IFast – [Stellar Record! Another Hit, Moving To All Time High? ]🚀🚀

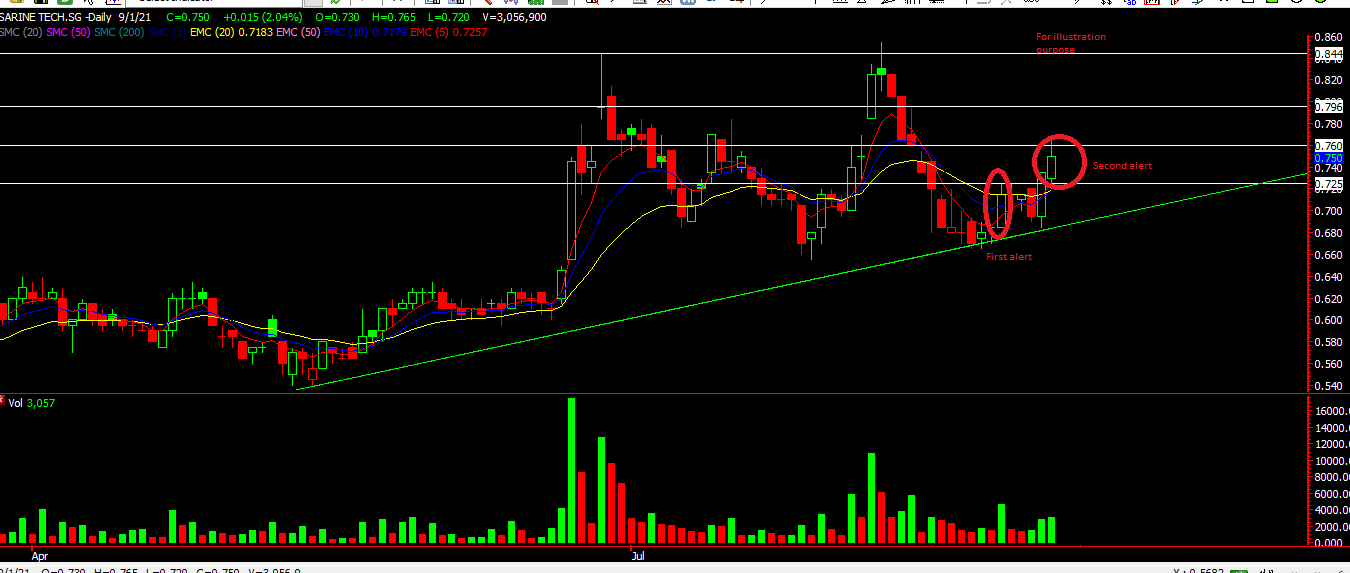

Chart Source: AdvisorXs 3rd Sept 2021

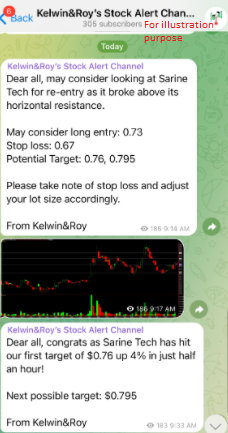

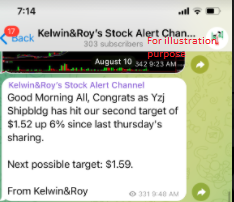

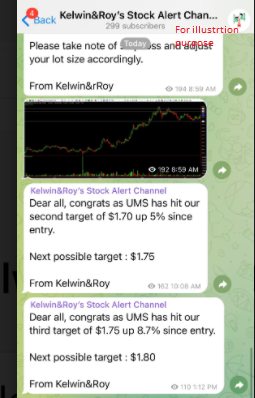

We had a stellar record for IFast with over five alerts over the last 8 months and each one hitting their targets. And our 6th alert was just on Wednesday when IFast was trading at $8.49!

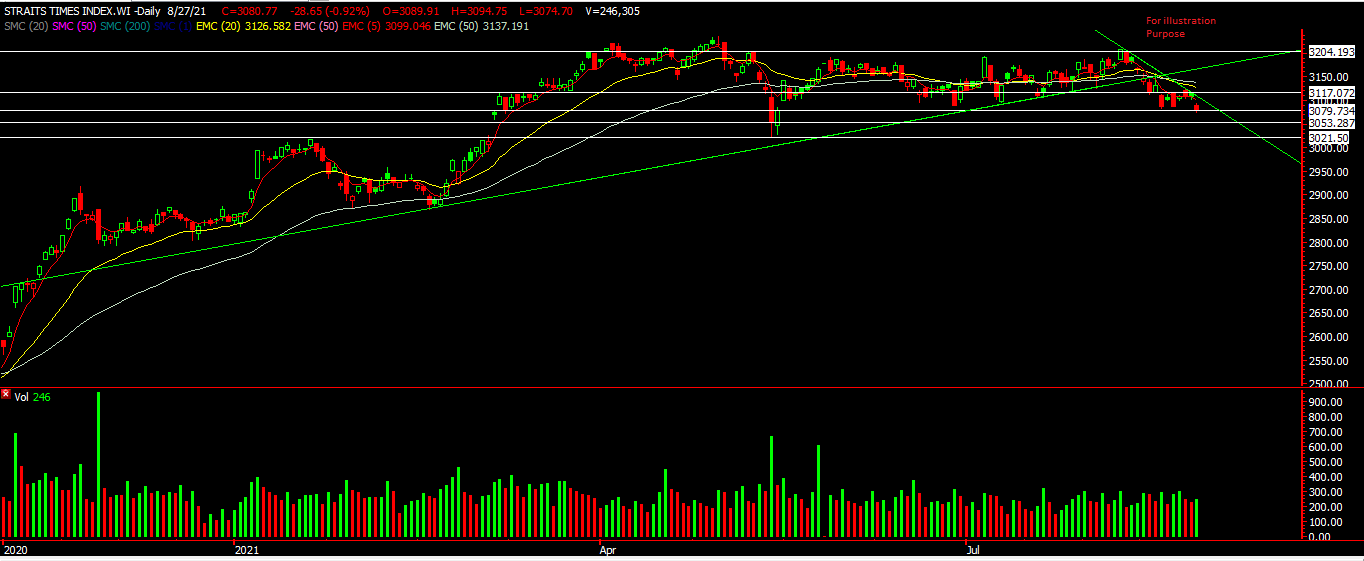

It has gone up 🚀 about 4% in just 2 days which we’re satisfied with. Our next possible target is $8.98 as per message which is around the gap resistance. Ifast is one of the fastest growing stock on SGX and has moved up over 200% since the start of Jan this year. Its asset under administration is growing steadily it continues to deliver stellar results over time. We’re glad we managed to catch this ride and below is just some of our alerts.

Take a look at our past alerts.

http://singaporehumblestock.com/ifast-covering-gap-were-you-fast-enough

http://singaporehumblestock.com/ifast-hitting-our-target-nice-end-to-q1

http://singaporehumblestock.com/ifast-positive-finish-to-end-the-week/

http://singaporehumblestock.com/ifast-a-fast-7-move-up-after-yesterdays-alert-where-to-now/

If you’re interested in receiving these alerts to your phone do drop us a message and we’ll let you know how to join us!

Want to be alerted of such potential entry?

Be our EXCLUSIVE CLIENT and find out how to be included in our growing community.

Yours

Humbly

Kelwin&Roy