Straits Times Index – [ Hitting Our Target! What We’re Doing Next]

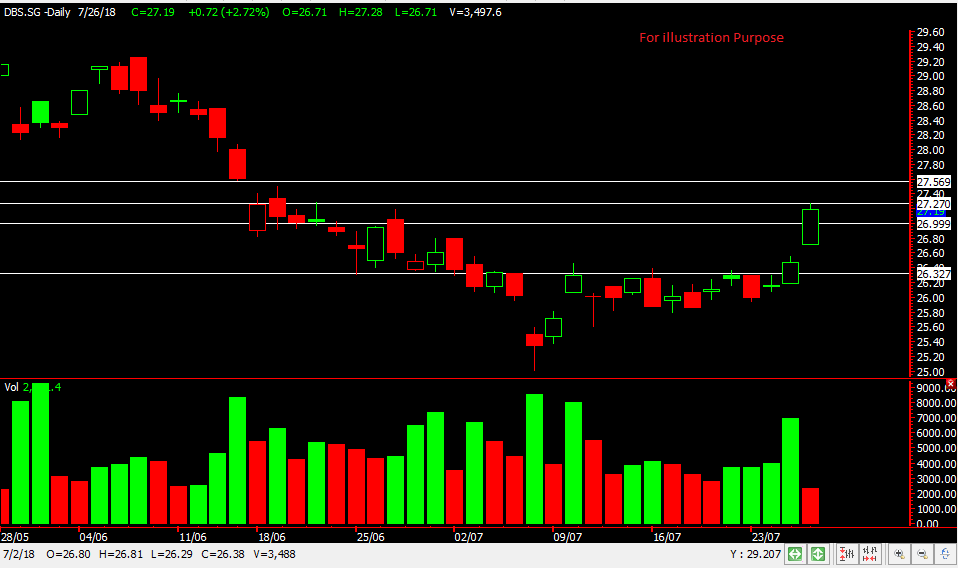

Chart Source: Poemsview 26th July 2018

Straits Times Index hits our target of 3334 region as previously blog. We’ve been constantly giving updates on the Straits Times Index guiding and sharing our views so that our community may benefit from it. In fact, the last time we updated was just 3 days ago.

The Straits Times Index had a nice rebound from where we spotted at 3220 till now, over 120 points.

A few things that we may do.

- Book some profit. As STI has seen over 3% increase we might want to book some profit as its currently at some resistance.

- Looking for an entry on pullback to about 3295 area or the 10ema depending on market developments.

- Our next target might be 3410 in the coming weeks.

Want to be part of our EXCLUSIVE CLIENT and be informed in advance of such trade analysis in order to plan and prepare?

Then be Kelwin & Roy’s client to enjoy such value added services.

Don’t miss out further!

Yours

Humbly

Kelwin&Roy