I will be speaking in an upcoming LIVE webinar on 23rd Oct (Wed) organized by Holistic Wealth Planners.

Time: 7:30 PM to 9:00 PM

Register here:

𝗦𝗽𝗲𝗮𝗸𝗲𝗿: 𝗟𝗼𝘂𝗶𝘀 𝗞𝗼𝗮𝘆, 𝗦𝗲𝗻𝗶𝗼𝗿 𝗙𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗦𝗲𝗿𝘃𝗶𝗰𝗲𝘀 𝗗𝗶𝗿𝗲𝗰𝘁𝗼𝗿

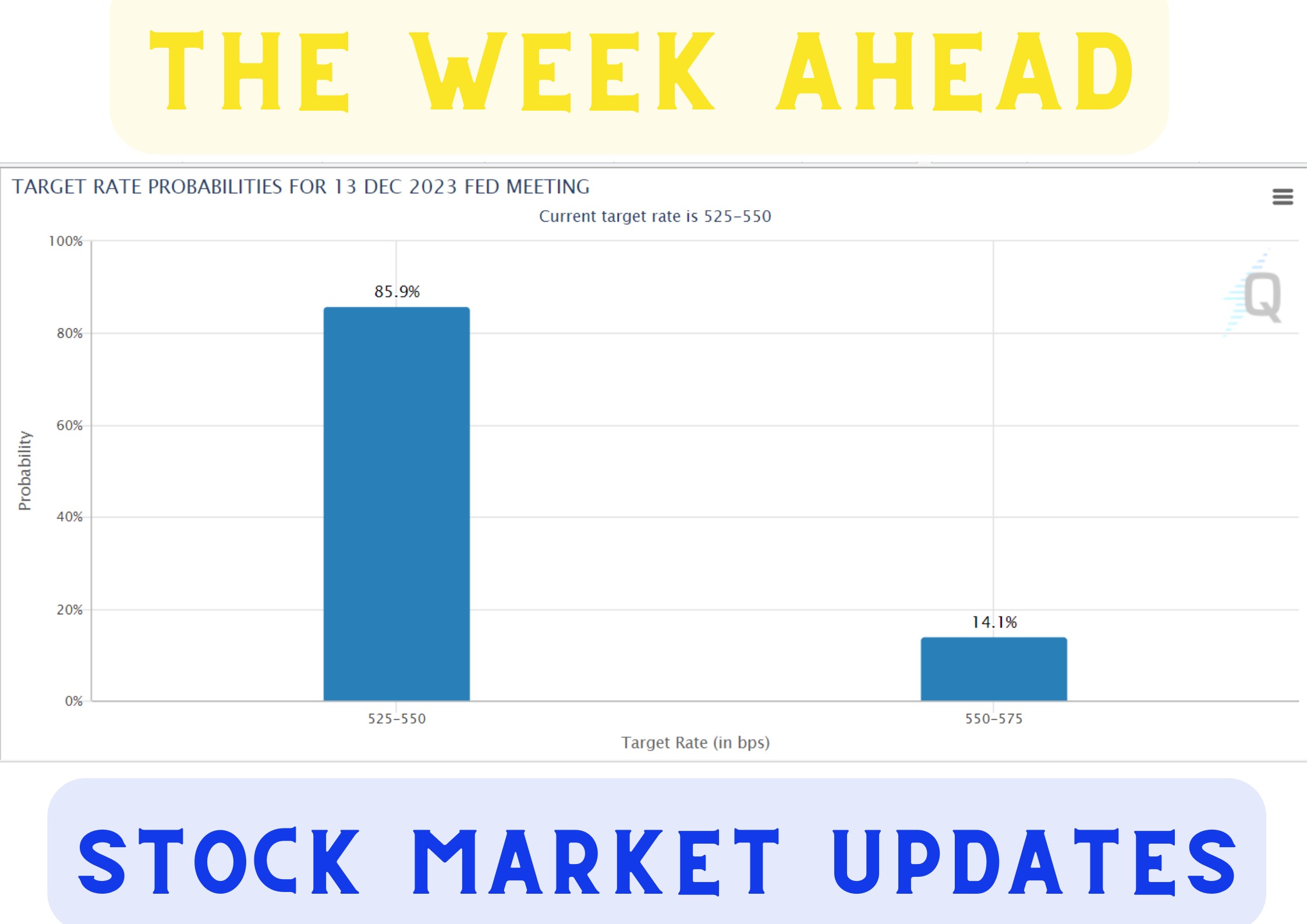

Louis will kick off the webinar with an in-depth analysis of the current market environment, focusing on global rate cuts, China’s recent rally, and their potential impact on various asset classes. He will also provide macroeconomic insights, covering key trends to watch and how they may influence different investment strategies in Q4 2024.

Three expert speakers will discuss strategies for three distinct client profiles, offering personalized advice based on risk tolerance, market involvement, and investment goals.

𝗦𝗽𝗲𝗮𝗸𝗲𝗿: 𝗔𝗹𝗶𝗰𝗲 𝗧𝗻𝗴, 𝗪𝗲𝗮𝗹𝘁𝗵 𝗠𝗮𝗻𝗮𝗴𝗲𝗿

This profile focuses on investors who prefer low-risk investments, parking substantial amounts of cash in Fixed Deposits, Treasury Bills (T-Bills), or Singapore Savings Bonds (SSB). With the rate cuts, they now face reinvestment risks. The speaker will address how to navigate these risks while maintaining a conservative approach, discussing options such as using money market funds, quality bonds, capital guaranteed instruments or exploring defensive sectors.

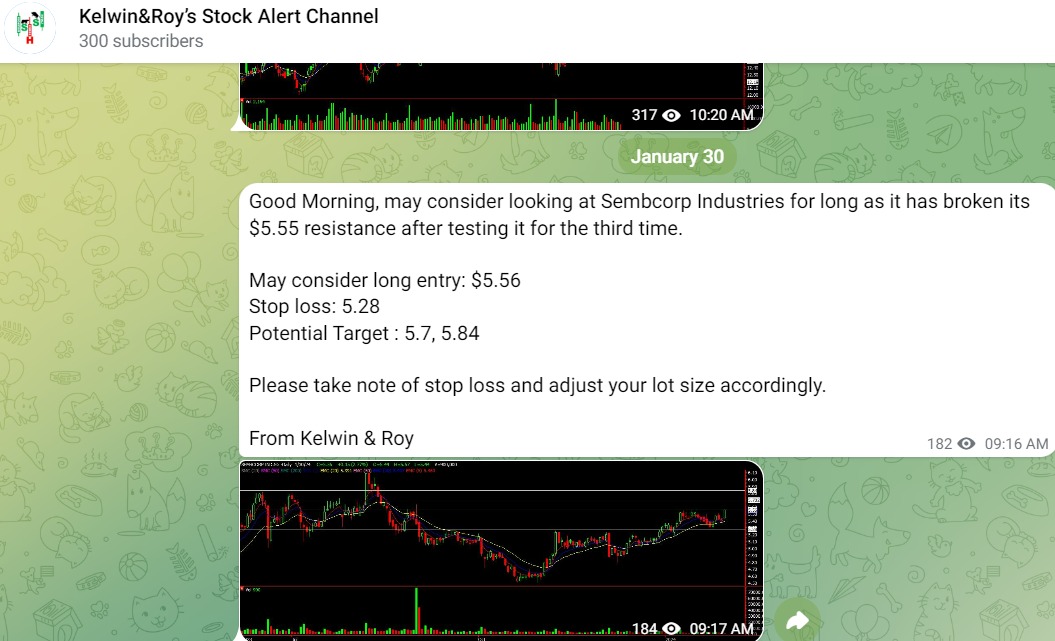

𝗦𝗽𝗲𝗮𝗸𝗲𝗿: 𝗞𝗲𝗹𝘄𝗶𝗻 𝗟𝗶, 𝗪𝗲𝗮𝗹𝘁𝗵 𝗠𝗮𝗻𝗮𝗴𝗲𝗿

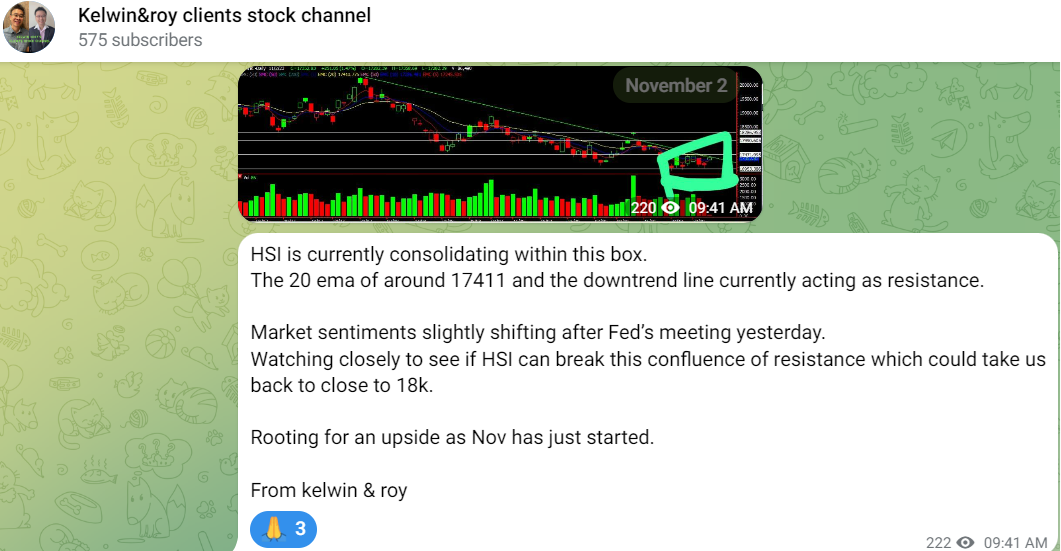

This speaker will address active traders who are closely watching short-term market movements. Should they short the U.S. market amid rate cuts and take advantage of China’s rally? This part of the discussion will dive into speculative strategies, technical analysis, and tactical positioning for those seeking to capitalize on short-term market swings.

𝗦𝗽𝗲𝗮𝗸𝗲𝗿: 𝗗𝗶𝗰𝗸𝘀𝗼𝗻 𝗣𝗲𝗸, 𝗙𝗶𝗻𝗮𝗻𝗰𝗶𝗮𝗹 𝗦𝗲𝗿𝘃𝗶𝗰𝗲𝘀 𝗔𝘀𝘀𝗼𝗰𝗶𝗮𝘁𝗲 𝗗𝗶𝗿𝗲𝗰𝘁𝗼𝗿

For busy working adults who are aware of the market shifts but lack time to actively manage their portfolios, this speaker will recommend practical, time-efficient investment strategies. They will explore the use of passive investments, such as funds, managed portfolios and using dollar-cost-averaging-method, allowing these investors to participate in market gains without requiring constant monitoring.

A brief wrap-up summarizing key takeaways from the market outlook and panel discussion, followed by a Q&A session to address audience questions.

Time: 7:30 PM to 9:00 PM

Register here: https://bit.ly/HWPInvestment2024