Sembcorp Marine – [ Reaching Our First Target Of $2.07, Next Target? ]

Chart Source: Poemsview 27th June 2018

Sembcorp Marine was one of the counter we highlighted just TWO DAYS BACK as oil started to turn up due to OPEC less than expected output increase.

We mentioned a break above $2 might see it move higher and indeed we’re glad it moved up to our first target of $2.07. Needless to say our EXCLUSIVE CLIENTS were informed of the break and managed to ride the wave to $2.07.

So where is our next target? As Sembcorp Marine hit our resistance and pulled back also due to market sentiments if it manages to stay above $2 we are still optimistic.

If Sembcorp Marine closes below $2 then we might see further downside from there.

Keeping watching.

Want to be part of this Exciting and Vibrant Trading Community?

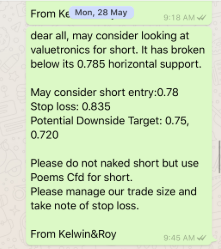

Be A CLIENT OF OUR TOP TIER REMISIER KELWIN&ROY and don’t miss out on anymore trade analysis.

Yours

Humbly

Kelwin&Roy