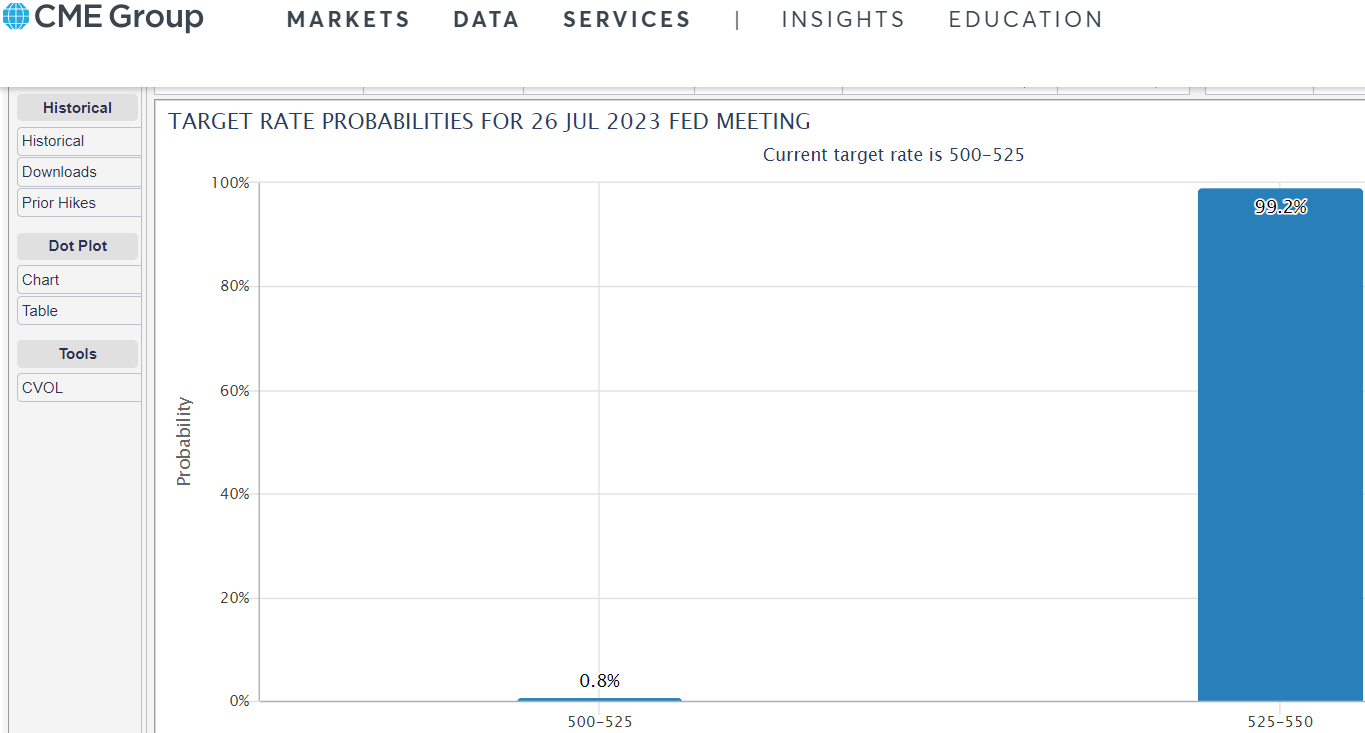

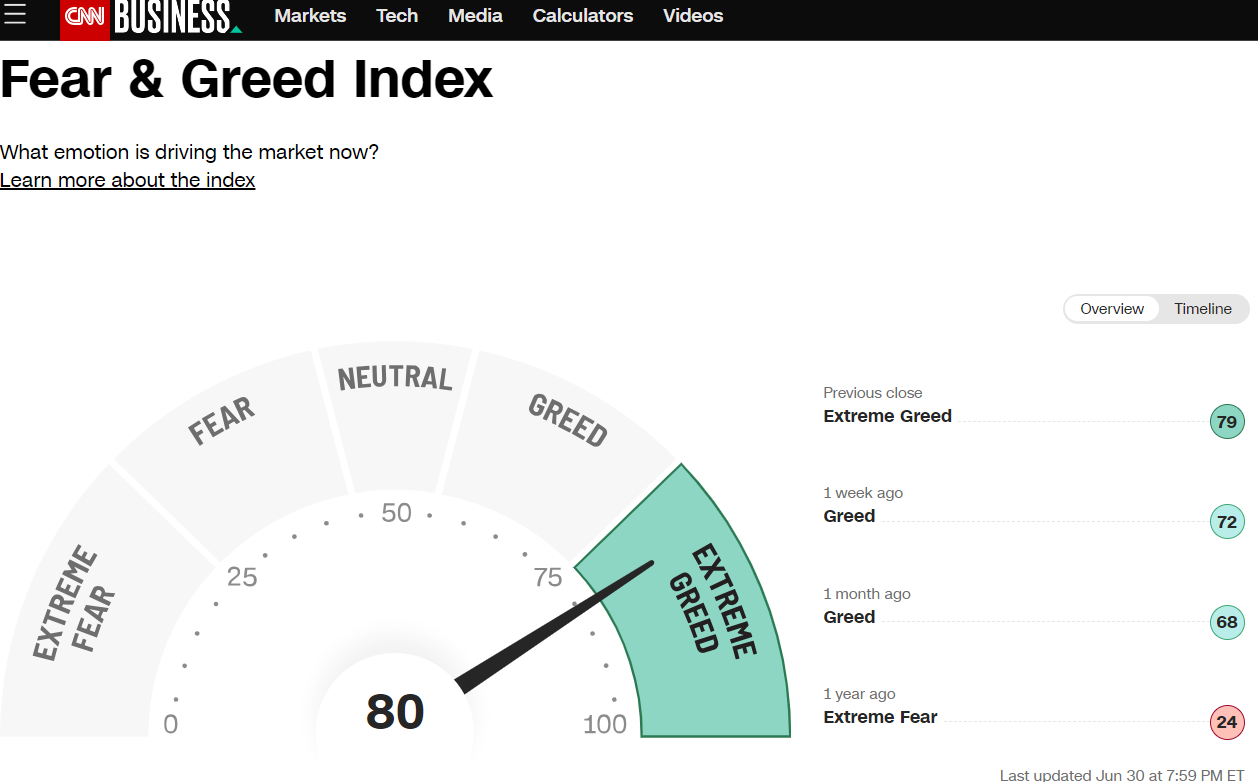

It was a rather flattish week for the US market as markets all priced in a rate hike from the Fed. Towards the end of the week we saw inflation data coming in lighter than expected which once again drove US markets up. S&P is track for the fifth straight month which is something we haven’t seen in awhile. BUT as S&P was flattish for the week the Hong Kong was up about 7.5% for the week! Let’s talk more about that in awhile!

Some key data to look out for this week would be earnings coming out. Sentiments would be dominated by earnings this week and China’s PMI data coming out this tuesday. After China’s Politiburo meeting on the 24th July, their stance and tone seems to have changed. They are now on an all out measure to turn their economy around after many quarters of slowing down.

STI

STI rebounded as mentioned last week earnings from UOB helped to push the three banks as results were promising and hitting expectations. For this week, we could see STI testing the 3400 level as see momentum coming in. At 3400 level, there could be resistance and it would be good to take some profits there. Many of our stocks that we have been alerting our clients to have been hitting their targets and its time to take some profits off the table.

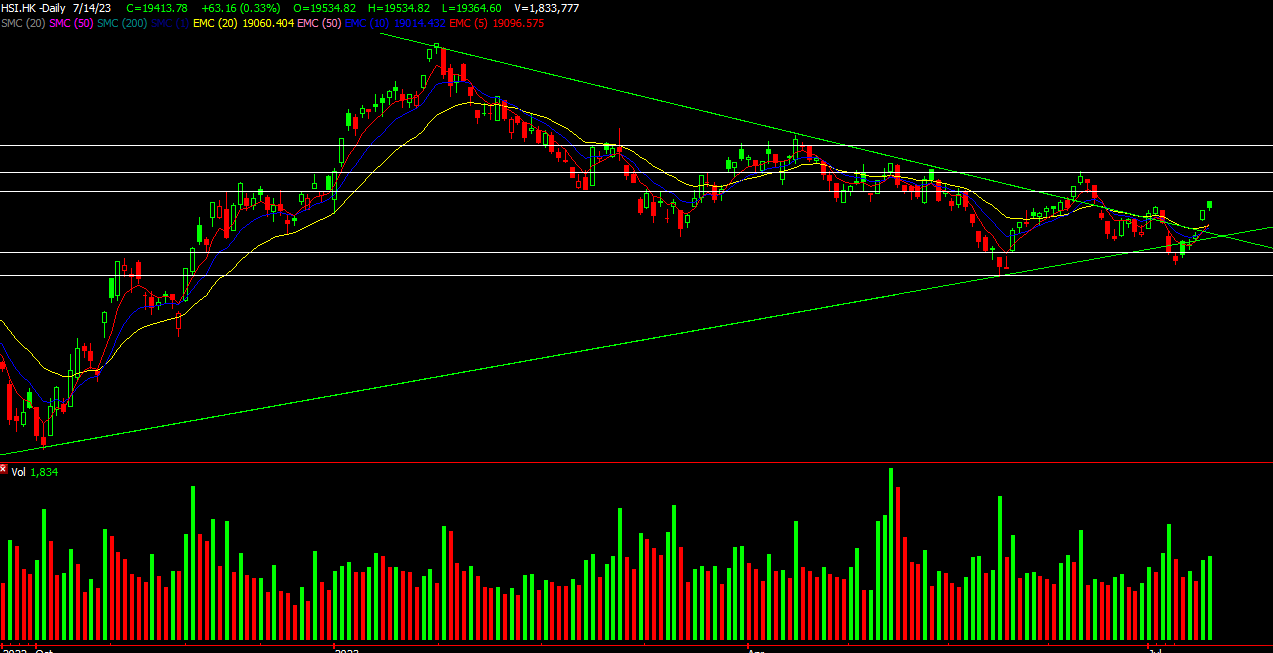

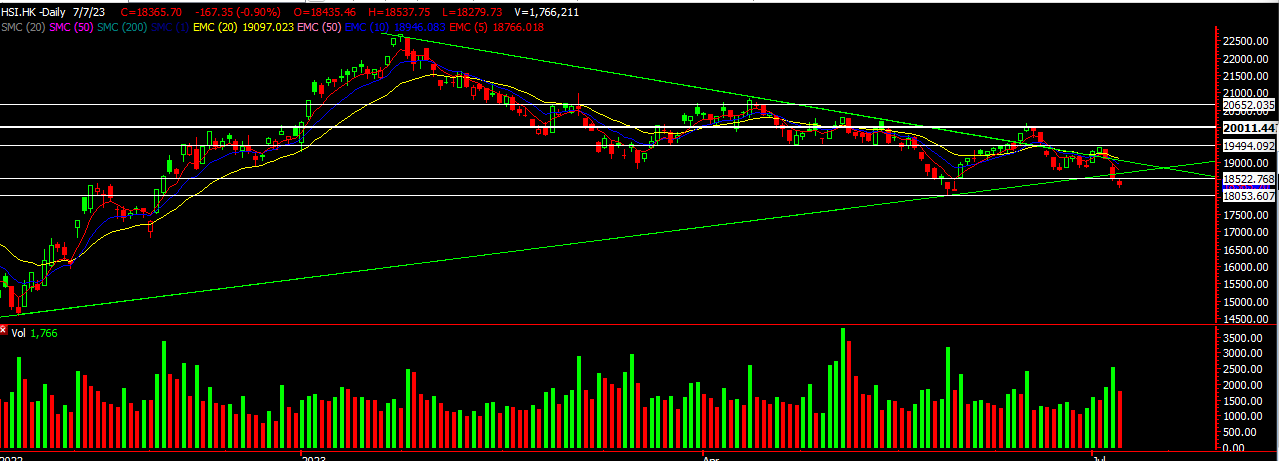

HSI

The Hang Seng Index, the beast of the east has finally unleased its power! Up about 7.5% As mentioned previously, we expected hong kong to rebound after holding critical levels. And after the Politiburo last week, China is stepping up efforts to grow the economy as worse than expected data started to flow out from China. This could help rally stocks for the short to mid term as China badly needs a big stimulus to grow and attract foreign investors.

For this week, we do see a continual momentum towards the 20119 level first. We’re targeting 20652 for the next two-three weeks. Not in a straight line but good chance to see it as investors who missed out will have to chase prices now.

Head over to our facebook for updates of the S&P 500 and Nasdaq.

Yours

Humbly

Kelwin & Roy