We have seen a good run up for the three local banks on better than expected results and on the back of rising interests rate. But can this run continue on forever? As we know, nope! There will be a time for a break and pullback and there is something we noticed.

DBS, as we can see has been guided by the 5ema and 10ema. This moving average has been guiding DBS for the last month and has never closed below that BUT today at close, we can see that it has closed below the 5 and 10ema. Is this a sign of more pullback? We think its possible! Its good for the banks to pullback so that those who missed the rally can possibly re-enter. The initial support would be at the 20ema of around $34.75. The Next downside support would then be around $33.84 near the uptrend and horizontal support. We can see the volume has increased for today too. This might also help support the downside. If you’re looking for a short candidate, this might be one counter. If DBS closes above $36 then this short trade would be invalid.

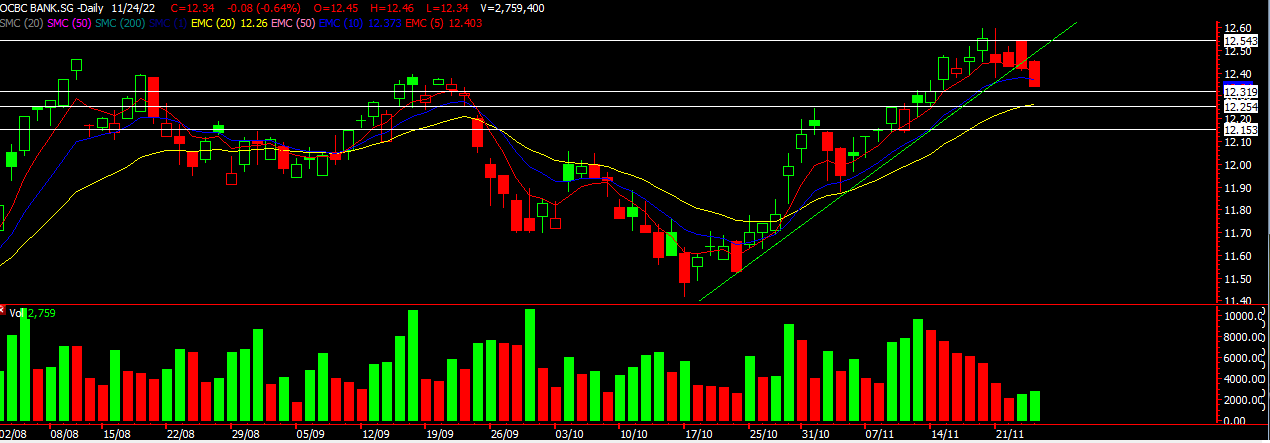

OCBC, also similar to DBS, it has closed below its 5 and 10ema which might signal more downside. An increased in volume might support the downside for OCBC too. It has closed below the short term uptrend line too and the first downside support is around the 20ema which is $12.26. If more weakness comes in then we might see $11.87 on the cards. A close above $12.60 would make the downside invalid. Remember, if you are looking to short always have a TRADE PLAN with a stop loss, entry and target price. Don’t naked short and one can consider using Poems CFD for short or even DLCs!

As for UOB, it hasn’t broke and close below its 5ema so until we see that, then some pullbacks will be on the cards.

If you got any questions, feel free to CONTACT US!

Yours

Humbly

Kelwin & Roy