Are Electronics Stocks Rebounding?

As market continue to roar back our local electronic stocks are looking back in play too.

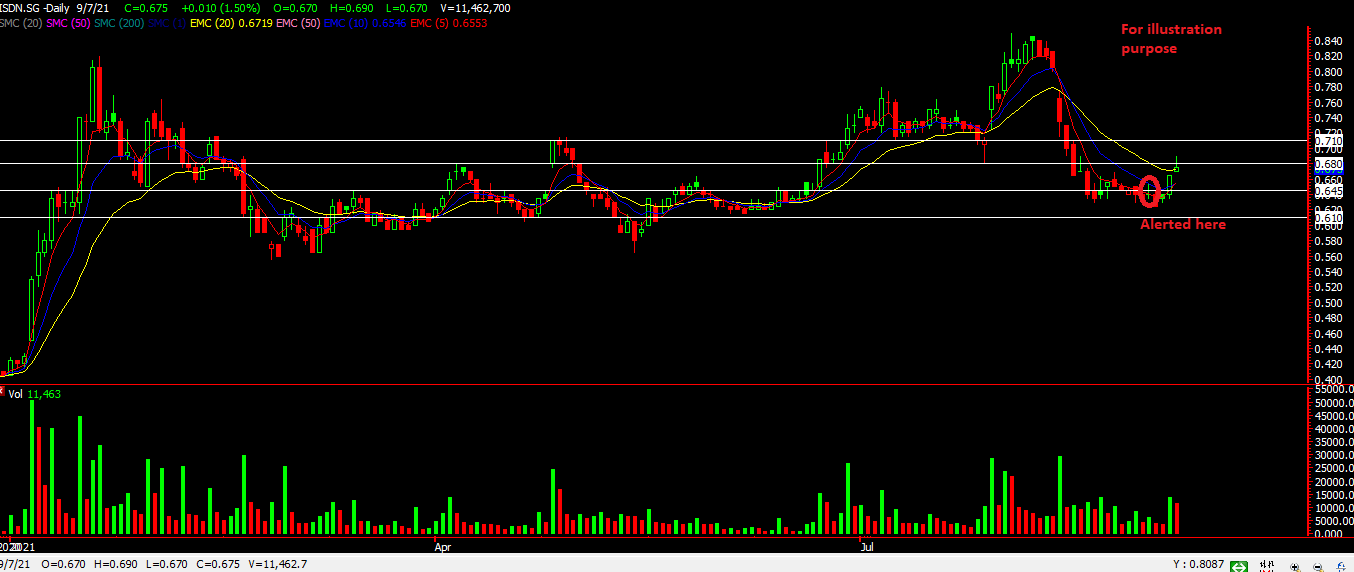

These are four of the electronic stock that we’re looking at and one of it has already hit our first target.

UMS has built a nice base around the $1.10 level and has seen a nice rebound. Current resistance at $1.22 which might see it break above in the coming days as momentum continues to build. There are some levels which we have drawn for the upside resistance!

AEM actually formed a double bottom around 4th march but due to the war in Ukraine and the rise in interest rates, we decided to hold back as there could have been more downside for AEM. But news of Temasek Holdings increasing their stake in AEM saw a gap up which we didn’t chase it. It crossed the 20ema which was a positive sign but as we were having a few more counters on hand, we gave this a missed! AEM does look like it has more room on the upside to that downtrend we drew and maybe even to $4.89. Volume is increasing which could help drive the momentum up.

Frencken hasn’t moved much and we’re looking at it with interest. =) Volume increased with a small bar! Watching out tomorrow.

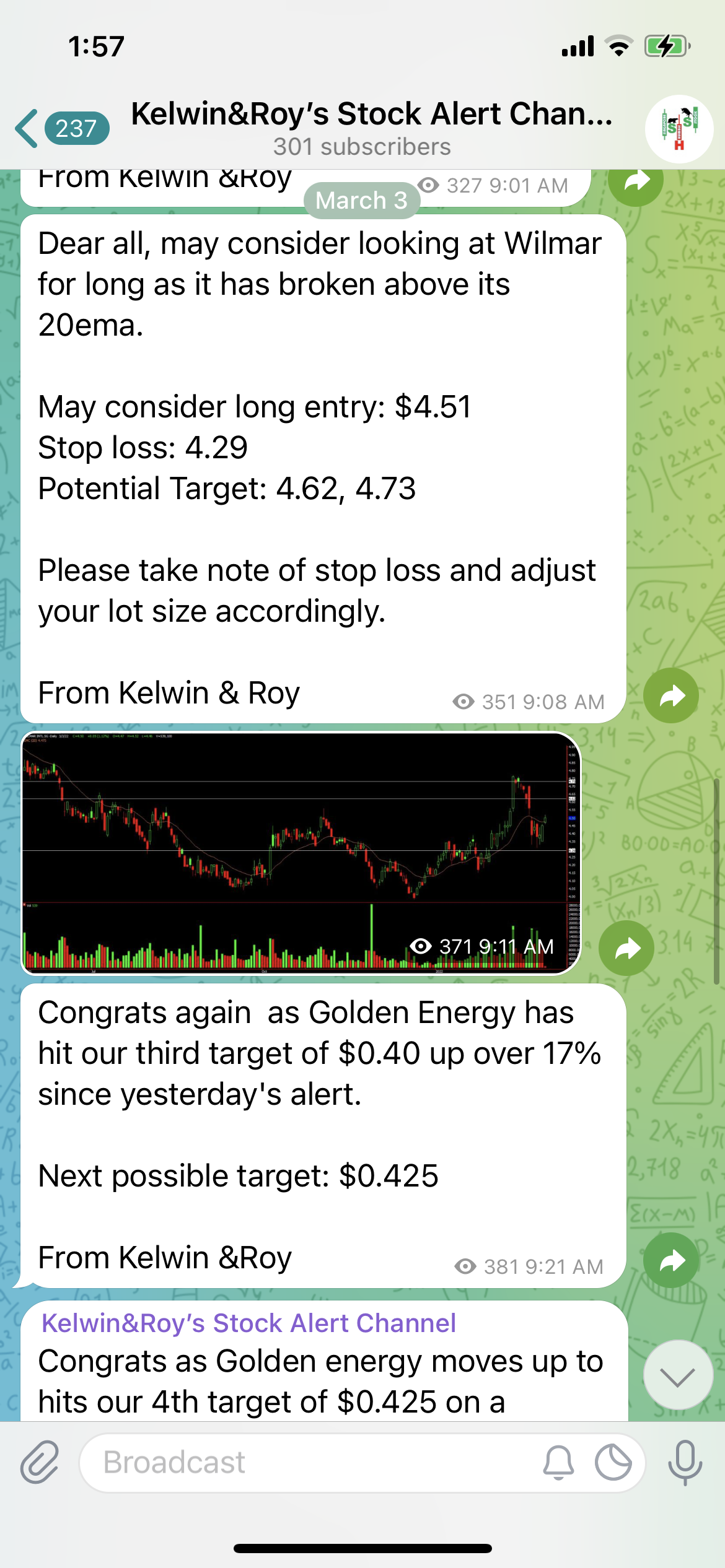

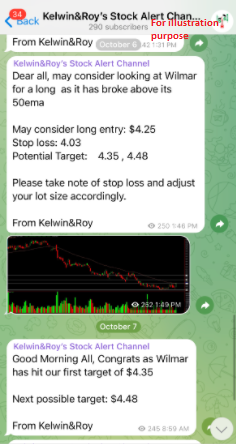

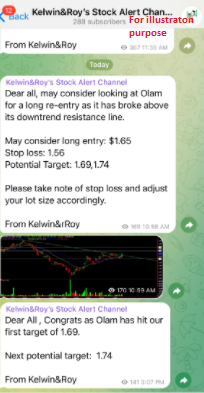

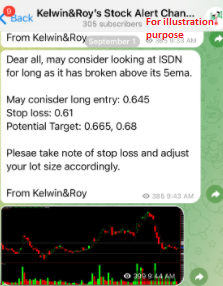

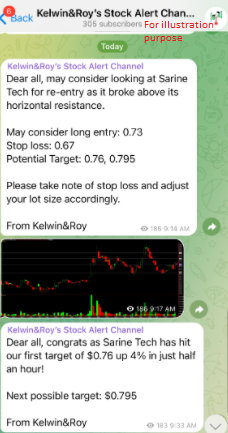

Want to be alerted earlier before the breakout?

Want to know what stock we’re looking at next?

Be our EXCLUSIVE CLIENT and be alerted earlier to not miss out!

Yours

Humbly

Kelwin&Roy