US STOCKS closed lower on Friday (Jun 23), capping a week dominated by Federal Reserve chairman Jerome Powell’s testimony. With few market-moving catalysts this week aside from Powell’s congressional testimony, all three indexes notched weekly losses, ending a weeks-long rally.

The Nasdaq snapped its eight week winning streak while S&P 500 broke its five-week rally. Is this the start of more downside? In our view we do think so given such a strong rally, a pullback is not too much to ask for right? Especially for those who missed out on this rally, this could be an opportunity to scale into the markets.

3 key events to look out for this week, the first being Fed’s speech on Wed, second is China’s PMI data on Thursday and lastly Fed’s preferred inflation data which is the PCE. As inflation is still above 2%, Fed is still trying to bring it down and is now looking at another two more rate hikes for the year. Friday’s data could give an insight to what Fed might do for the July’s meeting. Do head over to our Facebook page to find out more about the key levels to watch out for this week for the US markets.

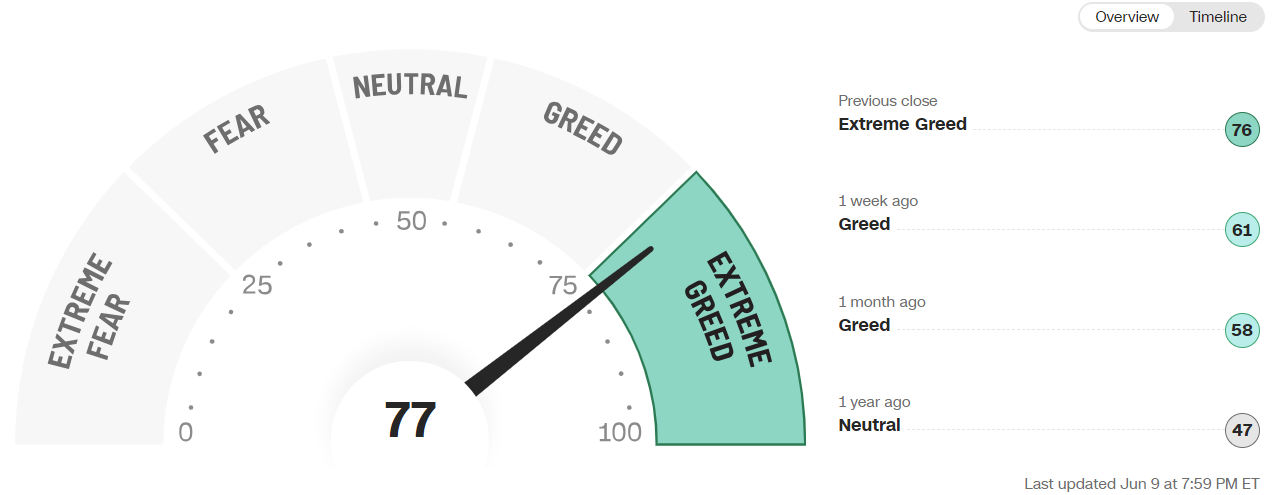

STI

Chart Source: DZH Internatioanl Advisor 25th June 2023

Following global sentiments, the straits times index also saw a pullback for the week as blue chip stocks like sembcorp industries, keppel corp and SIA all finally saw profit taking. Banks initially led some rebound as a higher rate environment could continue to lead to higher profitability for them.

Our Straits Times Index is currently at its immediate support of around 3186. It does look like there might be more downside to it which we might even see 3123 as the downside target. If the index reaches there, we do see good opportunities to enter the market.

HSI

Chart Source: DZH Internatioanl Advisor 25th June 2023

After a very steep rebound on expectations of rate cuts and stimulus from China’s government , HSI saw a sharp pullback. A pullback to 18522 level is possible for the week. PMI data coming out on Friday might help spur the govt to do more stimulus if data comes below expectations so that’s something to look at for the week.

Meanwhile, some more downside might be expected before a rebound. 18522 level first then a test of the recent low of around 18000 should give some firm rebound.

To find out more about the US markets don’t forget to head over to our Facebook page.

Yours

Humbly

Kelwin & Roy