We do apologize for the lack of updates to the public but rest assured that our clients are getting full updates just like the one below.

We’re in Nov a seasonally stronger month and we have seen markets rebounding fiercely for the last week. We hope you have positioned yourself for this rebound and for the long term investors taking advantage of the pullback. We could be looking at more upside for the HK market while S&P approaches some resistance and might not rebound as much.

STI

Chart Source: DZH advisor 5th Nov 2023

The Straits Times Index broke out of its consolidated range with a general rebound in the blue chip. Banks led the gain BUT we got to be careful as DBS will be reporting their results before market opens on 6th Nov ( Monday). Outlook could be a little more cautious as the economy is slowing down and concerns about loan book growth could start impacting the banks. UOB fell after their results so the same fate could be for DBS. OCBC will be reporting their results this coming friday(10 Nov) before market open.STI is currently at the resistance after covering the gap. We’re still positive for the week and could see STI make a break to 3186. SATS will be releasing their results also on Friday so if you would take a trade do take note of that and try not to hold over the results.

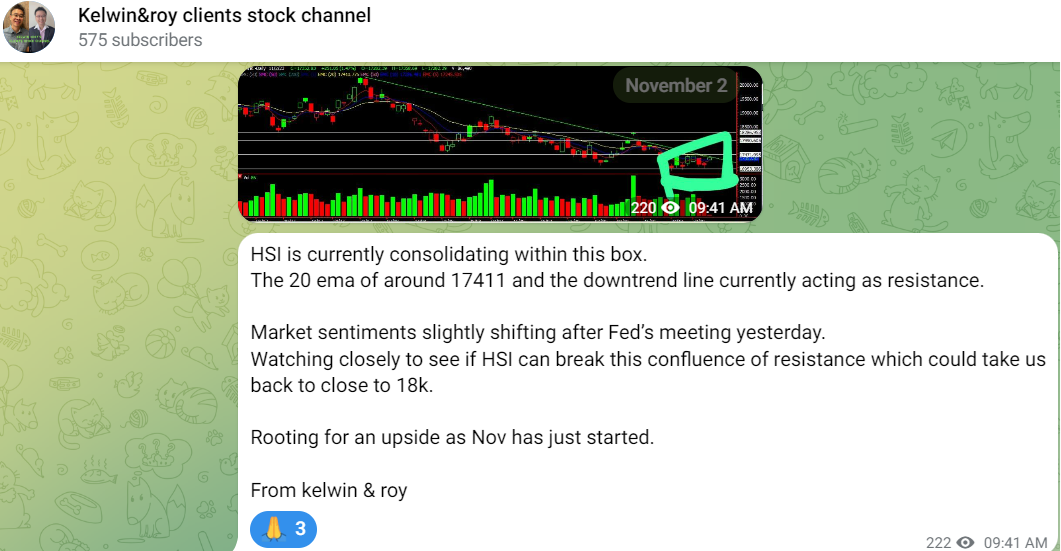

HSI

Year to date the Hang Seng Index has been rather disappointing BUT this could be changing as China is trying their very best to kick start their economy. The HSI broke out from its mini consolidation and this could now bring us to the 18k level and even 18500. It has broken above its 20ema resistance too which is a positive sign as it has always been resisted by that. Many stocks like Tencent, Alibaba, Geely are all breaking out too. Don’t miss this opportunity as this is the first day that HSI broke out. Many shortist will have to start covering if the rally gets stronger which could then add to this rebound. Looking to a positive week.!

Head over to our FB page for more updates on the US markets which you don’t want to miss.

Yours

Humbly

Kelwin & Roy