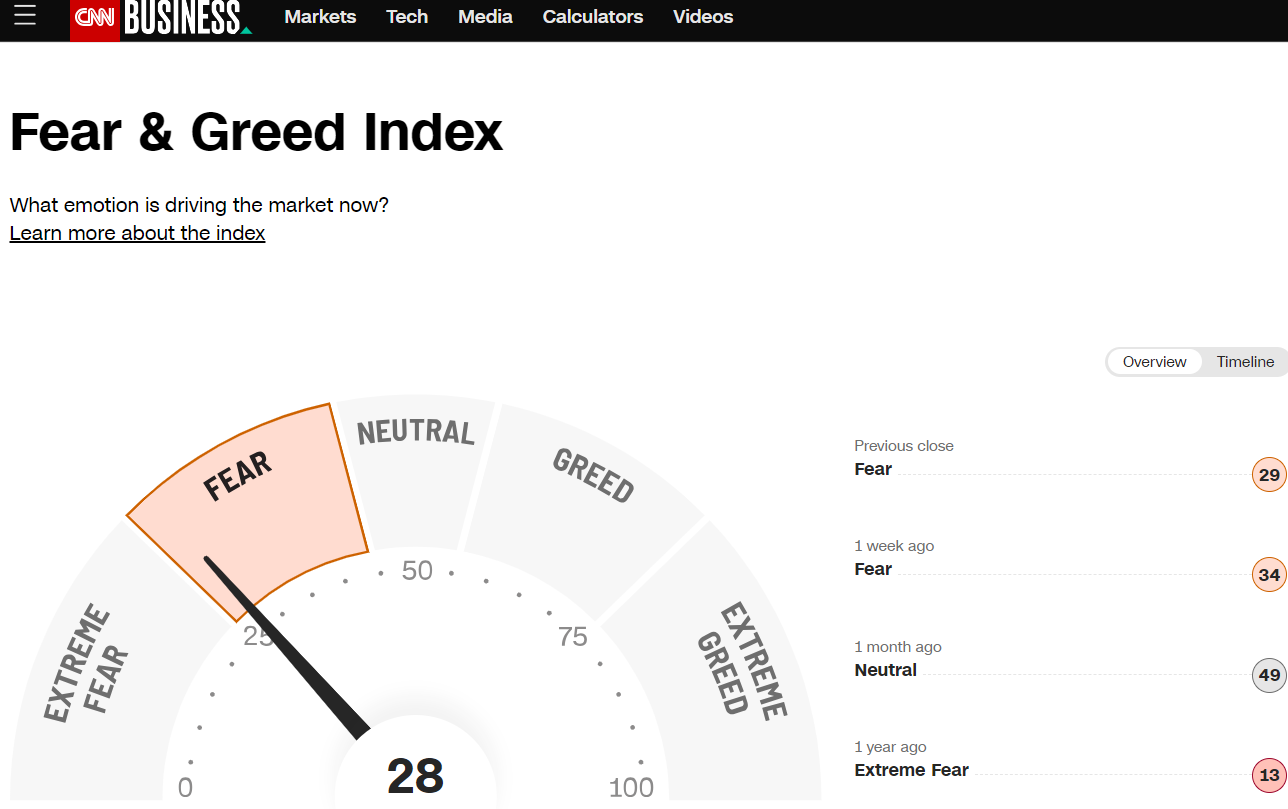

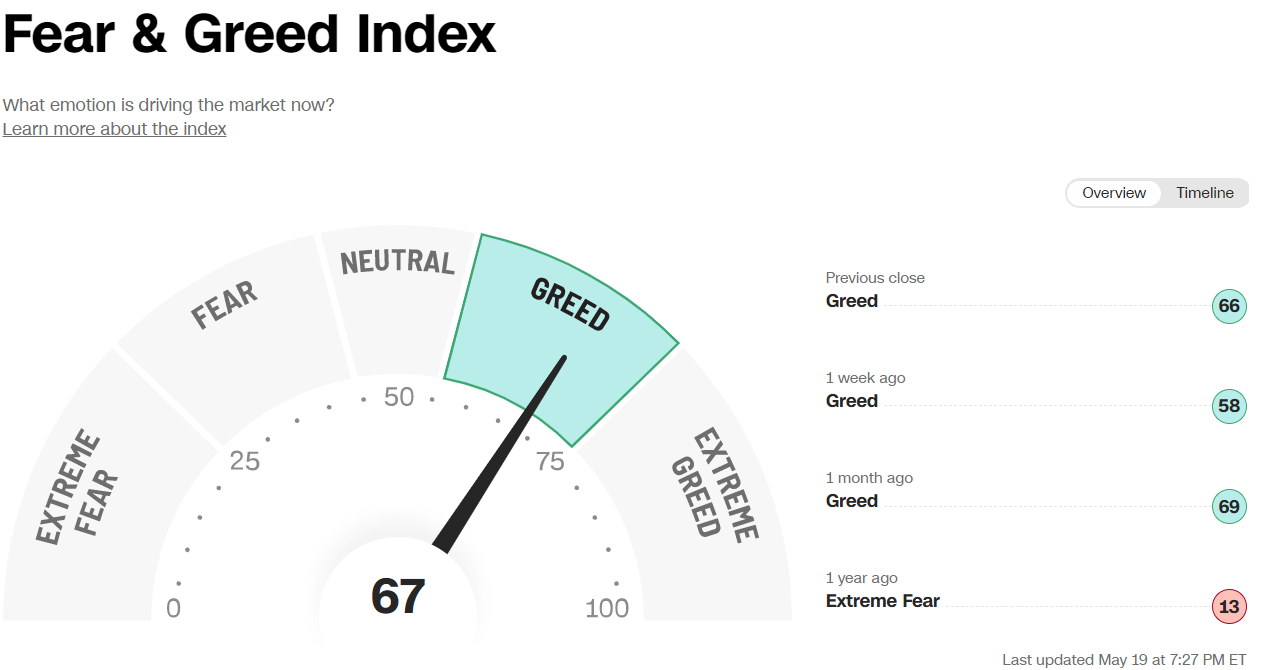

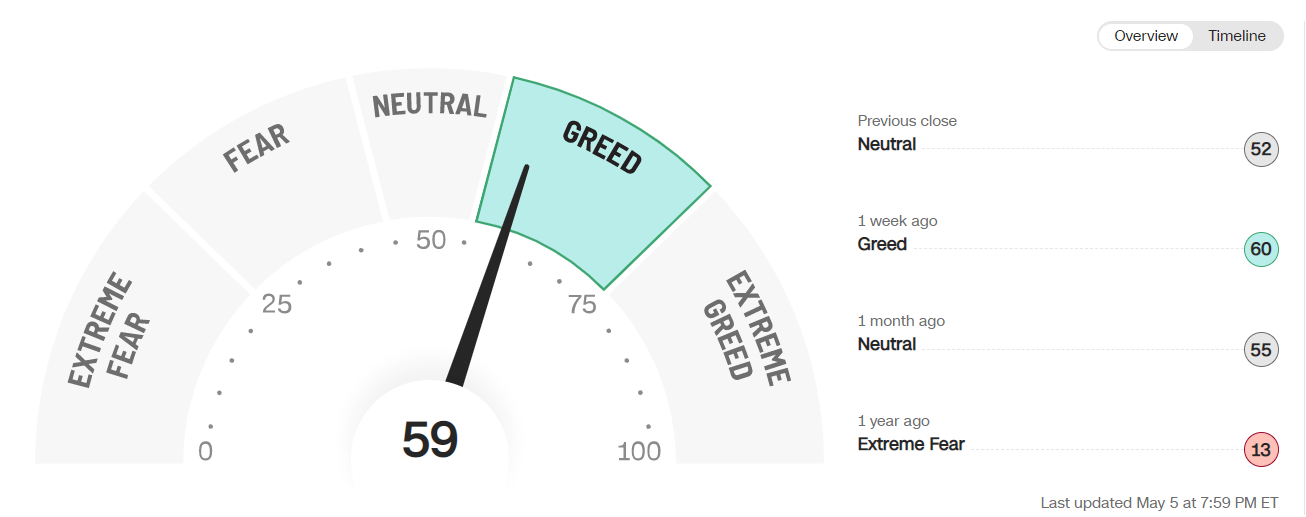

We can see the momentum in the US market is slowing down. After a huge rally its not uncommon for market to slow down. The Greed & Fear index which is one of the tool we use for reference is in the GREED quadrant currently. We could still see market push into the extreme greed before we start to get more cautious. S&P500 could push up to around the 4600 before some pullback. The Nasdaq has already broke above the previous high and also hovering around there.

For this week US inflation data will once again be looked at. Data will be out on Thursday which could bolster the case for an end to the Federal Reserve rate hikes.

China is to release official purchasing manager indexes for November on Thursday, with investors on the lookout for any signs of a recovery in the world’s second largest economy.

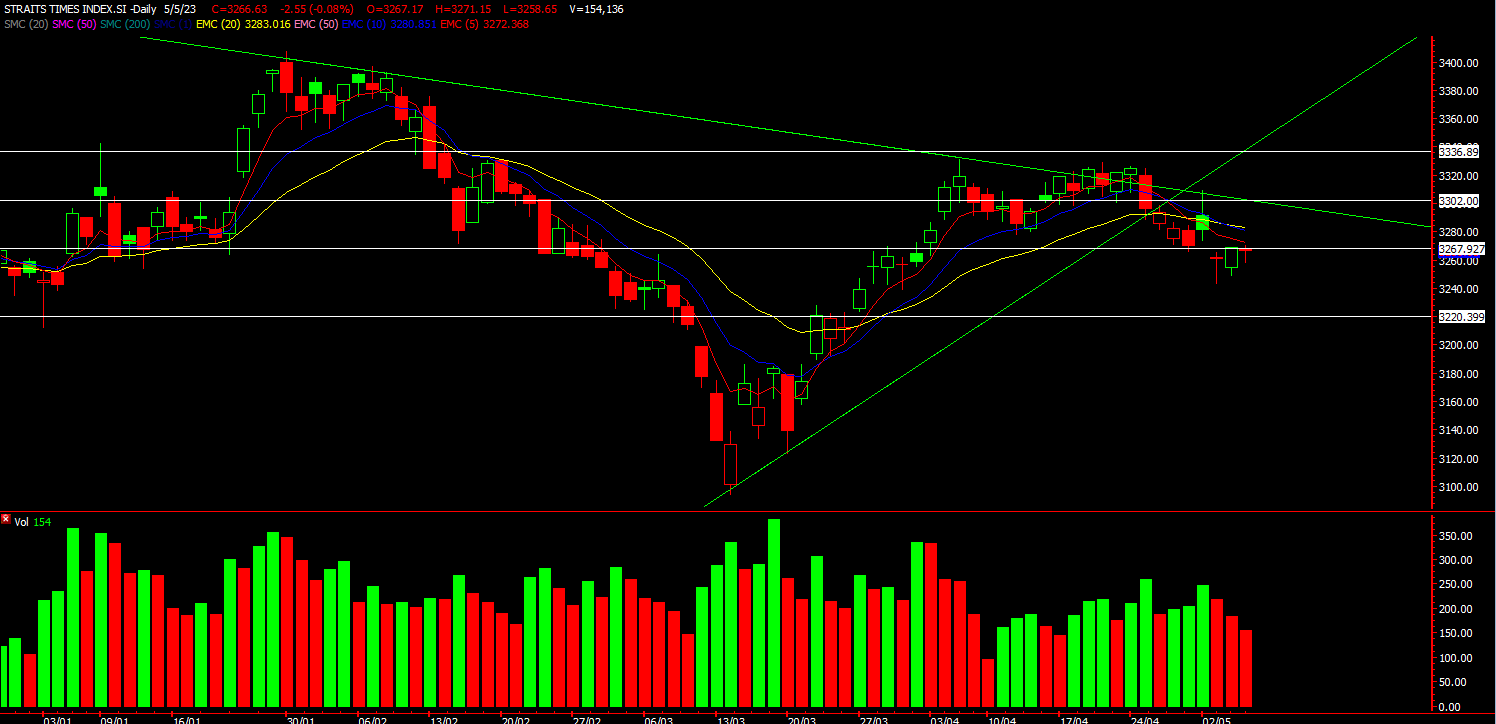

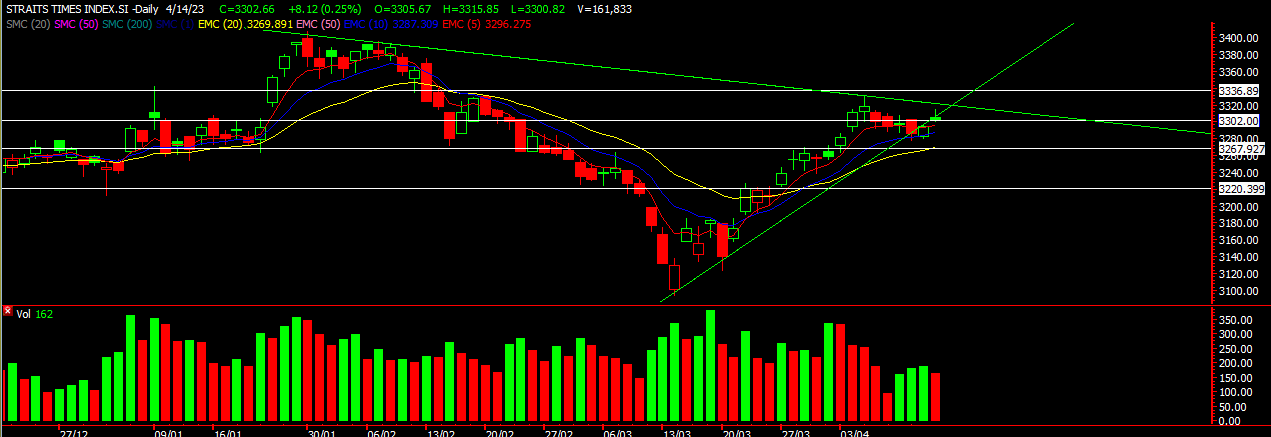

STI

Our Straits Times Index as mentioned before is lackluster with not much catalyst. It has been going sideways as our banks has been coming down after their results. We could see the STI heading lower should US side start to pullback. 3050 once again could be a support level before bouncing up again. Most blue chips are also in a sideways trend. We’ve been looking at S-reits as interest rates could have peaked which is good news for Reits.

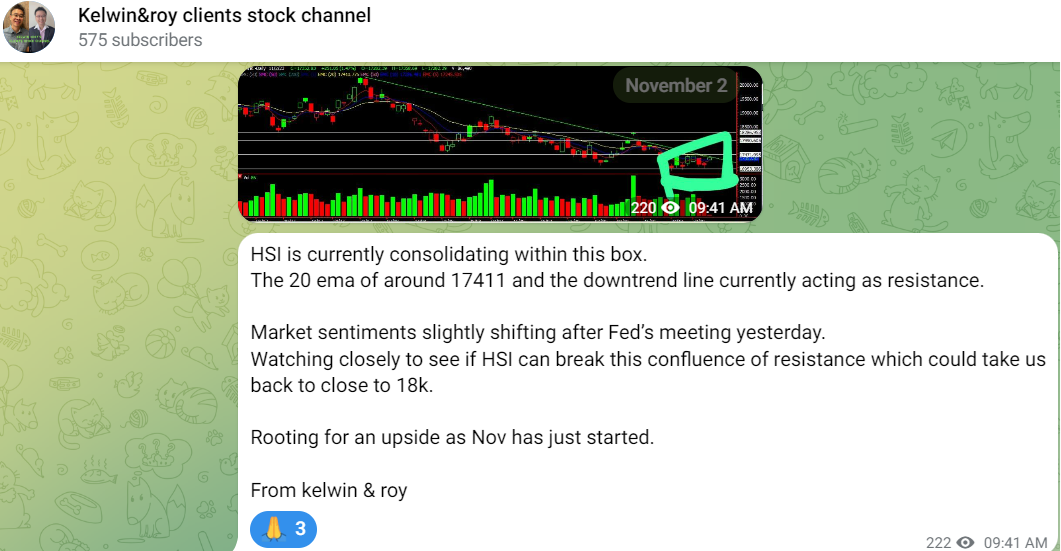

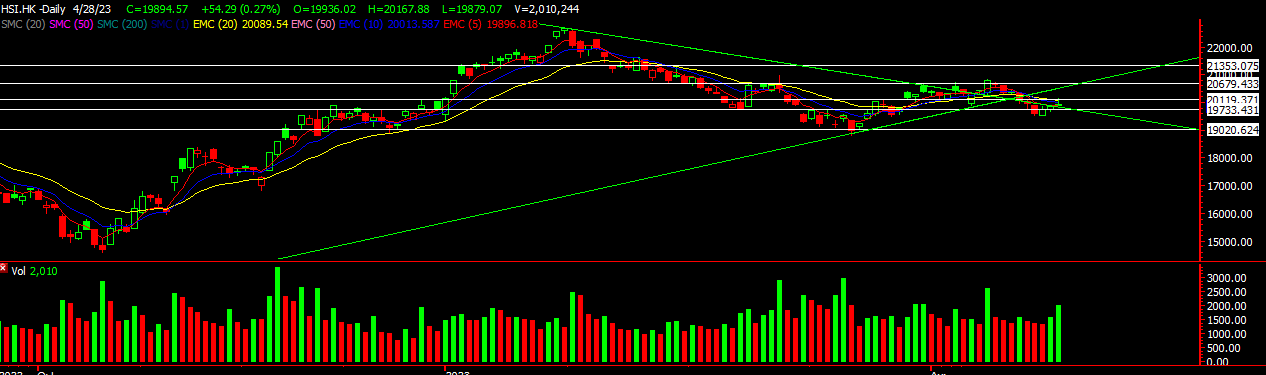

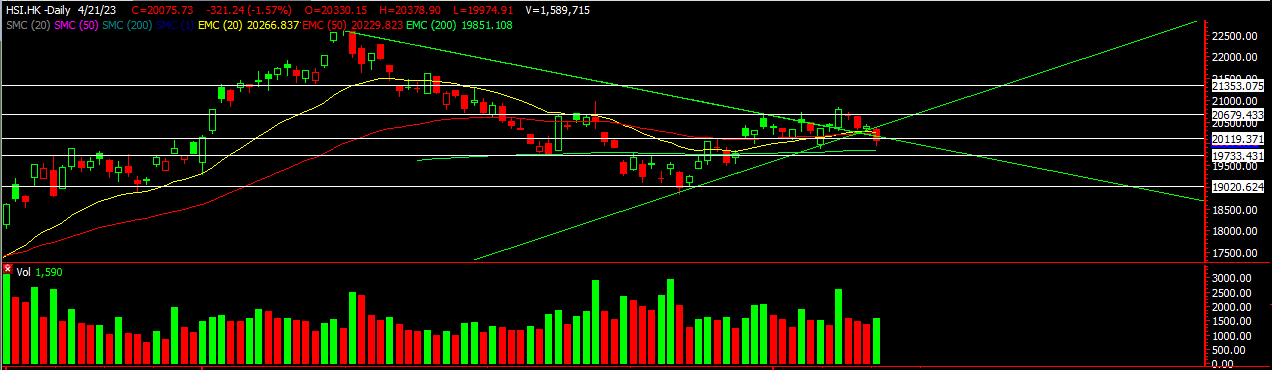

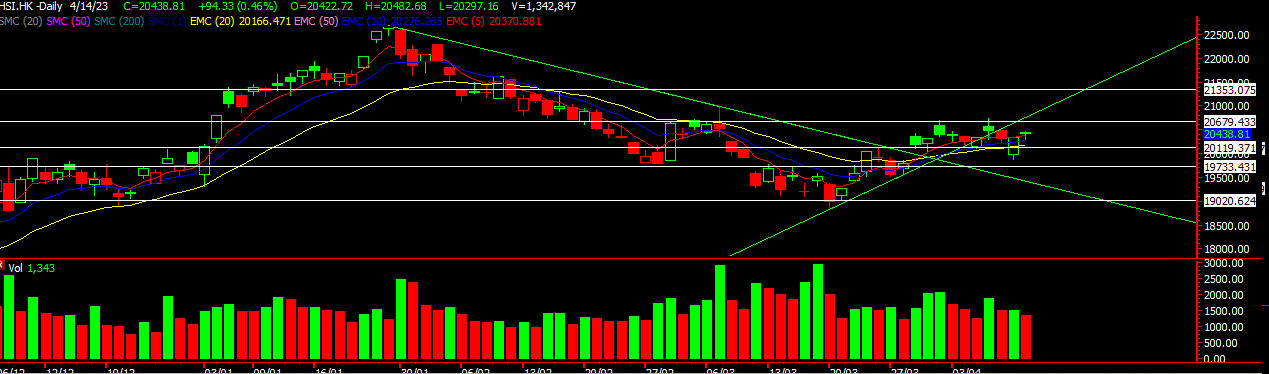

HSI

The Hang Seng Index also couldn’t push above its resistance line despite good closing from US side. For this week we could see the HSI head down towards the 17k level. HSI has been trying to find footing but with every rally it pullbacks. Not the best signs for now and for trading wise one got to be fast for HSI until the trend changes. Don’t expect too much on the upside and take your profits fast rather than facing the whiplash. Until HSI can stay above the downtrend line, we could see range trading so be fast!

Yours

Humbly

Kelwin & Roy