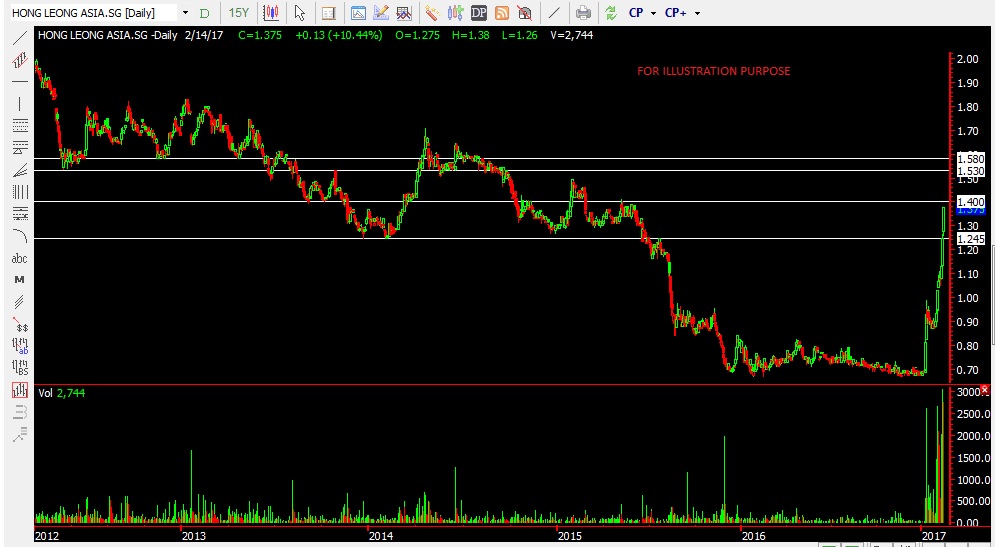

Sunpower- Anymore Power?

Sunpower Group Ltd. is recognised as a specialist in the design and manufacture of such energy saving and environmental protection products . If you’re interested you can find out more on their website.

It had a very powerful run and it seems resisted for now. Will it have more power to break that downtrend line? We’re hoping not yet. As you can see it’s currently also below the 10 days exponential moving average which is not a good sign. A good pullback would be healthy and we’re looking at a short entry around 0.795-0.805. We can place a stop loss at 0.835

We feel that the risk reward is not bad if Sunpower can move lower to 0.66 level Remember not to naked short but use Poems CFD(DMA) for shorting as this might take time to come down.

Yours

Humbly

Kelwin&Roy