YZJ ShipBldg – [ Target Met And Closed Day High!]

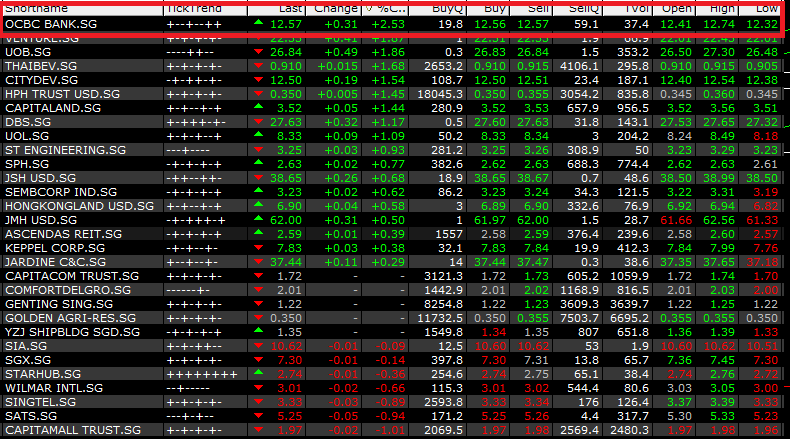

Chart Source: Poemsview 19th Feb 2018

YZJ up over 5% today and met our target of 1.45 and even closed above the 200ma.Its a positive sign but it has to stay above it for the next few days for the next move up. This is our Second stock in our list of TOP5 shopping list that has hit our target which we sent out to our exclusive client.

The volume that came in today was normal but an increased in volume today as compared to thursday would bring about more confidence for the next move up.

Our next possible upside might be 1.53 then 1.57.

Yzj results could be out during the first week of march.

Want to know what else is on our Top5 shopping list?

Don’t miss out furter and learn how to take advantage of the rebound.

Click HERE if you are serious about joining our exclusive community where we’ll reveal our TOP5 stocks that we’re looking at! OCBC has already met two of our targets!

We got a team of top tier remisiers waiting to serve you.

Yours

Humbly

Kelwin&Roy