9th July, 2023, 3:21 PM

S&P500 ended the week down of about 1.2%. Why are we excited as in the picture you might ask. Well, as we been bullish for the year and do want to add more positions into the market so of course when the market is down we are excited. =) Are you too?

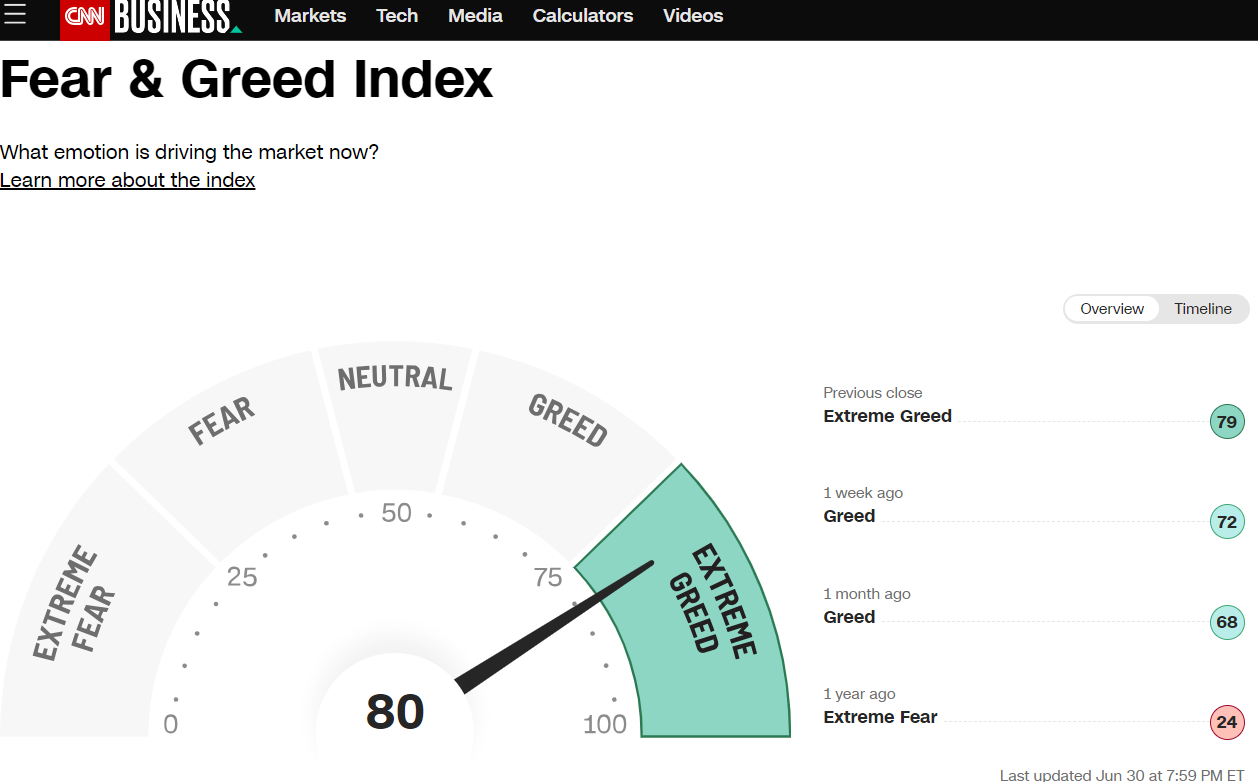

Greed & Fear index still at the extreme greed currently at 78 we are waiting for it to drop further before making an entry.

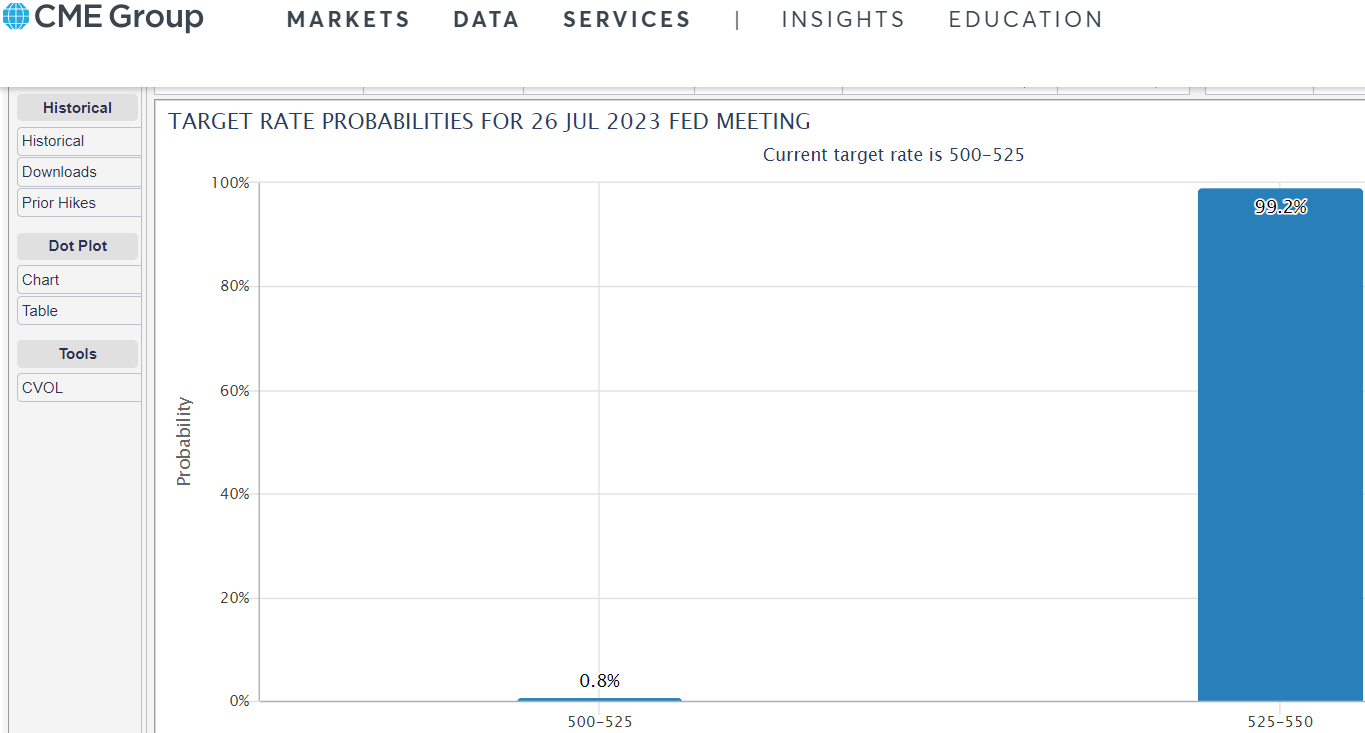

For this week, with Alibaba giving a boost to the HK market as China ends Ant’s Group regulatory revamp, this might raise hope of China ending it regulatory tightening on big tech. So we could see the upside coming in for HK.

Over in the US, earnings season is starting. With major banks reporting this Friday like Citibank, JP Morgan and Blackrock, this could bring the markets into some volatility. Keeping a lookout especially for the MAG 7 stocks which is a barometer of the economy.

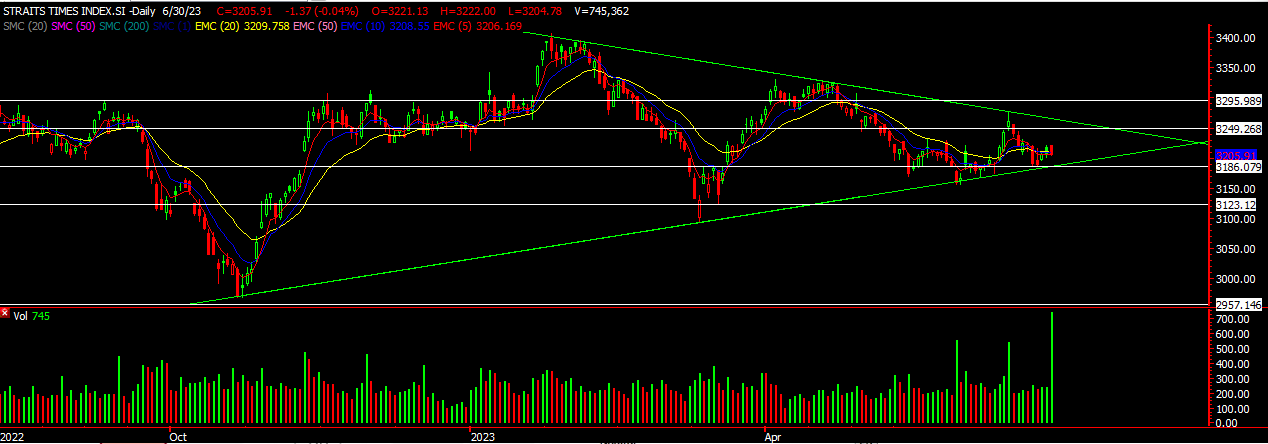

STI

Chart Source: DZH International 9th July 2023

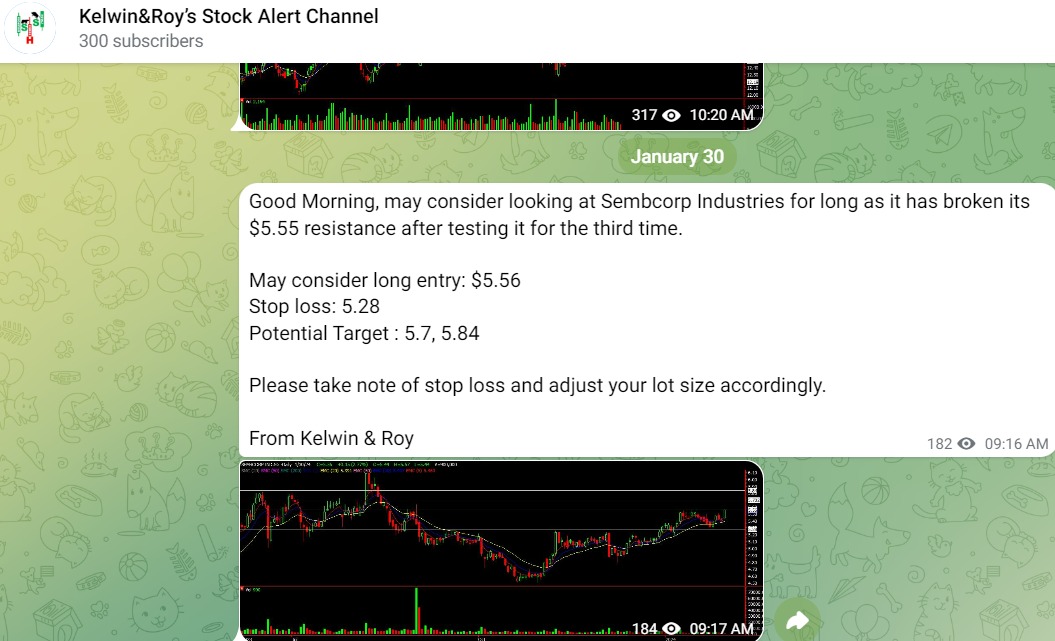

Our Straits Times Index dropped below our uptrend support line as banks and blue chips pulled back especially Sembcorp and Keppel Crop as they were the front runners for the STI for the past few months. Pullback is timely so that those who missed the rally can finally get in. But of course the time to re-entry is not yet. At least for us. We’ll be waiting for a base to form for Sembcorp Industries before deciding an entry. If you want to be informed of our next entry, ensure you’re in our telegram channel to receive all the latest updates and alerts.

STI could see a rebound this week as its coming close to the 3100 level. SATS looking strong despite the weak week.

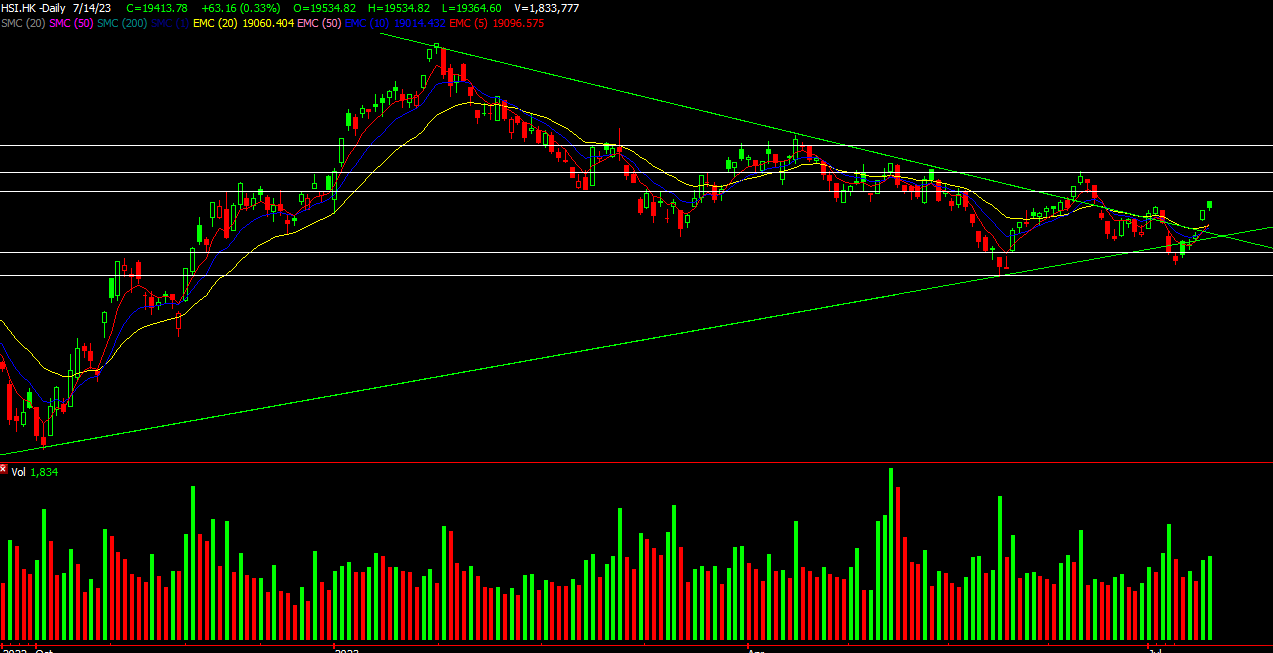

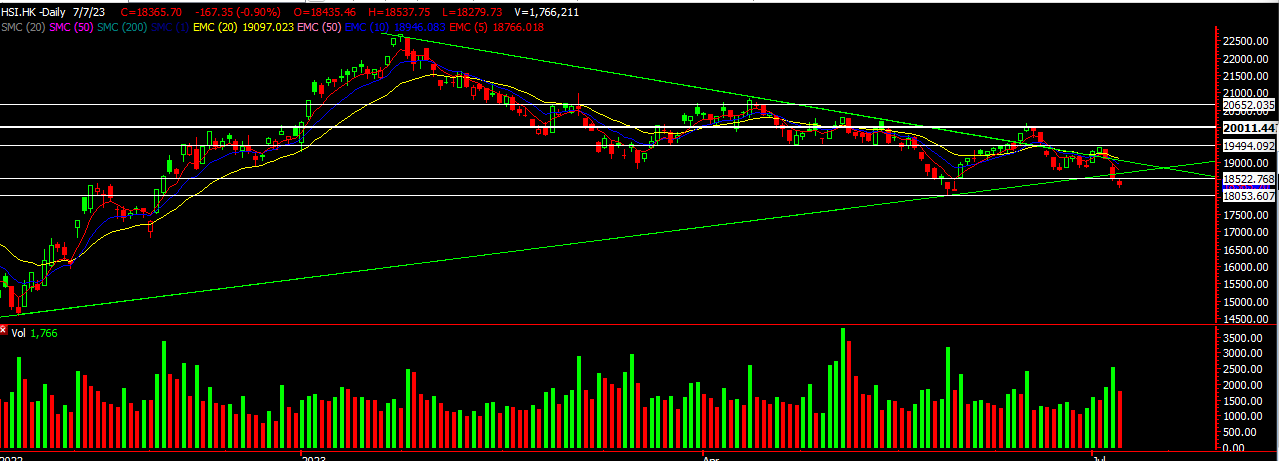

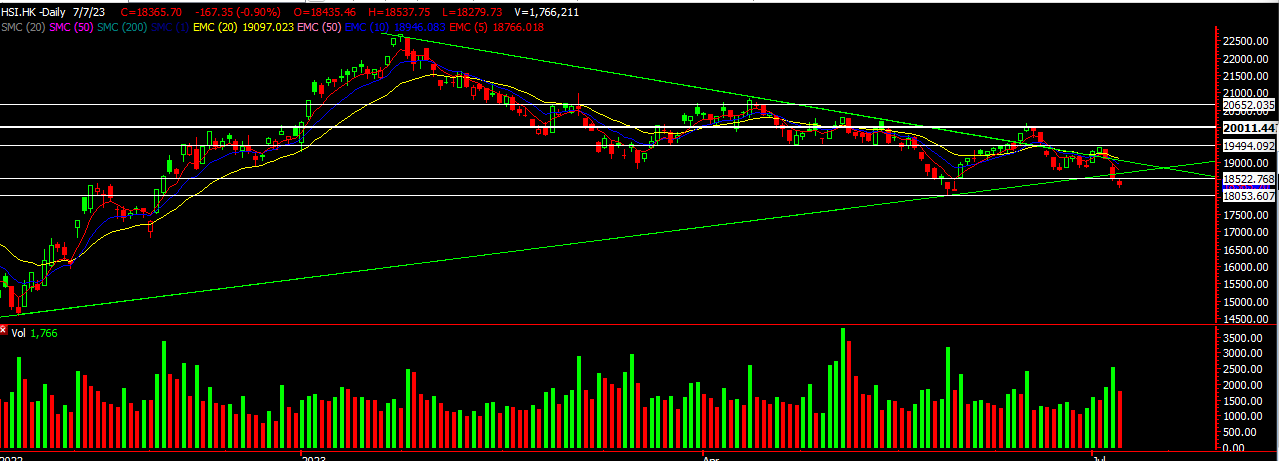

HSI

Chart Source: DZH International 9th July 2023

HSI once again imploded over the week BUT saw some light at the end of the tunnel as China ends it crack down on Ant group. This could be a good sign for the overall market and even better for Alibaba’s shareholders. HSI looking like a double bottom forming around the 18k level which is crucial. HSI has to stay above this level although a crack and rebound is one of the option to wash out weak hands. We could see HSI having some bargain hunting this week.

Currently market is looking for more stimulus as China badly needs a boost to their slowing economy. With this pullback, remember of your proper allocation into the markets. We are positive for HK but the proper allocation into the different markets matters too. Are you too heavy into the HK market? Need help in re-balancing? Let us know. We could shed some light.

Head over to our Facebook to find out more about our views on the US markets. IS IT TIME TO BUY?

Yours

Humbly

Kelwin & Roy