AEM – [ Up the AMP, Closing In To Our Third Target!]

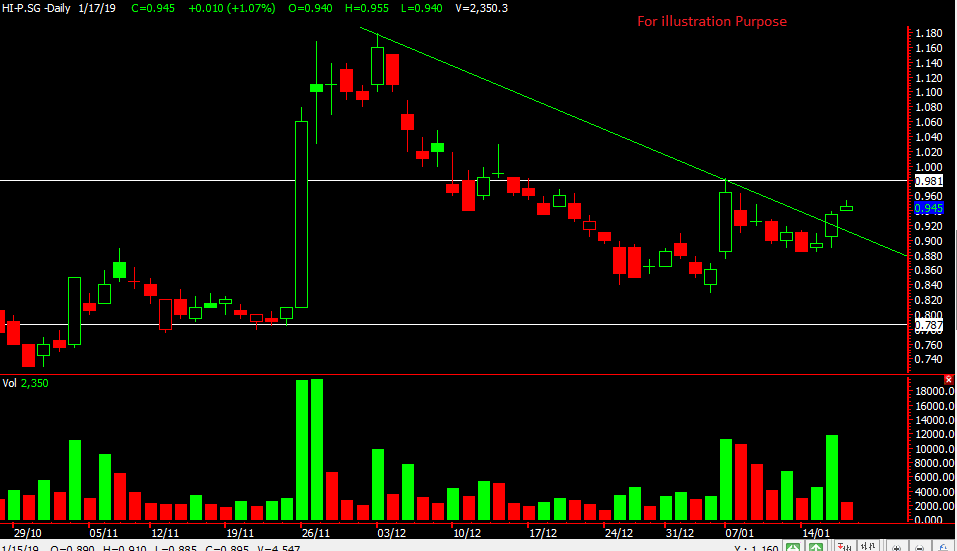

Chart Source: Poemsview 18th Jan 2019

AEM one of Singapore’s electronic counters, continues its move up as the general market continues on its bullish momentum.

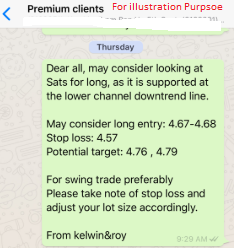

AEM has since hit our second target of $0.925 and is one pip away from our third target of $0.96. Other electronic stocks like Hi-P has also shown some positive signs.

AEM was a stock that we share with our EXCLUSIVE CLIENTS back last week when it was just at $0.85.

It had a good run of over 12% in under two weeks and we’re satisfied with the results. Perhaps a pullback might present an opportunity to scale back in. We’re watching to see if any pullback that might present some entry.

What’s your trade plan for AEM?

It is crucial to have a proper and sound trade plan with the right risk reward ratio in order to beat the market.

CLICK HERE to see how you can develop a sound and actionable trade plan which we share to our community.

Yours

Humbly

Kelwin&Roy