Straits Times Index – At A Pivotal Point

We’ve been asked by many on our views on the straits times index or STI for short and thought we’ll just do a short sharing over here.

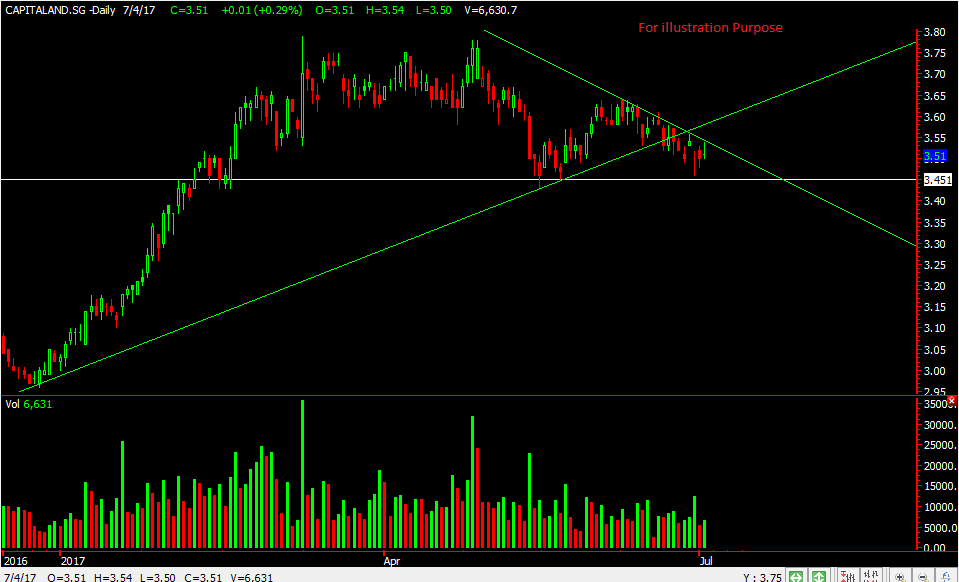

From our chart the immediate support of STI would be around 3200. Many eyes are on it and the moment it stays below that, it might attract shortist to come in.

STI has been ranging between 3258 region and 3200 for the last 2 months with no real direction. So if a break were to occur this might set the tone for a pullback. The 20 days MA is sloping down and have cut the 50ma too which in a technical term means the direction might be down. This hasn’t occurred since late last year. Dow, Nasdaq all have been making new high but our Straits Times Index hasn’t seem to make any new high.

With each rebound STI can’t seem to break out too. So lets watch to see which levels play out. We got our next few levels of support drawn. And would be ready in the case if STI starts to fall. The 200ma would be our final support. The banks which have largely been supporting the STI also seems to be pulling back.

We’ll be using Poems CFD and did you know that poems is the only stockbroker in Singapore that offers the Straits Times Index for trading? =)

If you want to learn more about Poems CFD and how you can be trading the STI both long and short. Just click HERE as we’ll be having a seminar next Wednesday show casing our CFD and some of our strategies. Hope to see you there.

Yours

Humbly

Kelwin&Roy