Sembcorp Industries – [ $1.55 Target Hit! Next Target?? ]

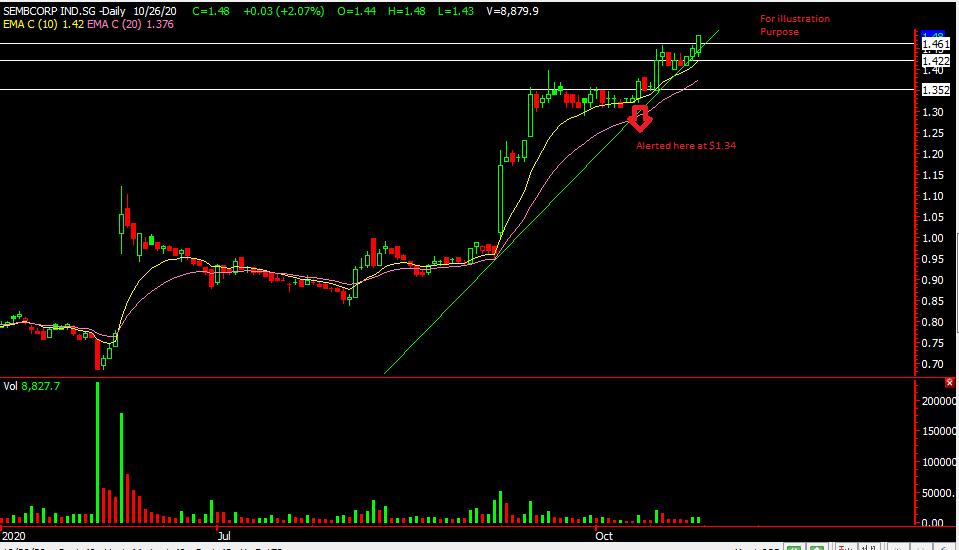

Chart Source: Poemsview 27th Oct 2020

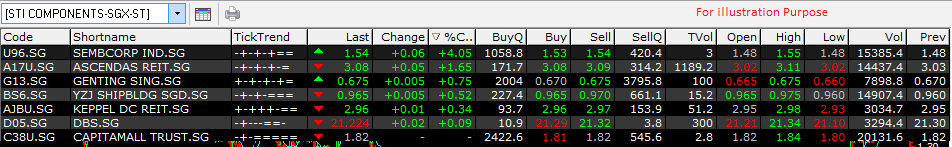

Sembcorp Industries gave us a pleasant surprise and moved up over 4.5% to hit our target of $1.55 just a day after we posted. Once again it bucked the overall trend and emerged top for the STI component.

So now that $1.55 has been hit, what’s our next target? We’re looking at $1.60 then $1.64 but of course not overnight unless Sembcorp Industries decides to surprise us! It’s good to learn how to swing your trade using CFD and not overtrade by going in and out. Learning to have a trailing stop is also important in order to ride your trade. The 10ema would be our support for now.

One suggestion might be the breakout point of $1.46 as ur trailing stop or maybe even $1.50 if u want to protect more of your profit. Remember to always take some profits off the table so you can utilize your funds too.

Want to cut through the noise and get such trade alerts straight to your handphone?

Then be our EXCLUSIVE CLIENT and find out how much value is waiting for you!

See you onboard soon!

Yours

Humbly

Kelwin&Roy