Straits Times Index – [ Panic All Around But Some Signs Were There When We Posted Back In Sept]

Chart source: Poemsview 12th Oct 2018

It was a crazy day yesterday where most traders might rather erase it from their memories as our Straits Times Index plunged 84 points or down 2.69%. Such days don’t occur so often and whenever it does it does cause panic and fear unless you’re on the right side.

How to avoid such pitfalls? Looking at the support/resistance could be one way. Another way is to have an extra pair of eyes during market hours to help bounce off ideas and remind one another of potential dangers. Two Heads are better than one!

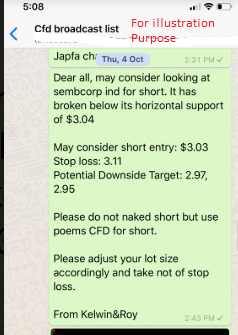

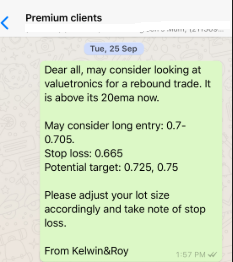

From our previous update of the Straits Times Index just end sept, we mentioned that a key resistance was around the 3260 area and true enough the market could not push through and started retracing. From then we were also actively looking out for stocks that were weak as they might be the first to be sold down True enough they started peeling off one by one. And we’re glad that our EXCLUSIVE CLIENTS were warned out it. Blue chips started to come off after the rebound, followed by mid cap which we were glad we caught them on the downside and was spared the meltdown yesterday.

We have drawn some possible support levels for the Straits Times Index. Some possible scenarios might be an attempt to rebound to the gap area and failure to clear might see more downside to our lower support of 2985 area. Or it could continue to slide with mini rebounds in between.

Will update more when the time comes.

Meanwhile Happy trading!

and If you need an extra pair of eyes during market hours you know who to Contact!

We’re right here waiting!

Yours

Humbly

Kelwin&Roy