Nanofilm- [Gapping Up On JV With Temasek, Our Next Target?]

Chart Source: Poemsview 20th April 2021

Good News greeted traders/shareholders of Nanofilm as they are forming a joint venture with Temasek to generate growth in the so-called “hydrogen economy”, increasingly touted as a cleaner substitute for the fossil-fuel economy.

The joint venture, Sydrogen Energy, will tap on Nanofilm’s capabilities in applying its advanced nano-coating to critical parts in fuel cell and electrolyser systems, which is poised to enjoy wider commercial application as more attention is focused on sustainability principles. More can be read from the article on theedgesingapore.com.

On the back of such news we saw Nanofilm gapping up and even broke its all time high of $5.48 before closing just below it.

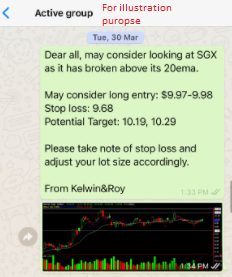

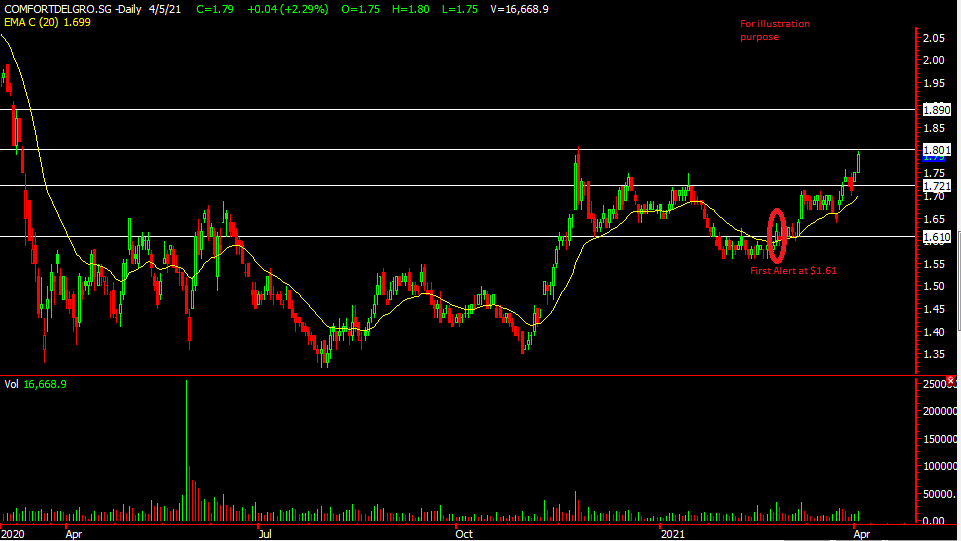

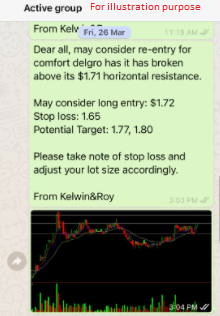

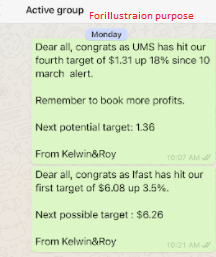

Nanofilm was a stock which was on our watchlist since March and after its retracement we alerted our EXCLUSIVE CLIENTS on positive price action. (Take a look at the alerts above☝) It was trading at $4.92 then and once again just on Monday when it gave us another opportunity when it broke above its 5ema. All in all, Nanofilm has been moving up nicely achieving our upside targets.

From a technical perspective, some profit taking might come in at the all time high of $5.48 and after that we might see it push higher to new levels of around $5.54 then $5.59.

Don’t want to miss the next trade alert?

Be our EXCLUSIVE CLIENT and receive such trade alert sent straight to your handphone!

Don’t miss out on our next alert! Be a client and find out how to be included in our whatsapp broadcast list.

Yours

Humbly

Kelwin&Roy