Sembcorp Industries – [ Continue To Slide Down As Per Blog, Some Learning Points]

Chart Source: Poemsview 29th May 2020

Sembcorp Industries lost its footing and fell close to 10% today. It was the second top loser in percentage for the STI component stock . Part of this fall might be attributed to the removal of Sembcorp Industries from the MSCI Singapore Index. Other stocks like SPH, Comfort and SATS also saw a fall for today.

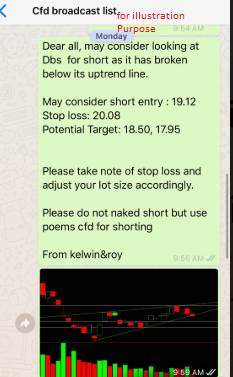

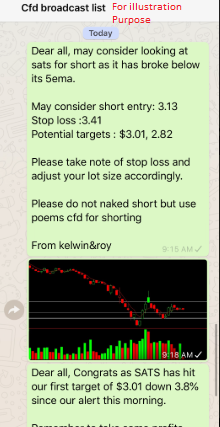

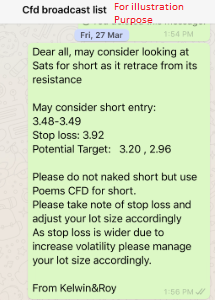

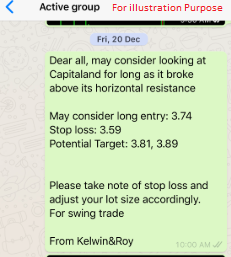

Let’s re-look and see if we can learn anything from this. As from the blog, we posted in the MORNING when Sembcorp Industries was trading at around 1.46 and gave a warning sign that it might continue to fall. As it was consolidating for a few weeks, a breakout or breakdown might set the tone for the stock in the coming days. True enough Sembcorp Industries broke down and headed south . Another explanation could be investors/traders buying near the support might cut loss as it broke their support, this also might invite shortist to come in to short as has broke down .

Hope our readers have learnt a thing or two from our trading blog. We look forward to sharing more with you.

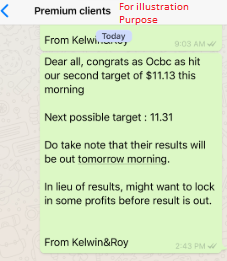

Interested in being our client to receive value added services?

Drop us a line and you’ll get back to you soonest.

Yours

Humbly

Kelwin&Roy