Sunpower – [ Lost Its Shine? Any More Power Left?]

Chart Source: Poemsview 8th March 2019

Sunpower had a good run over the last one month and finally hit the brakes to come down.

Using the moving averages we can see that sunpower broke its 5ema and started coming down.

Our EXCLUSIVE CLIENTS were alerted of this analysis given that the uptrend line was supporting it too. A break below the support of $0.585 saw Sunpower moving down relatively fast to its 20ema.

We’re glad that using such a simple indicator helps strengthen our analysis and gives us an additional tool to increase our probablility.

Currently Sunpower is supported by the 20ema but a break of might see it move lower. Our next support is at $0.53

Want to know how to use the moving average indicator to strengthen your analysis? Then come join us for our workshop on Moving Averages.

Details are below:

Date: 11 March 2019

Time: 7:30pm

Please register in the link below as we have very limited space.

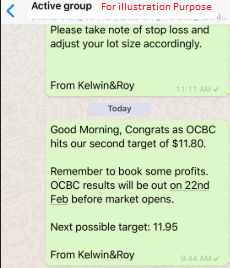

In addition, We’ll also share how to receive such trade analysis straight to your handphone.

Yours

Humbly

Kelwin&Roy