Valuetronics – [ Lower High On Each Rebound, What’s Next?]

Chart Source: Poemsview 20th March 2019

Valuetronics together with the other electronic stocks had a retracement after having a decent run up over the last week.

Valuetronics has caught our attention for some of the reasons below.

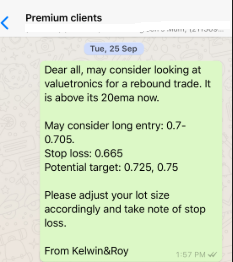

- Its rebound is lower than the previous rebound at $0.74

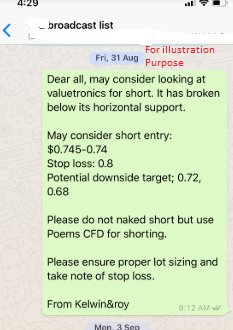

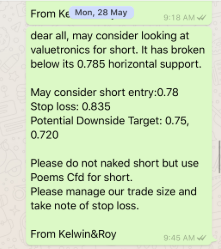

- Valuetronics is below its uptrend line now.

- Valuetronics is near the horizontal support of $0.68. A break below that might signal more downside.

- Valuetronics is also below its 20ema

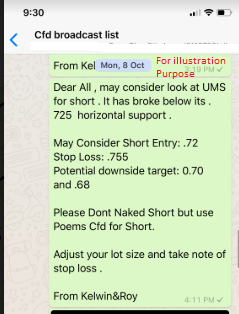

With these reasoning Valuetronics is now on our radar. A break below that $0.68 might have more downside.

Is Valuetronics on your watchlist?

What’s your trade plan for Valuetronics like?

It is important to have a sound and actionable trade plan in order to be discipline in your trades.

CLICK HERE to see how you can learn how to plan a sound and actionable trade plan and to be part of this EXCLUSIVE COMMUNITY to enjoy such value added services.

Yours

Humbly

Kelwin&Roy