This Sector Looks Ready For A Bounce

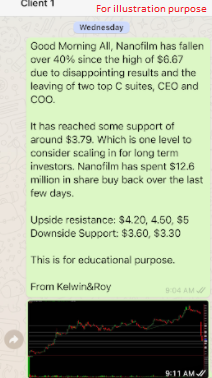

This sector as a whole hasn’t been performing well due to the rising rates and a possible slow down due to disruption. Our electronic sector as a whole hasn’t been doing well and has been on a steady decline. But could a rebound be in sight with an improving market sentiment?

UMS has broken above its 20ema which is a positive sign as its the rare few E stock to be above the 20ema. It is currently resisted by the downtrend which also coincides with the 50ema. If this breaks we might see it move higher to the possible resistance levels drawn. There is an increase in volume too. The key is to watch for the break first.

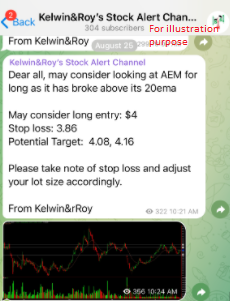

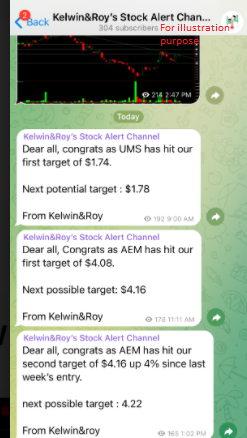

AEM also showing strength with an increase in volume today. It has broken above the short term downtrend line but is near the resistance of the 20ema and the horizontal resistance of around $4.50. Watching for a good clean break of these resistance for further upside!

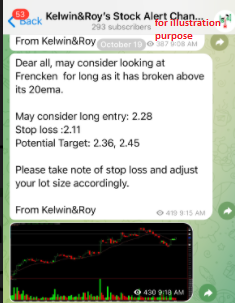

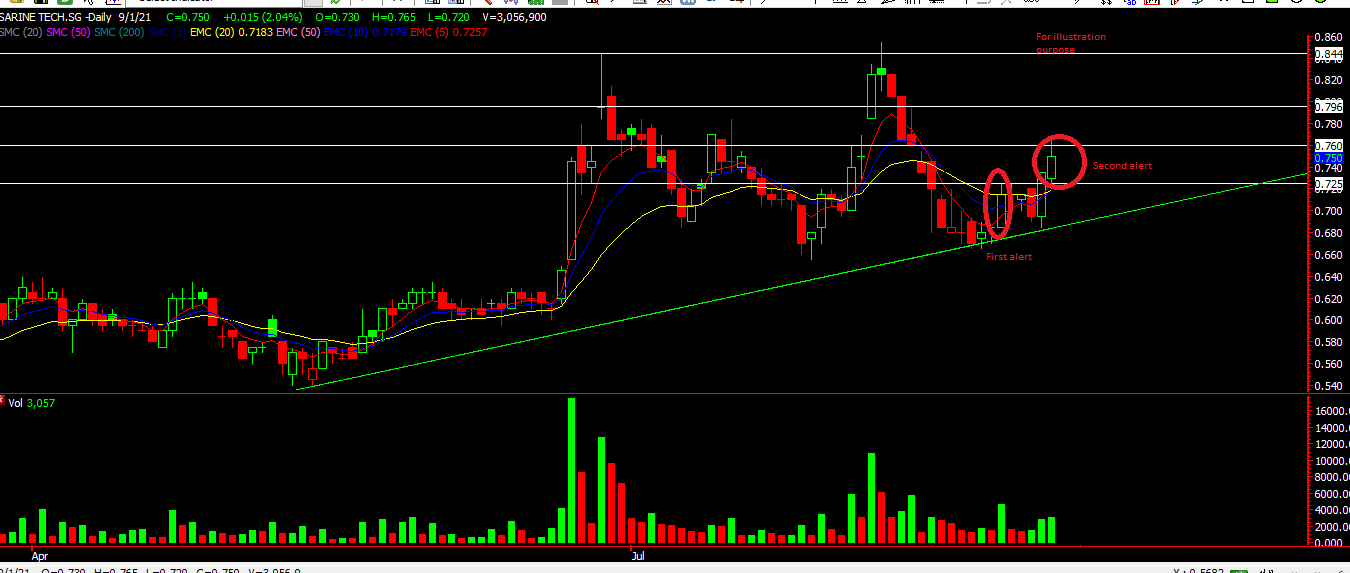

Frencken also consolidating at the lower end and currently resisted by the downtrend line. There has been an increase in volume today also which is showing interest in Frencken. The next upside resistance is at the 20ema and also the horizontal resistance.

These are the three Electronic stocks we’re closely watching for a rebound. Are You?

Yours

Humbly

Kelwin & Roy