Hi Friends,

Do you feel exasperated, confused or experience difficulty in trading stocks with the recent swings in markets?

Are you struggling to navigate this market alone with no guidance from anyone ?

Would you like to receive FREE education? And receive timely market updates and stock analysis from Top Remisiers you can rely on ?

If you reply yes to the above questions – Fret Not , We are here to HELP and assist YOU. Do not worry and Rest assured that this is not another workshop selling courses.

We would like to invite you to our sharing session which is absolutely FREE. Here’s a look at what you can be expecting:

- Sharing some simple yet effective strategies to identify stocks with good risk reward and how to trade with prudent risk management.

- Sharing on how we can provide FREE and consistent education, guided by us (Phillips Team of Top Trading Representatives Kelwin & Roy)

- How to join our community and benefits of being our clients and receiving the quality services we provide in our community like useful and timely stock analysis via WhatsApp in future.

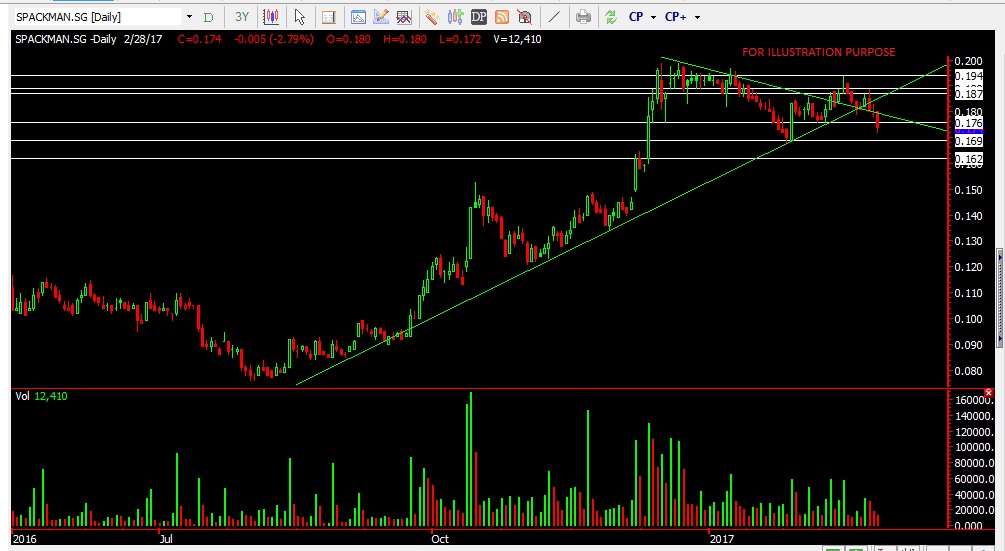

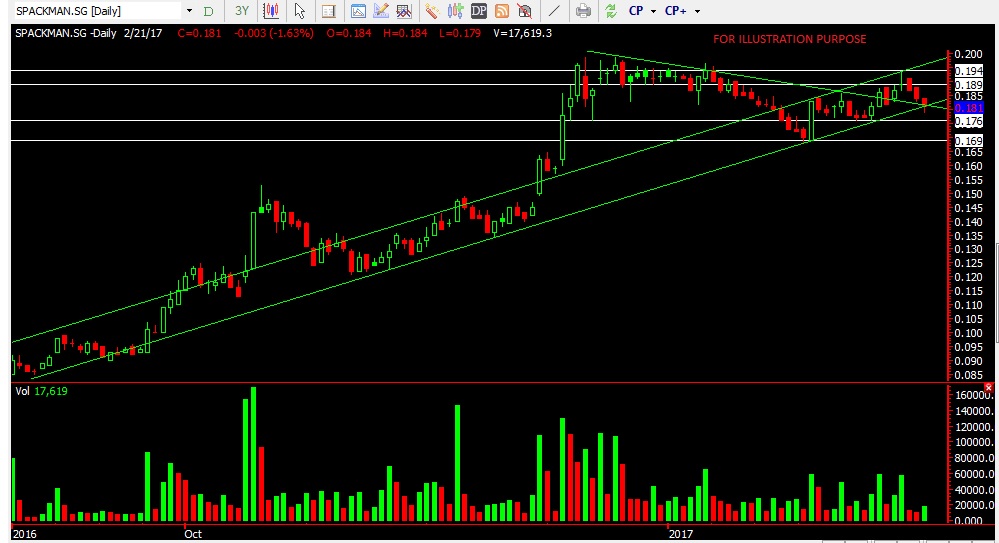

- Sharing on Other technical stock trading fundamentals with specific stock analysis and examples:

- How to identify Potential Entry, Stop Loss and Target Profit Zone on Long and Short Positions.

- How to Short Sell Stocks using CFDs so that you will be prepared for the next market pullback like our blog post on Wilmar

Again, This Session is absolutely FREE. We don’t believe in piling up unnecessary course fees and would like to have a casual sharing on some analysis and to have a personal touch point with you, our readers.

You are certainly more than welcome to come with a friend who can also benefit from this. Do NOT give this opportunity a miss!

Register now at https://www.eventbrite.sg/e/trading-success-identify-stocks-with-a-winning-edge-tickets-36065084639!

Yours

Humbly

Kelwin&Roy