4th November, 2018, 9:14 AM

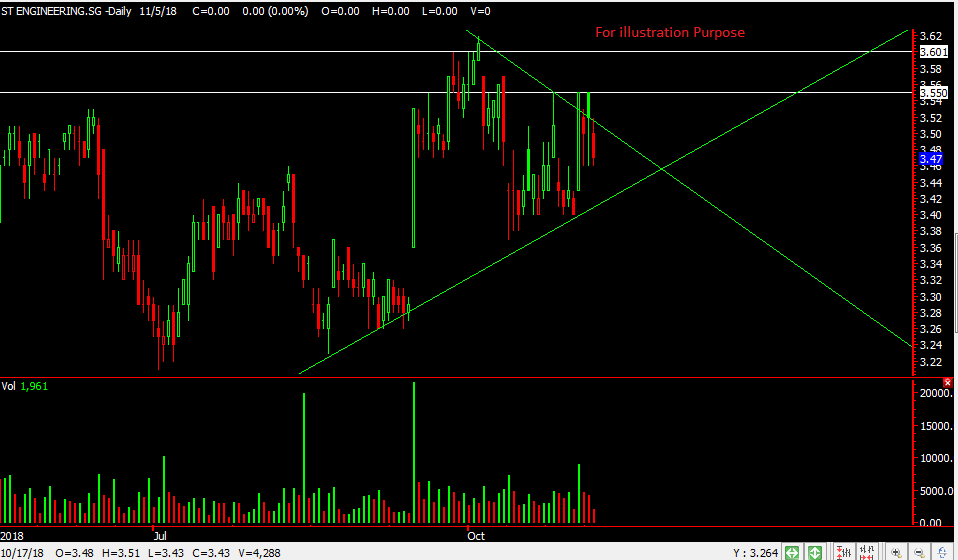

Chart Source: Poemsview 4th Nov 2018

Straits Times Index had a magnificent run once again with a rebound of over 100 points since our post on it last Monday Night.

While many were still bearish and looking to short from our post we were looking out for a rebound.

STI ran up over 100 points or close to 4% in three days causing most shortist to cover their position. Such an increase might have taken traders by surprised but we were prepared for such a run.

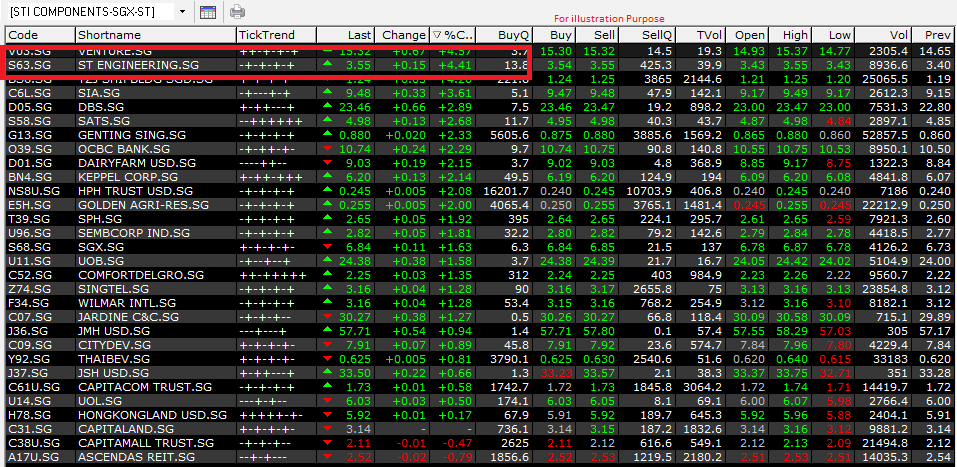

Blue Chips like Banks and Property Stocks led the Charge as mentioned in the same Blog Post too. We hope that our avid readers have learnt something from this and maybe even benefitted from this rebound!

So what are we seeing in STI next?

- We have drawn the downtrend resistance line which is around 3160 and might be our target for this rebound for now

- Currently, STI almost covered the Gap resistance and is also around the 50ema resistance which is 3130 area.

- A pull back wouldn’t be too much to expect and a pull back might present some opportunity for short term trading.

Last week for a good week for bullish traders and we hope it was good for you too. Our list of stocks all performed well. How about yours?

We’ll be conducting a final workshop on how to use CFD to long or SHORT the STI index in Nov before the year comes to a close.

Look out for it!

Still clueless on the market direction? Not sure of which stock to look out for during a rebound?

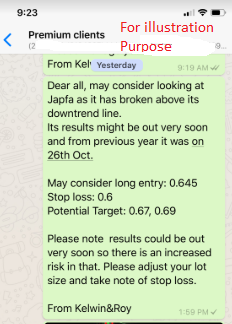

Want to be part of this EXCLUSIVE COMMUNITY help guide and prepare for market.

Don’t wait and CLICK HERE to see how you can join this community and all the exciting perks of being a Client of Kelwin&Roy

Yours

Humbly

Kelwin&Roy