Capitaland Retail China Trust – [ Moved Up 6.5% After Our Post, Still Worth Looking At It? ]

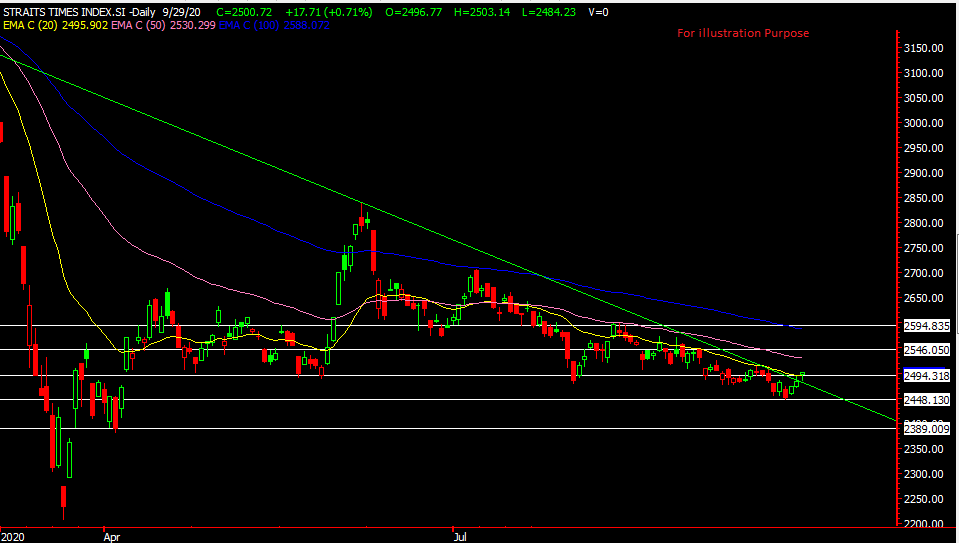

Chart Source : Poemsview 12th Oct 2020

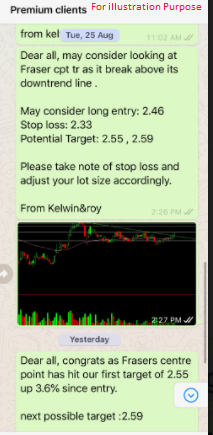

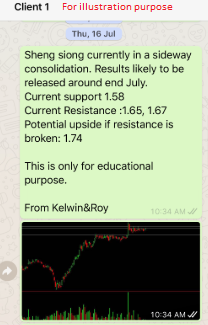

If you read our blog just last friday we mentioned CaptaR China Tr was a stock that we’re looking at given their new investment strategy and a good dividend yield with a strong sponsor.

Well, just within the day it shot up over 6.5% to reach a day high of $1.28 from the previous day close of $1.20. It’s pretty impressive if you ask us, given that its a reit and we wouldn’t expect to see such a spike up.

So some have been asking, can still buy?? Fundamentally nothing changed overnight and the company is still on track with their expansion so let’s take a look of it from a technical perspective.

CapitaR China Tr has broken out of its downtrend line with a healthy volume and is moving away from that. If you missed this breakout then maybe for a retracement might be an idea. A good retracement might be the test of $1.20 where one can look for some entry again.

There could be more upside room for CapitaR China Tr and you got to ask yourself if you’re comfortable with chasing the stock now.We have drawn the resistance

Our upside target are drawn on the chart and we’re intending for this is to a midterm trade rather than a short term trade.

Don’t forget to subscribe to our blog or you can be our client and be informed of any latest updates.

Yours

Humbly

Kelwin&Roy