CapitalandInvest (9CI) – [New HIGH For the New Year! Our Next Target?]

Chart Source: Tradingview.com

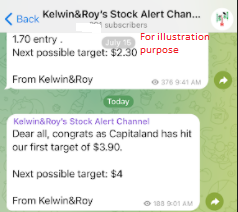

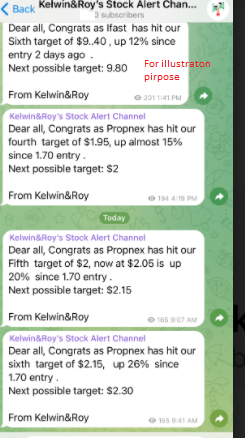

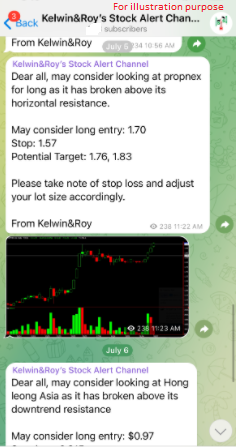

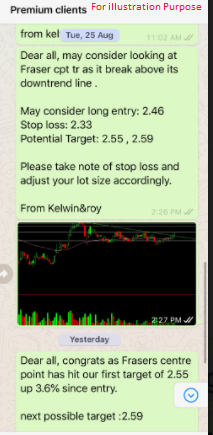

Great start to the new year as we saw Capitaland Investment Ltd making a new high today! It had consolidated more than 2 months and finally shown a great move! Another catalyst might be a local brokerage has reinitiate ‘buy’ on Capitaland Invest with a $4 target. And why are with happy with that? Simple, as we saw movement in Capitaland Invest, watching it break the downtrend line, we notified our Clients about this. We’re glad that with the observation it finally moved up after such a long consolidation. As Capitaland Invest is part of the STI component, that is why we’re seeing the STI moving higher together with the banks.

Our first two upside resistance target has been met and our third one might be around $3.78 area. Its about 24 cents from the previous resistance and the previous support. So we might see more upside in the coming days.

Missed out on this trade?

Don’t want to miss out on another trade alert? Want to know what stock we’re looking at next?

Then JOIN our growing community and see how you can receive such trade alert sent to your phone.

Yours

Humbly

Kelwin&Roy