13th August, 2021, 7:57 PM

Chart source: AdvisorXs 13th Aug 2021

This property stock went against the general market sentiments and even went up 10% today!

APAC REALTY went against all odds and closed up despite negative sentiments around. Even its counterpart Propnex didn’t manage to close up and went down instead. So why did Apac Realty move up that much and should one chase it now?

For one, it had a good set of results. Fueled by strong demand from local buyers, revenue jumped 121% y-o-y to $358.4 million, while earnings surged 107.4% in the same period to hit just over $17 million. Earnings per share stood at 4.8 Singapore cents, while net asset value per share stood at 46.6 cents, as at June 30, 2021.

The group declared an interim dividend of 3.5 Singapore cents, representing a payout ratio of 73 per cent, and a one-off special dividend of 3cents per share. This brings the total dividend to 6.5 cents. As a dividend hungry Nation, this probably caused a spike in price as investors chased the dividend. We saw a gap up in the morning and for those who didn’t enter this trade started to chase. This also helped us in achieving our first profit target of $0.875

Singapore’s housing market continues to remain strong for the past year due to the delay in new built and BTOs. Developers have sold 7,601 private residential units (including executive condominium units) in H1 FY2021, up 68.1 per cent from 4,532 units sold in H1 FY2020, figures from the Urban Redevelopment Authority showed. Some analysts have suggested that sales volume in the primary market could climb as high as 12,000 units this year. This could be a driver for an increased in the stock price BUT we are rather cautious now as prices has risen for APAC Realty.

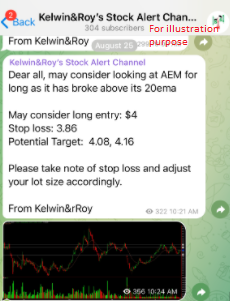

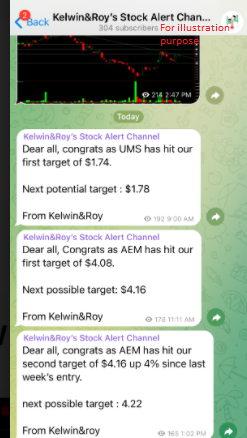

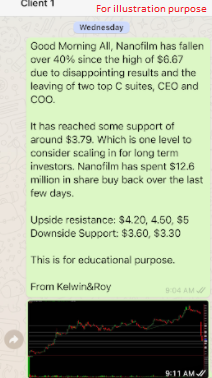

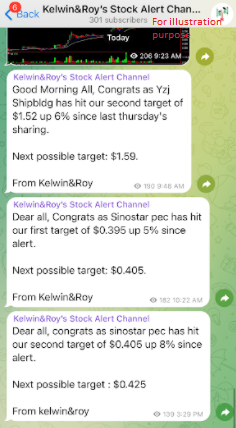

Our community of traders have received an earlier alert this week as shown from the message above and as traders pile in, we were looking to take profits instead. We wouldn’t want to add or chase the price now but prefer to take some profits off the table as prices rise. So what is key is getting in a trade and not chasing it as this doesn’t put you in a favourable stance.

Want to join a growing pool of community of like minded traders? Want such trade alert sent to your handphone straight?

Want to know what stock we’re looking at next?

Be our EXCLUSIVE CLIENT and be alerted earlier to not miss out!

Yours

Humbly

Kelwin&Roy