As we say goodbye to Jan 2023, is this year turning out to be more promising than last year? Stocks have had a stellar start to 2023 and S&P500 is up 6.2% A solid Jan could be a good sign for the market and potentially foreshadow a continued uptick in the months that follow. Of the five instance in which the S&P gained more than 5% in Jan after a negative year, the benchmark index rose 30% for the year on average according to Carson Group’s Ryan Detrick.

So are you bullish or bearish this year? and just sharing a slide from our webinar just last week on what happens after a negative.

So with that combined, we’re quietly bullish for this year and with pullback presenting opportunities if you missed out on the recent rally.

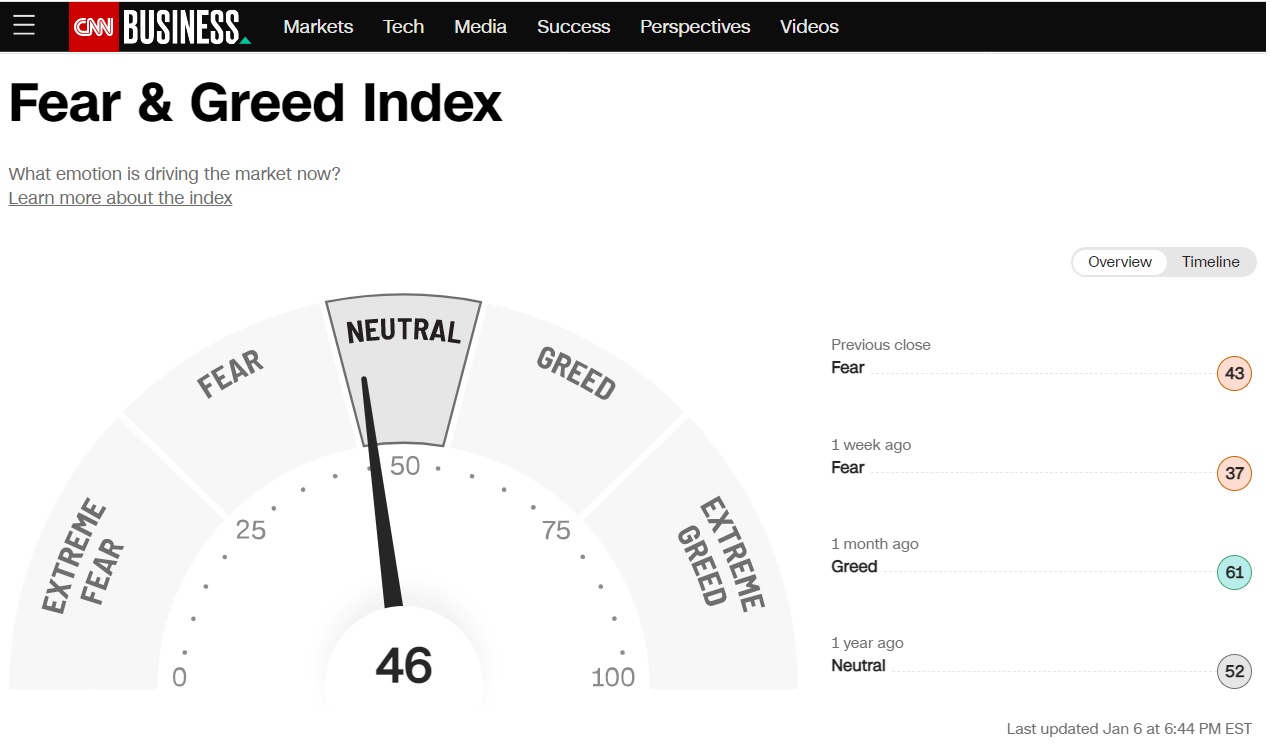

For this week, markets will be looking to Fed’s chairman Powell speech and with the blowout jobs report on Friday, this could put a dampen on whether Fed will pivot sooner rather later. Also, watch how the market reacts! IF Powell remains hawkish with a tough stance on interest rates and market still rallies, then this might signal that market has looked past all these interest rate narrative.

China-US tension is also rising with the Air Balloon being shot down over the weekend. Watch for more development as any retaliation on both side might cause a temp knee jerk reaction.

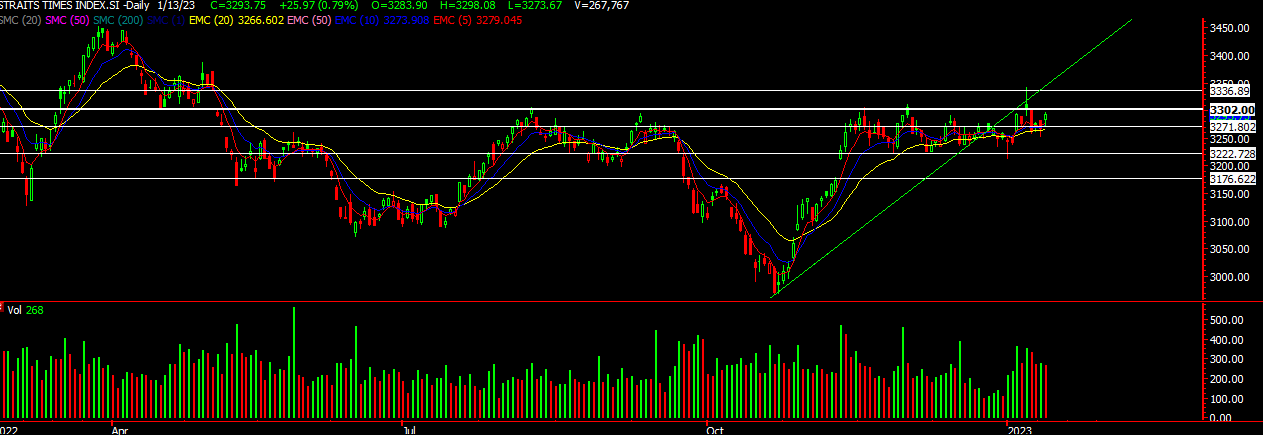

STI

STI was consolidating for the week after reaching our resistance. As negative sentiment might flow from US closing plus Fed’s upcoming statement we might see STI opening lower and pushing down lower for the week. Immediate support at 3372 then 3336 then 3302. Quite a few blue chips in the STI has moved up so pullback now is expected.

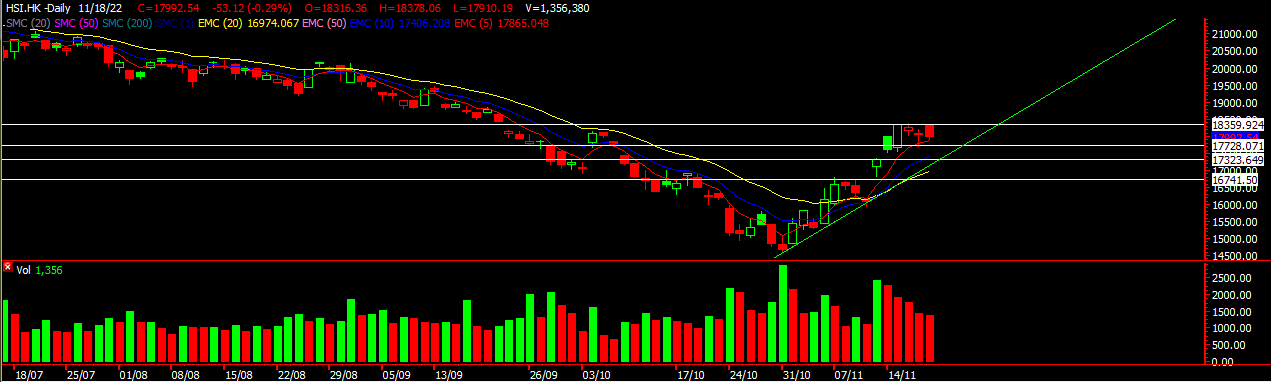

HSI

HSI seeing some pullback for the week as we all hoped for! It has come down to our first level of support which is that uptrend line and the 20ema. It present an opportunity for a small entry especially for those who missed out on the recent sharp rally. A further pullback to 20624 would present an even better entry so don’t miss out! Big tech stocks are also on the radar, Baidu, Tencent, Alibaba are just a few to name.

S&P500 has reached very close to 4200 and seeing some pullback. Head over to our Feacbook page to check out our updates on the S&P500 and Nasdaq.

Yours

Humbly

Kelwin& Roy