HKEX (388.HK) – [Is The Sell Off Over?]

Chart Source: Poemsview 17th March 2021

The Hong Kong Stock Exchange is the exchange base in Hong Kong and its the world’s largest bourse in terms of market capitalization surpassing Chicago-based CME. As of end 2020, it has 2,538 listed companies with a combined market capitalization of HK$47 trillion. It is also one of the fastest growing stock exchanges in Asia.

This stock exchange is owned by the Hong Kong Exchanges and Clearing Limited ( 388.hk). The Hong Kong Government is the single largest shareholder in HKEX, and has the right to appoint six of the thirteen directors to the board.

Just a while back Hong Kong’s government increased its stamp duty on equity transactions on the city’s stock exchange for the first time in almost three decades which caused a knee jerk reaction despite posting three straight years of record profit.

Now, is the selling done? Has the selling been a bit too much?

Lets take a look from a technical perspective.

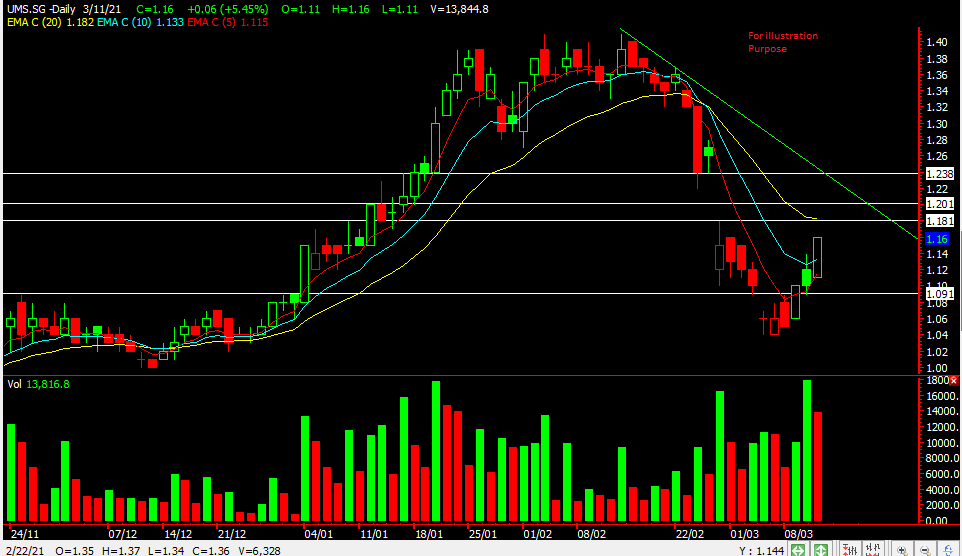

HKSE(388.HK) has corrected about 26% from its peak and its a healthy correction to us. It has found some support at around HK$437 and its starting to build a base around there. The 5ema is current its immediate resistance . It tried to break that yesterday but didn’t managed to. A break above that might see a test to the 10eam then the 20ema of around $476. For long term investors, this might present a good opportunity to scale in at this level. The next support we might see is around $415 if the horizontal support doesn’t hold. The mid term upside target might be $508.

Will update more as time goes by. We’re bullish on HKSE in the longer run and such a fall present us with a good chance to scale in.

Yours

Humbly

Kelwin&Roy