13th August, 2023, 11:00 PM

Some might feel a bit sad as the markets have been pulling back the last week or so with the Nasdaq pulling back about 6% and the S&P about 3.5%. As we have been mentioning for a few weeks to be prepared for a pullback especially after such a nice rally for the past few months. Many reasons can be attributed to the pullback like inflation slightly ticking up, US banks downgrade and so many more. What matter most is to make use of this pullback to continue to add to solid companies or for those who missed out on the rally to finally get in.

Source: Cnn greed & fear index

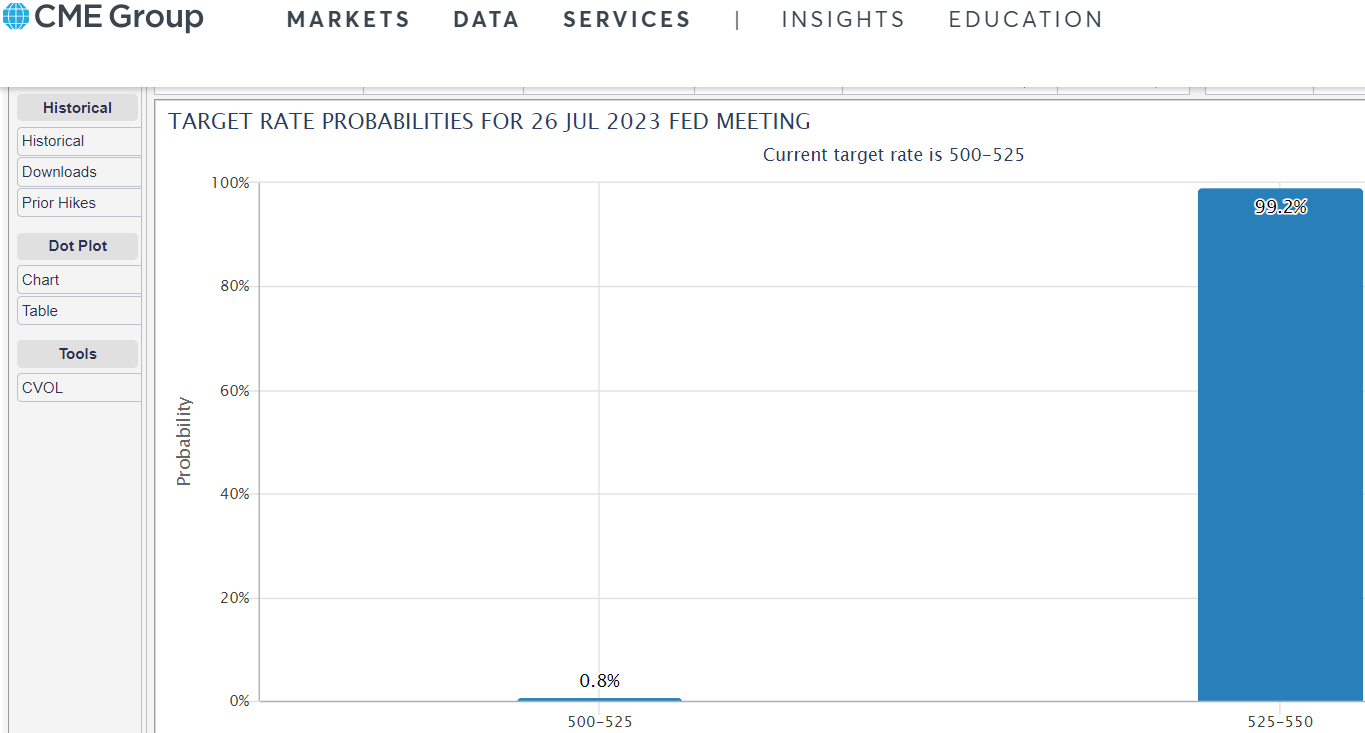

As cautioned back in July when the indicator was at the extreme greed area and when everyone was rushing into the market for the fear of missing the boat we patiently waited. Finally we are seeing some pullback and some bad news starting to come out of the market.

Nobody will know how much this pullback will last. But a good 10% pullback could be a chance to make an entry. Also , take a look at your individual stock as they could pullback more than the S&P like Microsoft is already down 12.5%. =)

S&P 500

Source: Tradingview 13th Aug 2023

S&P500 as cautioned many times saw a nice pullback for the week. It has covered the small gap of 4463. Bad news is starting to flow out of US and for the untrained investor then this might cause some panic. The first support for the S&P500 could be at the 50ema of around 4429 level then then 4383 and even 4300 These are some levels to scale in if you’re looking for an entry.

Nasdaq100

Source: Tradingview 13th Aug 2023

Nasdaq100 has pulled back more than the S&P500 because it has also risen more during the rally. Tech stocks lead the way when the recovery starts and when it pullback then its time to scale in at the support. For Nasdaq, the first level of support is at 15000 level which we saw some rebound. This rebound could be short lived to about 15300 and then a downside support target of 14720 level might be touched. Don’t miss out on this opportunity to scale in.

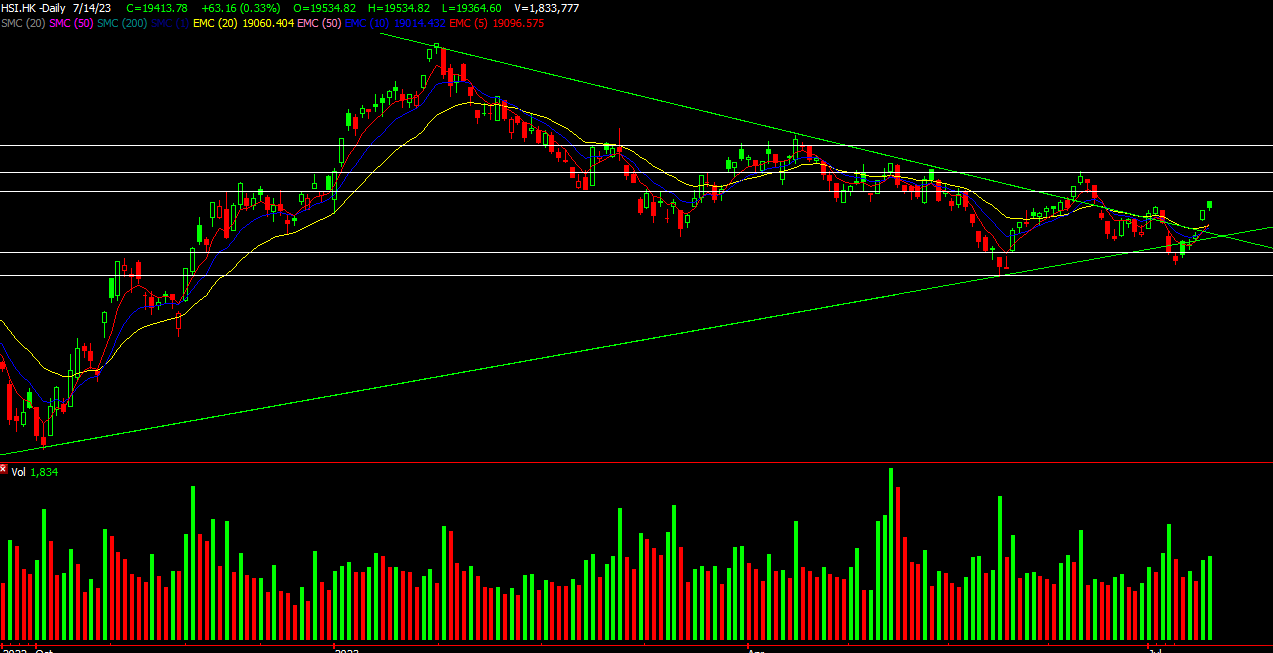

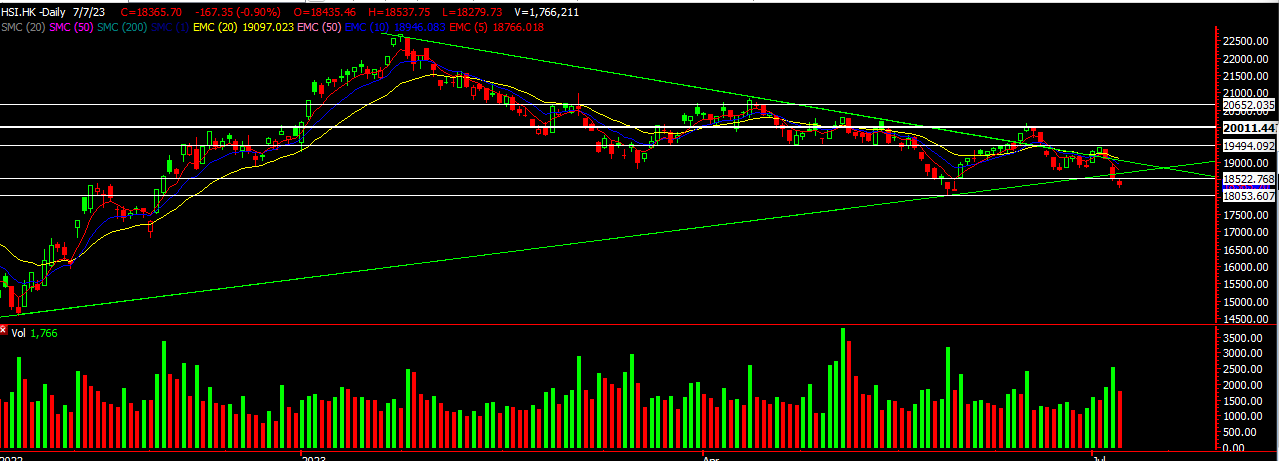

HSI

Source: DZH International Advisor 13th Aug 2023

The Hang Seng Index did not close that well for the week. A red bar with volume could see more downside for the HSI this week The next support is at 18560. This has to hold for the hang seng to resume its uptrend and not get back down to a downtrend mode. Will be watching closely for this as this could be another buying opportunity. Still a lot of negative news and deflationary concerns surrounding the China markets which is causing a stall in this rally. China needs a more conclusive policy to help boost the market sentiments and get them out of this state.

STI

Source: DZH International Advisor 13th Aug 2023

The Straits Times Index bounced off the 20ema on Friday but we might continue to see more downside for the STI to 3240 levels. Over there then we might see a good rebound coming in. As Singapore market looks a little dull for now, set your eyes to the other markets for better returns and that is key in order to survival in such a market.

We hope you have gained some insights for the week. As usual, if you need any help in your portfolio or unsure of which stock to enter. Feel free to reach out!

Yours

Humbly

Kelwin & Roy