Raffles Medical – [ Increase Testing for PCR Swab Due To Increase Cases And What It Means For The Stock Price?]

Image source: Rafflesmedicalgroup.com

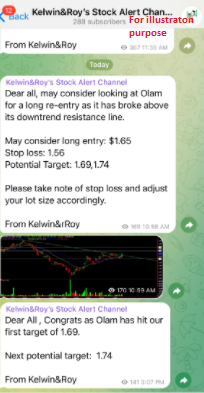

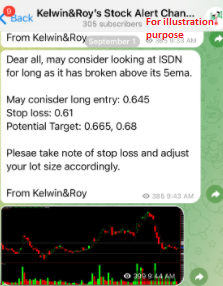

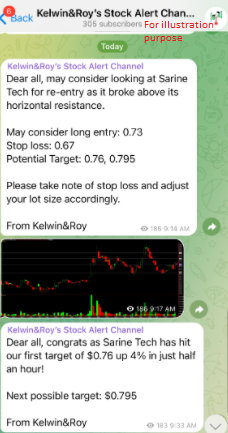

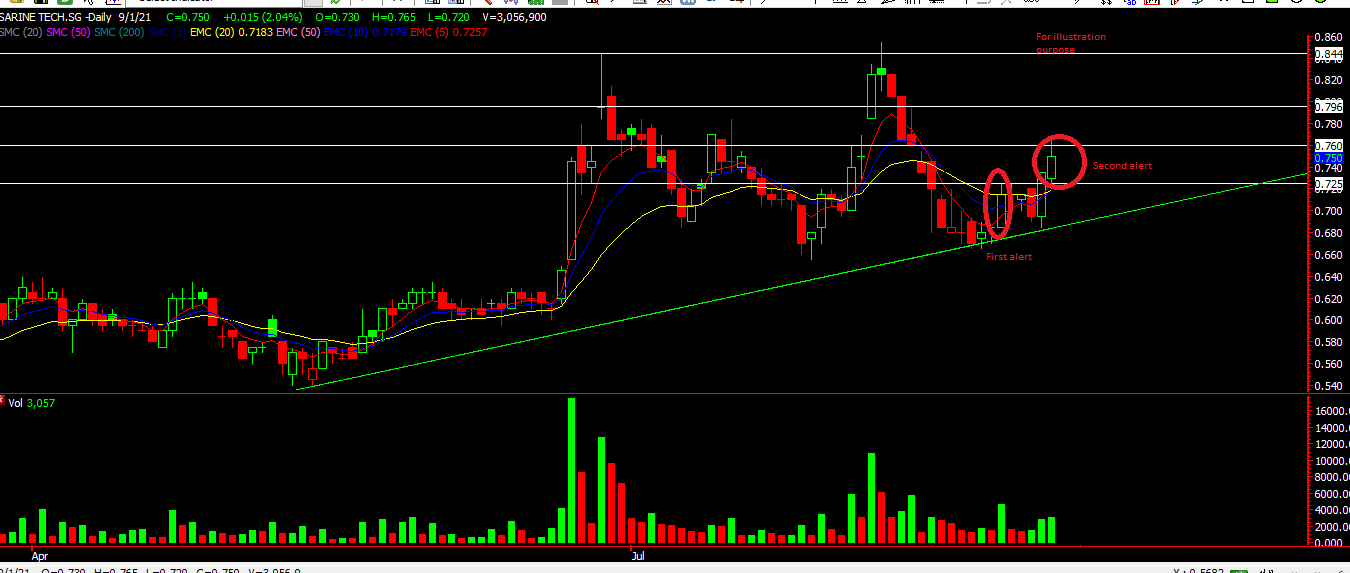

Its been a tough and rough few weeks for many as not only did the markets were choppy, Singapore saw its record number of covid cases surpassing the 2000 mark. But Raffles Medical bucked the overall trend and continued its move up. The increase in testing benefits the group and also the spillover of patient from the public hospitals as hospitals are coming under pressure. At the same time, as air travel increase, Raffles Medical stand to benefit from its PCR test from incoming passengers. Brokerage houses are also increasing its target price for this counter.

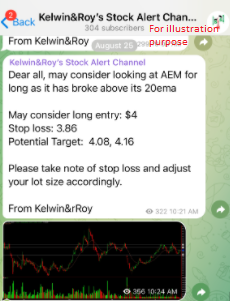

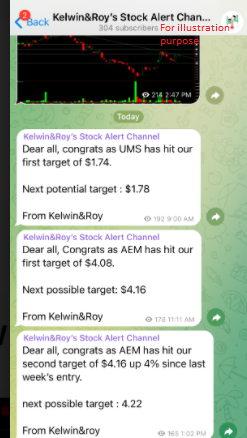

On the back of strong demand, this has led to an increase in the stock price. We have first observed a break of the downtrend line which we drew and follow up to alert our EXCLUSIVE CLIENTS. In just a week’s time we have seen it hit our first target of $1.46 and it closed right at our resistance point. If it manages to break and stay above $1.46 we might see our next target of $1.51.

If you’re interested in receiving these alerts to your phone do drop us a message and we’ll let you know how to join us!

Want to be alerted of such potential entry?

Be our EXCLUSIVE CLIENT and find out how to be included in our growing community.

Yours

Humbly

Kelwin&Roy

Image Source: Marketwatch.com

Image Source: Marketwatch.com