5th August, 2019, 12:55 PM

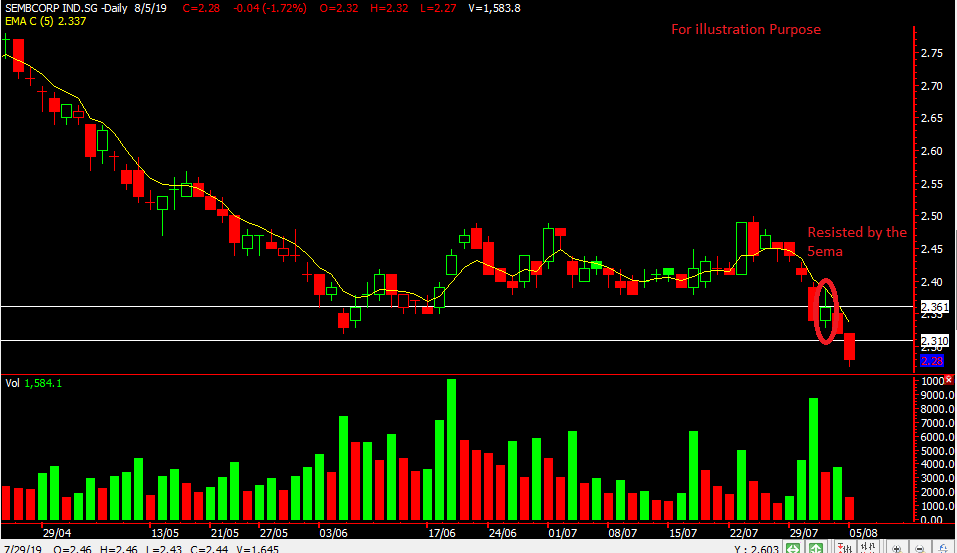

Chart Source: Poemsview 5th Aug 2019

Sembcorp Industries together with other blue chips like the banks and property stocks took a beating since last Wednesday before fed concluded their meeting.

The 4 days drop in STI took out gains from the last two months! Amazing! 4 days drop and there goes 2 months of gains!

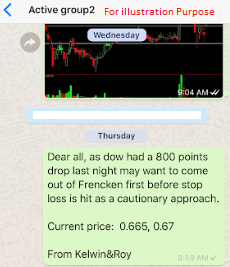

It was a very fast and furious drop that we have experienced and a trader has to be swift and decisive.

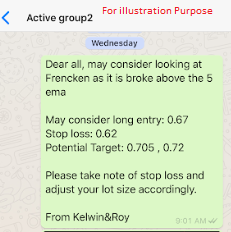

We’re glad we managed to catch some of the counters that fell and Sembcorp Industries is one of them.

Our EXCLUSIVE CLIENTS were alerted and also warning them of the impending release of their earning results. There was a little time left but it’s always good to be mindful of the earning results so as not to be taken by surprise.

Sembcorp Industries is nearing our second target of $2.26 and because results will be out soon so taking some profit is always good.

Learning to short is vital to today’s market. As we have witnessed how fast the market can turn and knowing how to short will allow you to ride this downturn.

We’ll be conducting a seminar on 2oth Aug ( Tuesday) at 7:30pm on how to use CFDs to short the market especially in such times. Knowing only how to Long and not SHORT would put a trader in a severe disadvantage as he or she can only trade in one direction. Hence it is of utmost importance to equip oneself with the knowledge and tool for shorting to hedge and manage market volatility .

Sign up Via the link below:

https://www.eventbrite.sg/e/trade-war-interest-rate-cut-how-to-use-cfd-moving-average-to-manage-current-volatile-market-tickets-67919419813

See you there!

Yours Humbly

Kelwin&Roy