The S&P500 and Nasdaq both posted worst week since March after Fed meeting. As always, we warn not to take up too much positions before any major events. Fed didn’t hike rate as anticipated BUT it always mentioned that it won’t be cutting rates that aggressively in 2024 which saw market selling off. The 10 year yield also started moving up which puts more pressure on the markets especially on Nasdaq.

For this week, there are some critical levels to watch out for especially for the US markets.

S&P500

The S&P500 currently sitting on a first level of support of 4320 could see it move down lower during the week. We could see it test the 4264 level which coincides with the 200ema and the uptrend support line too. This could be the first level to scale in if you have missed out on the year’s rally. This level would represent about a 7% pullback and its well within a healthy market pullback. In fact, a 10% pullback shouldn’t be seen as a surprise given how much markets have ran up too. So get your ammo ready!

Nasdaq100

Nasdaq, the index that is more sensitive towards interest rates movement has already seen about an 8% pullback since the high. But don’t forget this is the market that has risen a whooping 45% for the year too! so an 8% pullback once again shouldn’t be too much to ask for. For the week, we could also see Nasdaq continue to drift lower. The 200ema or 14078 level could be a good point of support. Waiting around there to add more positions into the Nasdaq.

STI

The Straits Times Index pulled back more than expected as the negative sentiments flowed through Asia after Fed’s meeting. STI has found some support at the 3186 level but this might not be able to hold that well. For the week, we could still see more weakness coming in as STI tries to defend the 3180 level. The next critical support would be at 3120.

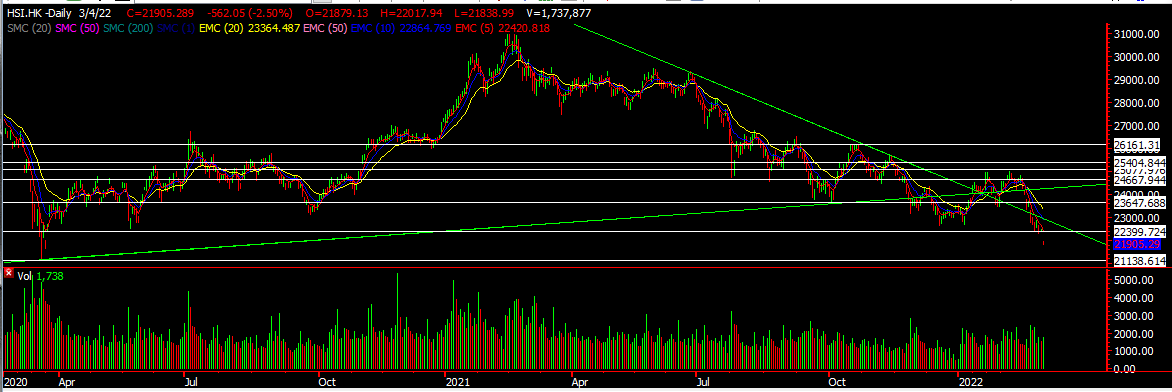

HSI

The Hang Seng Index saw a strong come back of about 2.2% on Friday as funds put US$1 Billion back into China markets. Investors picked up badly beaten up stocks like Tencent which came to its $300 psychological level. HSI could push higher to 18500 level this week but take note that whenever HSI rallies, it tends to fizzle out. So don’t be overly optimistic on short term rally and be quick on securing profits. The support of 17570 had been tested and is proving to be a credible support for now. Once this holds well we might really see the bottoming for the Hang Seng Index. Fingers CROSSED!

Yours

Humbly

Kelwin & Roy