It was a brutal end to the week as markets tanked after Powell’s speech after he reiterate that more pain is ahead as Fed continues to look to increase interest rates. Its not something unexpected but markets didn’t like the tone and the massive sell down came. S&P500 gave up all its gain and broke its support which indicates more downside.

STI

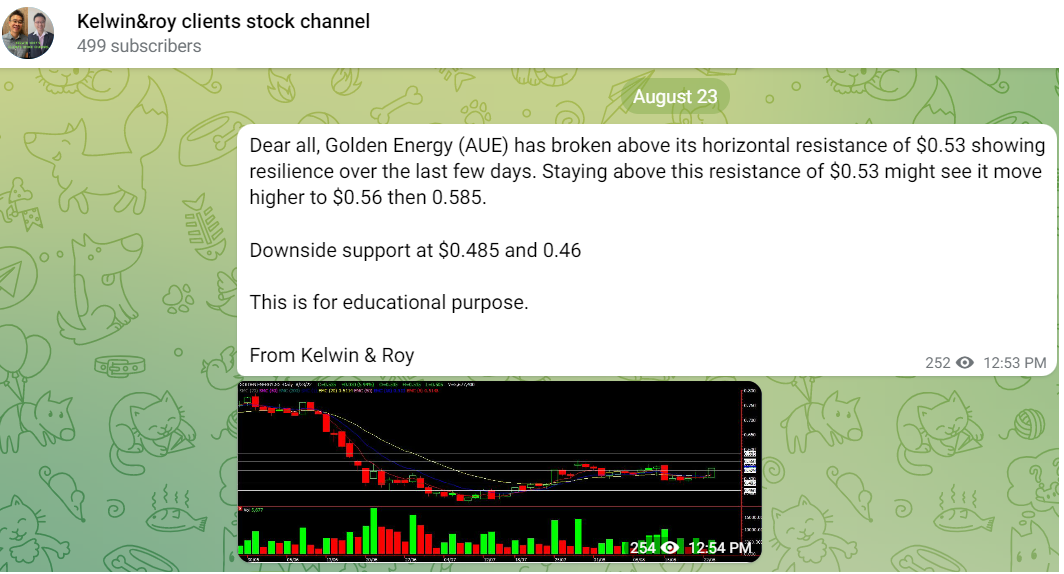

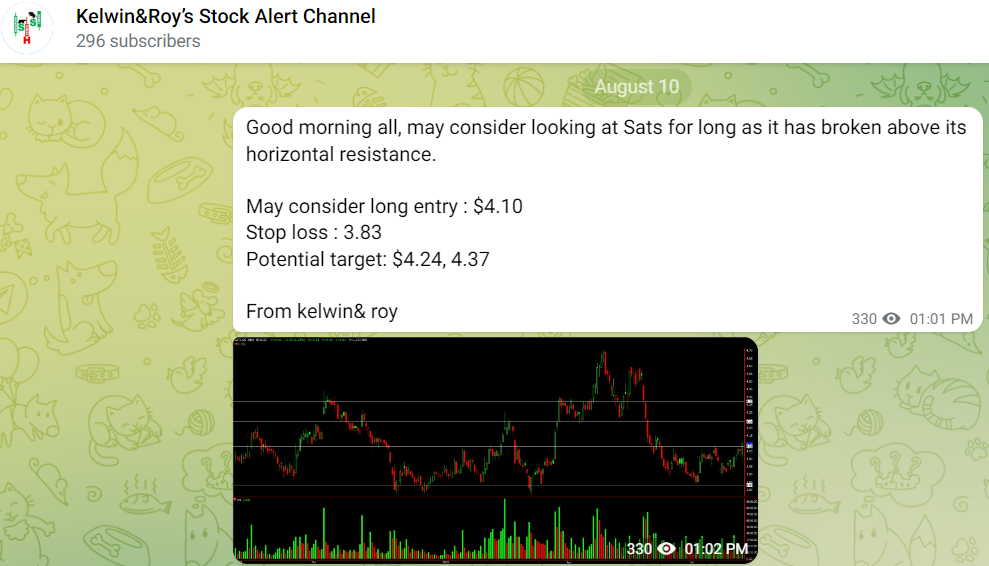

STI fell at the start of the week but regained some grounds towards the end. Overall market still remains sideways to weak but with Friday’s sell down, some negative sentiment might spread over to Asia. So downside movement is expected for the week. But despite all these we managed to squeeze in some winning trades like Golden Energy. Waiting for more pullback in the market.

HSI

HSI came roaring back after China stimulus and more hope of the end of Covid zero policies. It broke the downtrend line BUT with the selldown on Friday some negative sentiment might flow over to HK so some pullback should be expected. We might see a pullback to 19500 and if that holds we could see a real bounce.

Do head over to our Facebook page for more updates on S&P500 and where it might head after the massive sell down. Updates for Nasdaq is also over there.

Yours

Humbly

Kelwin & Roy

Melvin Lim, the Co-Founder of PropertyLimBrothers to share his views on the recent rise in interest rates and market trends.

Melvin Lim, the Co-Founder of PropertyLimBrothers to share his views on the recent rise in interest rates and market trends. and unsure of when to enter the markets, then we got a solution which might help you.

and unsure of when to enter the markets, then we got a solution which might help you. So mark your calendar, invite your friends and come soak up the knowledge As spaces are limited and we’ll be expecting a huge turnout, do register with the link below as soon to avoid disappointment.

So mark your calendar, invite your friends and come soak up the knowledge As spaces are limited and we’ll be expecting a huge turnout, do register with the link below as soon to avoid disappointment.