As expected, we continue to see selling across global markets BUT with this pullback, its giving rise to some opportunity to enter the market.

Inflation data last week started to creep up and it spooked the markets with some selling. Some data coming out this week like initial jobless claim and Fed’s Waller will be speaking. Though not a very key speaker, but market will be listening in to see what the Fed’s stand is in the coming months. As market has seen selling for the past few weeks, we might see some rebounding coming in this week.

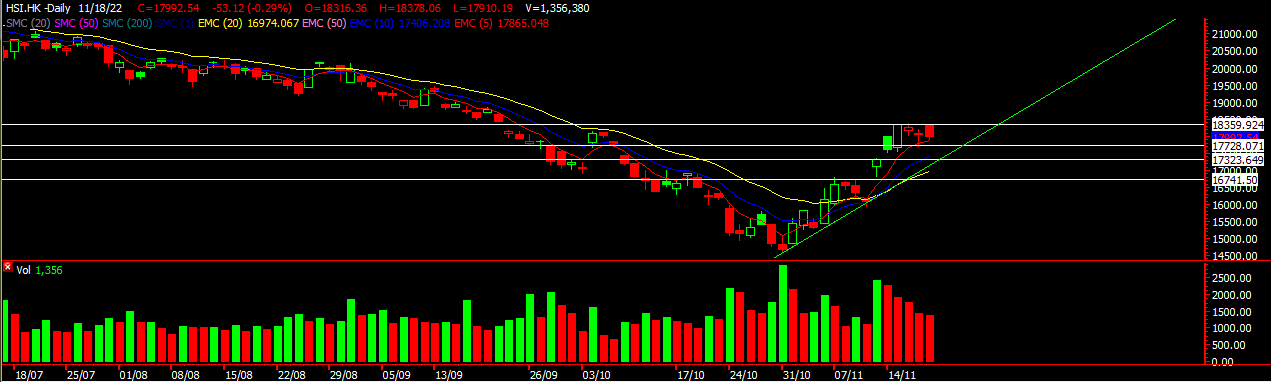

HSI

HSI has corrected about 12% since the high in Jan. A correction can be anywhere from 10-20% so don’t be surprised if we see further downside. BUT with such downside comes an opportunity to get back into the HK market especially investors missed out on the huge run in since Nov. The Spy balloon was the first cause that started this correction but at the same time could be a distraction The HSI might see a little more downside to around 19500 level before we see a rebound. This might not represent the bottom as yet and we’ll have to wait and see for it to be tested to ensure that’s the bottom. A rebound could take us back to 20k mark. Eyeing Baidu, Tencent, Alibaba and a few others during this pullback.

STI

STI also came off to the level we anticipated with 3270 being a critical support. The main reason is that the banks have been experiencing selling after their results causing our STI to move down. We might see some rebound in the coming week but a better place to scale in might be at around 3220. There is a gap support over there and if it really doesn’t hold then 3180 could be the lower level we should see. Don’t miss this opportunity.

To know more about the levels to look out for in the S&P500 and Nasdaq100 do head over to our facebook for more details.

Yours

Humbly

Kelwin & Roy