Keppel DC Reit – [ What Are The Chances Of Testing Previous High? ]

Poemsview : 13th Oct 2020

Keppel DC Reit is an unique asset class on its own and it’s the first pure-play data centre REIT listed in Asia on SGX.

Data centre has been a hot asset and keppel DC Reit has been a beneficiary of it.

From a dividend yield Keppel DC Reit isn’t that attractive of around 2.5% due to the vast increase in price but due to its strong name and financial standing it might be still worth looking at it.

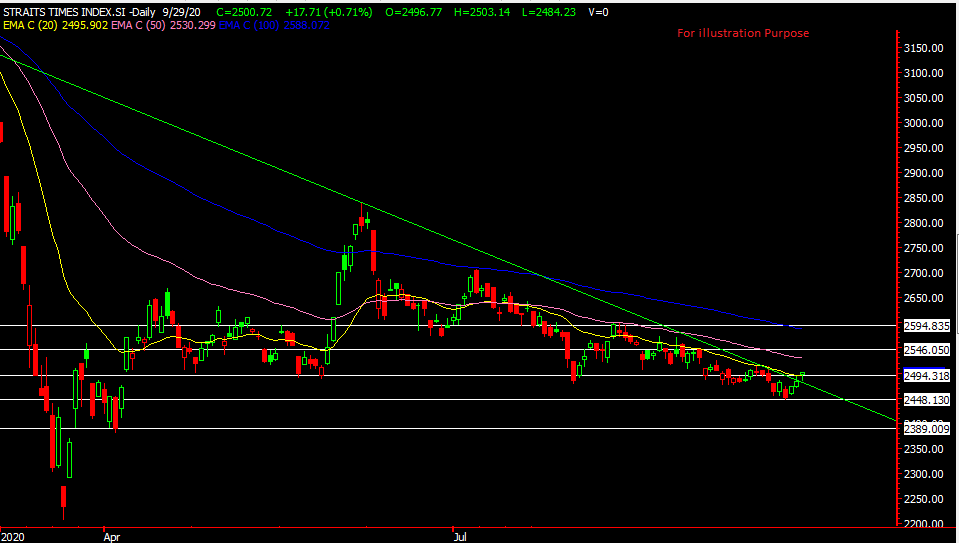

From a technical point of view, it could be in a range with support being at $2.87and the upper limit at $3.07. It has stayed above the 20ema which is a positive sign. What would be good is that the volume could have been more which could indicate a sustained uptrend. Nonetheless, we think Keppel DC Reit stands a good chance to test $3.07 in the near future. It consolidated for the last two weeks and a push to $3.07 could be on the cards. Would prefer a swing for this counter.

Let’s keep a close watch!

Yours

Humbly

Kelwin&Roy