A BIG week went by and it yield a positive result for us. Fed increased rates by 0.75%, GDP shrank for the second month in the US and big tech results mostly came under estimates BUT despite these challenges the S&P500 closed up for the week. Data is important but remember to watch the price action to see if its showing weakness. Despite all the data that came out, one might have expected markets to continue to come down but it did the total opposite which shows strength. This rebound does look like it has a bit more room to go before it hits the critical resistance of 4200 for the S&P 500.

HSI

Still no bullish sign for HSI as it continues it downwards move towards our 20k support. We’re still waiting for more bullish signals to come out before any short term trades to be executed. There has been a string of negative news for HSI recently hence the pullback. The property scene in HK is not stable yet with property counters still not out of the woods. The next possible downside target might be 19200. Keeping watch.

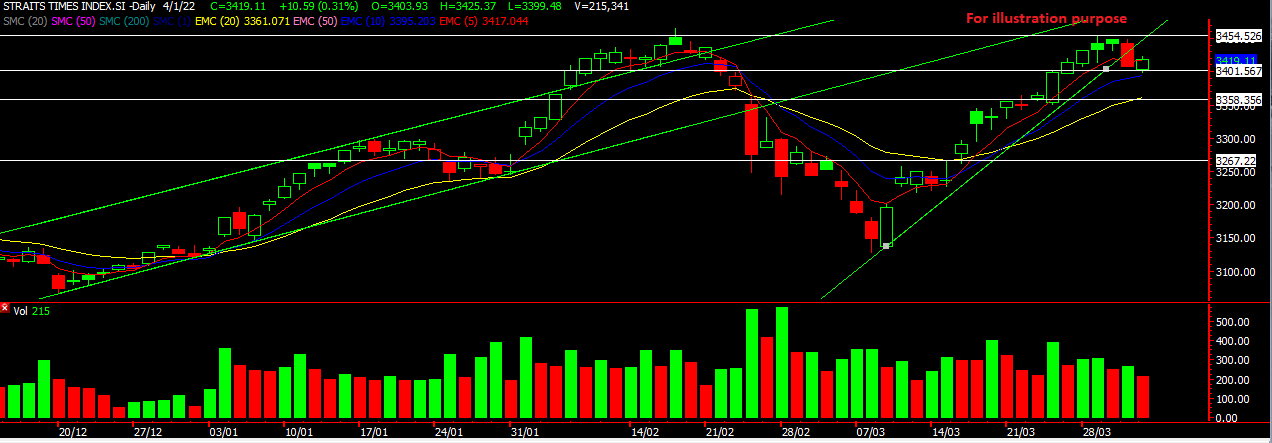

STI

STI did much better than its peers in the region and outperforming the HSI for this week. It has reached our target upside resistance of around 3249 and pulled back ever since then. Banks led the way but gave up its gain on Friday as traders took profit after a good week. Counters like yzj shipbldg and First Resources also a nice upside leading it to hit our targets this week. Once a healthy pullback is done we might see STI moving back up to 3297 region. Be fast and nimble under such market condition.

Head over to our Facebook for more updates on the S&P500 and Nasdaq which has both shown strength through the week.

Yours

Humbly

Kelwin & Roy

Melvin Lim, the Co-Founder of PropertyLimBrothers to share his views on the recent rise in interest rates and market trends.

Melvin Lim, the Co-Founder of PropertyLimBrothers to share his views on the recent rise in interest rates and market trends. and unsure of when to enter the markets, then we got a solution which might help you.

and unsure of when to enter the markets, then we got a solution which might help you. So mark your calendar, invite your friends and come soak up the knowledge As spaces are limited and we’ll be expecting a huge turnout, do register with the link below as soon to avoid disappointment.

So mark your calendar, invite your friends and come soak up the knowledge As spaces are limited and we’ll be expecting a huge turnout, do register with the link below as soon to avoid disappointment.