16th September, 2019, 9:07 PM

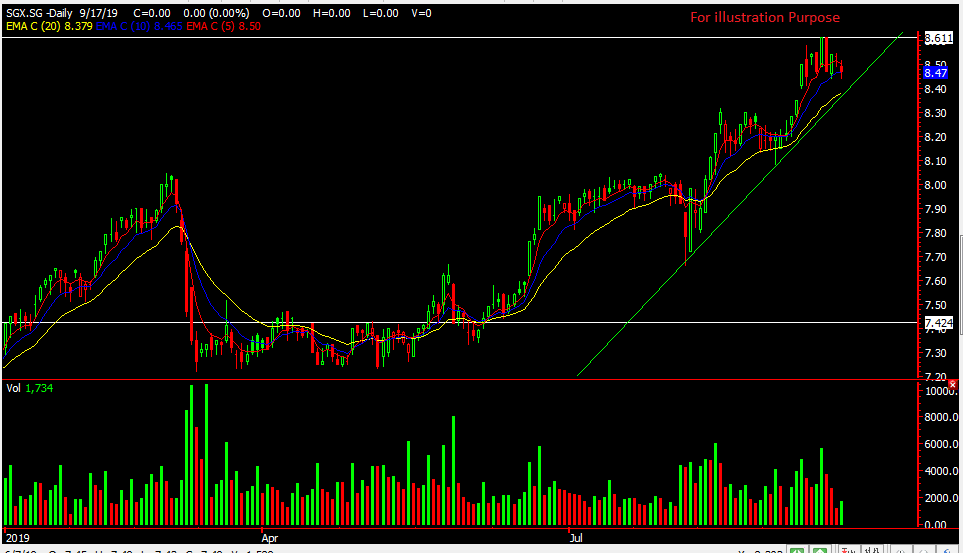

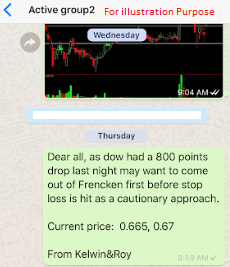

Chart Source: Poemsview 16th Sept 2019

OCBC saw a nice run ever since building a base around $10.50 level and started climbing up.

Once we saw that OCBC climbed to the point where it broke its previous horizontal resistance we decided to alert our EXCLUSIVE CLIENTS on it. An entry at $10.67 saw a nice risk reward ratio for this trade. Despite all the fears around, with the trade wars and interest rates cut, OCBC continued its climb allowing us to hit our 4th target of $11.08 all within a short span of two weeks. It is important to learn how to swing your trade in order to capture more upside especially if one thinks that market might present more opportunities. If a trader were to just contra his or her trade they might miss out on the remaining run. Hence having some leverage to swing a trade becomes very important. We’ll explain of this in our upcoming seminar next monday.

As for OCBC now, much of it might be decided on the upcoming fed’s decision. They will be meeting from 17-18sep(USA timing) which means only on 19th Sept then will we know the results.

Hence for such cases we usually try to avoid touching the stock as we don’t want to be shocked by any surprises. As OCBC has risen quite a fair bit we would rather take profits off the table and sleep in peace and not anticipate what the might or might not do.

Want to learn how to use CFD to swing your trade and not trade in and out all the time?

On 23rd Sept we’ll be revealing to you one of our trade secret and how to use CFD to swing your trades and avoid overtrading .

Date: 23rd Sept

Time : 7:30-9:30pm

Registration is a must and can be done via the link below

https://www.eventbrite.sg/e/continuation-of-trade-wars-how-to-use-cfd-moving-average-to-manage-current-volatile-market-tickets-72254205273

See you there

Yours

Humbly

Kelwin&Roy