Wilmar – [ Moving Against The Trend, Advanced Alert Given, Let’s Take A Look]

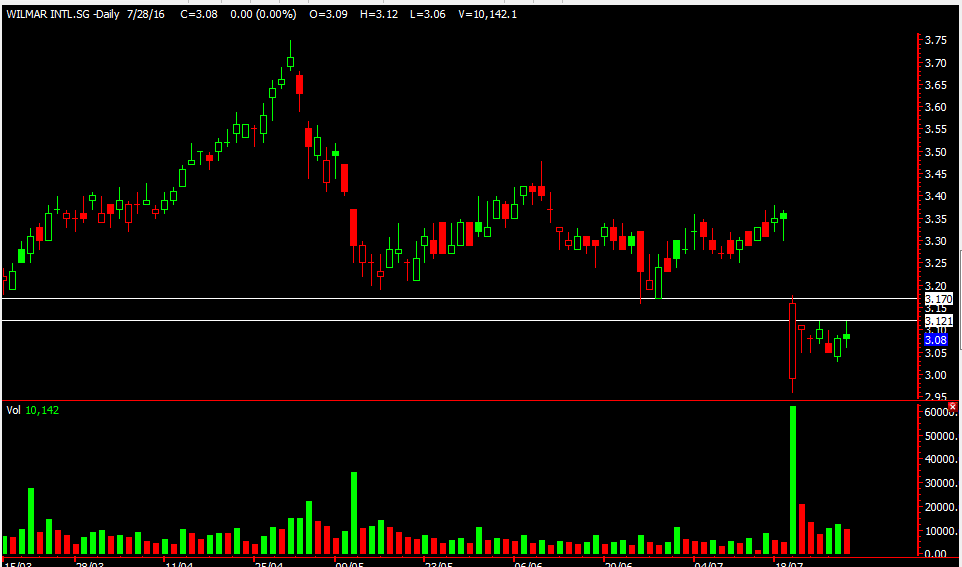

Chart Source: Poemsview 25th Oct 2018

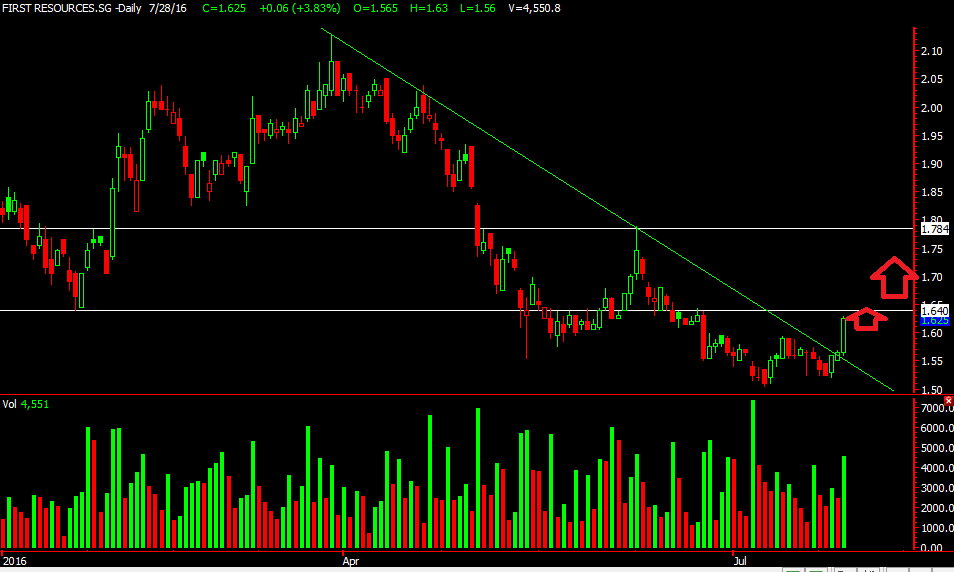

Wilmar one of the rare few STI component stock that is up on such a negative day. Dow closed down 600 points and sent another selling frenzy in asia in the morning. As market started to recover so did Wilmar. Wilmar put up a good fight and almost topped the list in terms of percentage gain for the day.

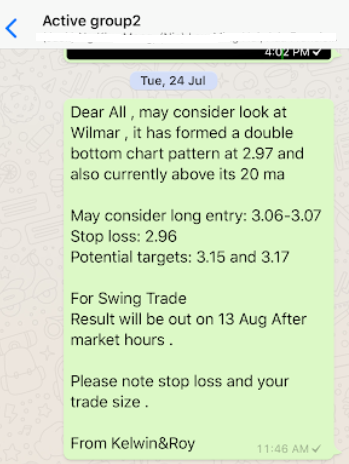

We’re glad we managed to alert our EXCLUSIVE CLIENTS earlier this week on monday when Wilmar was still trading at $3.01.

Slow and steady and it managed to reach our $3.11 target within the week.

For now the $3.11 resistance for wilmar looks strong. A break above that might see it move up to cover the gap and maybe to $3.18.

Wilmar’s results will be out on 12th Nov after trading hours.

Not getting such value added services?

Want to be part of this EXCLUSIVE COMMUNITY?

Don’t wait and CLICK HERE to see how you can join this community and all the exciting perks of being a Client of Kelwin&Roy

Yours

Humbly

Kelwin&Roy