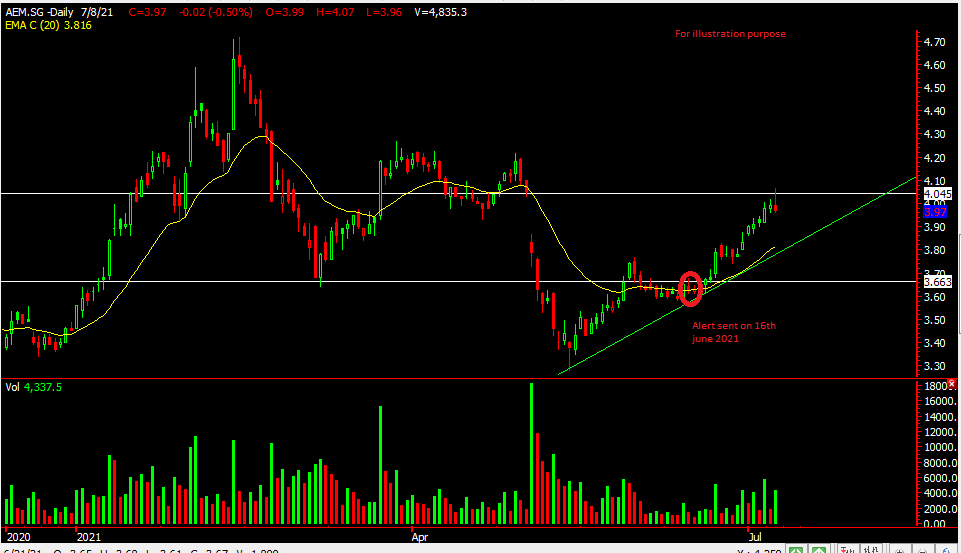

Sembcorp Industries – [ Keep Watch!]

Chart Source : poemsview 15th July 2021

Sembcorp Industries had hit our first target of $2.22 back in June before pulling back. Using technical analysis, we can see that its still on an uptrend supported by that uptrend support line. As its part of the STI component, a positive sentiments on the blue chips might see this start to move.

What we like about it is that its supported, it closed well yesterday with a nice green candle. Volume is also increasing and its above its 5ema. There’s some upside left to that downtrend line resistance of around $2.22 then a break of that might see some more upside to $2.25 and even the previous high.

Keeping watch on Sembcorp Industries! Are you?

Yours

Humbly

Kelwin&Roy