5th March, 2017, 9:33 PM

Singapore Budget 2017 was delivered by our Finance Minster Mr Heng Swee Keat on Feb20 and we’ll just cover it briefly and what are some stocks that we are looking at. More can be read on the budget over here.

There were no major surprises for the Budget 2017 and some of the focus was on the smart Nation or digital economy, accelerating infrastructure projects and helping sectors facing cyclical headwinds. Our markets didn’t react too much after the budget was announced so markets were not expecting too much to begin with.

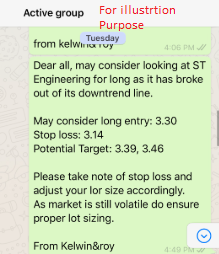

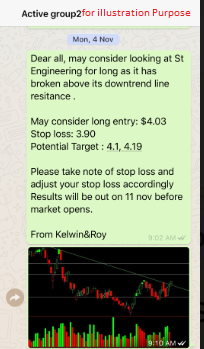

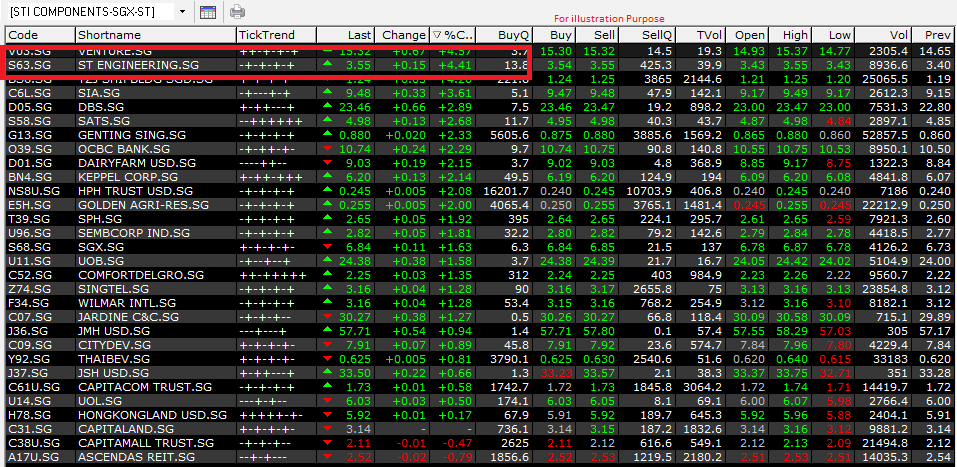

With a 4.5 billion dollar programme to promote growth and competitiveness , the Committee on Future Economy (CFE) continues to emphasize the need to build skills and capabilities and to develop an innovative and connected economy. Digital Disruption continues to the buzz word and firm will have to adapt to that. St Engineering subsidiary St Eng Electronics could be a beneficiary of this as their Smart City solves city challenges and integrates systems that sustain future growth.

Just some technical levels we’re looking at: 3.60-3.62 as the immediate support. If it breaks lower could see 3.45 levels in which we might consider entering. Currently its a little high now. Would prefer for a pull back .IF it breaks the 3.70 resistance we might see it eventually test 3.82.

Construction spending : The Singapore government will bring forward $700 million of spending on public- sector projects in the next two fiscal years . Some firms we are looking at would be Hock Lian Seng which has jumped close to 10% since budget day. They boast over 45 years of experience in civil Engineering & Construction. They have been carrying out civil engineering works for bridges, expressways, tunnels and MRT with a few of these being awarded ‘construction excellence’

Hock lian seng hitting 60 cents which is the all time high. Some pullback would be good to levels of 56 or 53 or even 50 cents and over there we might consider an entry. If it breaks 60 cents we might probably see 68 cents first.

Another company we’re looking at would be ISO Team. Having been around for 19 years they are an established player in the building maintenance and estate upgrading industry in Singapore. They are also the exclusive applicator of paint works for both SKK and Nippon Paint in the public housing sector in Singapore. Major customers include town councils and government bodies.

Iso Team usually consolidate for awhile and breaks out then consolidate again. Would probably have to buy and hold rather then to time the break out. Around 0.375-0.395 would be a good be good entry point. If it goes lower then we’ll have to wait and see.

The offshore and marine sector continue to remain weak and even with the foreign workers levy hike deferring for another year this will probably benefit SMEs a little more.Keppel Corp and Sembcorp Marine would be our picks for the O&M sector.

This is not all but of course as said we’ll briefly cover some points of the budget and do email us if you would like more ideas on the Singapore budget 2017.

Yours

Humbly

Kelwin&Roy