added into our group.

Yours

Humbly

Kelwin&roy