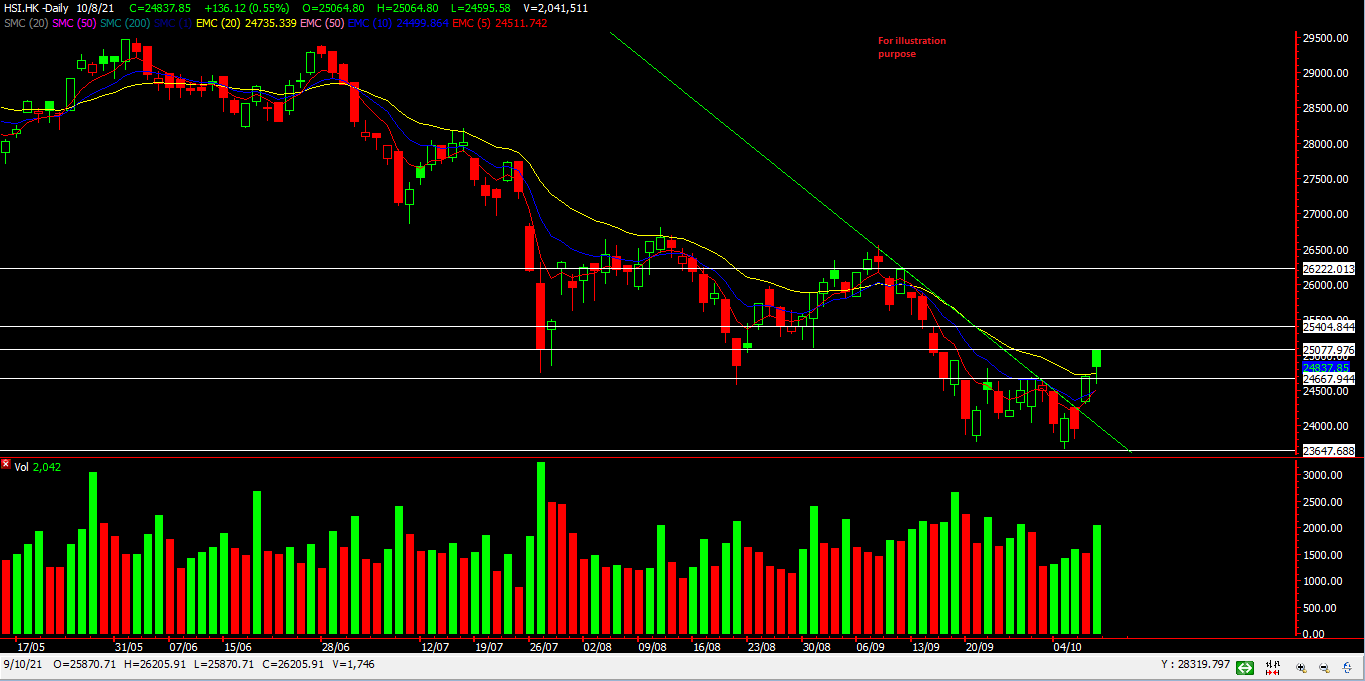

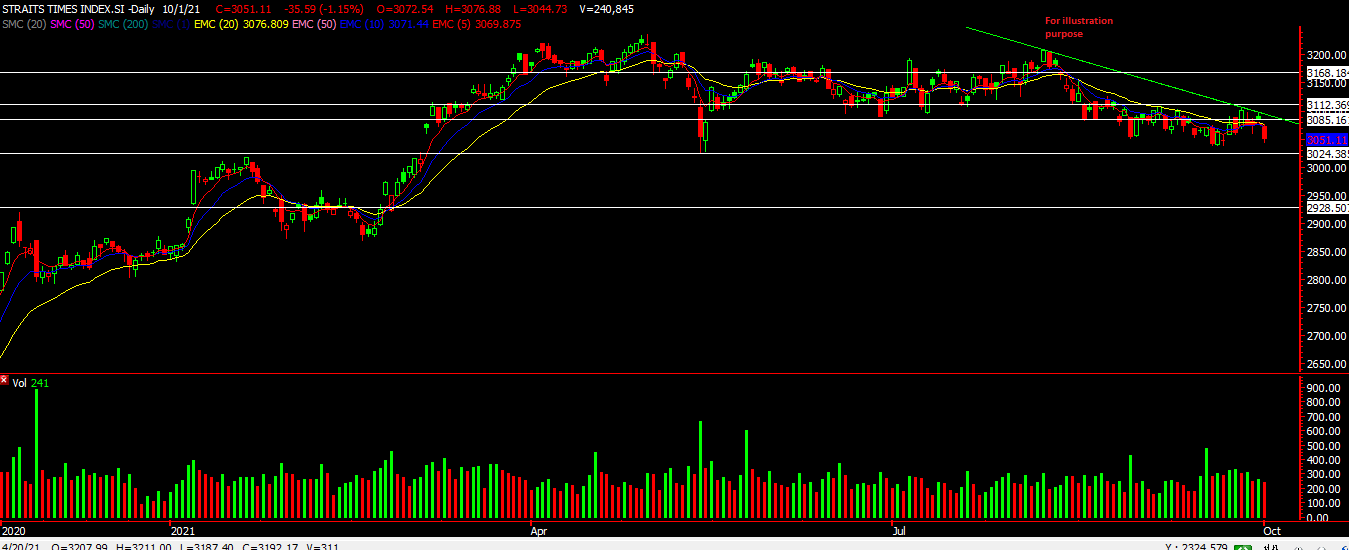

Are Banks Back In Play?

Are banks back in play? Lets take a quick look at the charts to see if momentum to the upside has returned.

Lets take a look at OCBC first.

Chart source: AdvisorXs 14th Oct 2021

OCBC Bank has broken above its horizontal resistance of around $11.64 which our clients were alerted on. From there we can see if move higher to our upside targets. A new upside move might be in play as banks are starting to come back in play. The big banks in US are also reporting results this week which might give a boost to our Singapore side if results are good. Volume is also starting to return as traders are starting to come back to the bank counters.

We might see OCBC move up to around $12 which is the gap resistance and a break of that might see it push higher to $12.24.

UOB

Image Source: AdvisorXs 14th Oct 2021

UOB chart quite similar to OCBC’s chart as it broke above its horizontal resistance of around $26.34. Volume started to come in yesterday too as our three local banks started getting more attention. If this level is able to hold, we might see it move to $26.90.

DBS

DBS is the only bank that has yet to break out. Will it breakout soon? Is this on your watchlist? We have drawn our levels what we are targeting. What will your trade plan be like?

As we can see, momentum looks like its returning to the three local banks with DBS lagging behind. Will it catch up?

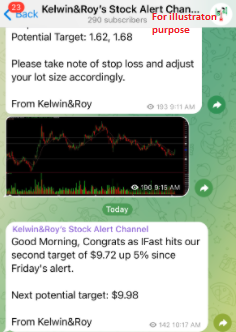

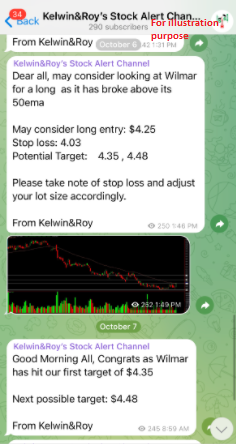

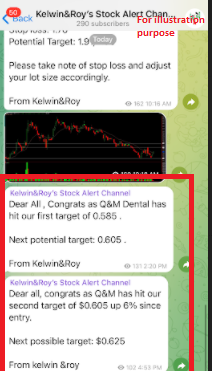

Don’t want to miss out on another trade alert? Want to know what stock we’re looking at next?

Then JOIN our growing community and see how you can receive such trade alert sent to your phone.

Yours

Humbly

Kelwin&Roy