DBS – [ All Time High! What To Take Note Now?]

Image source: giphy.com

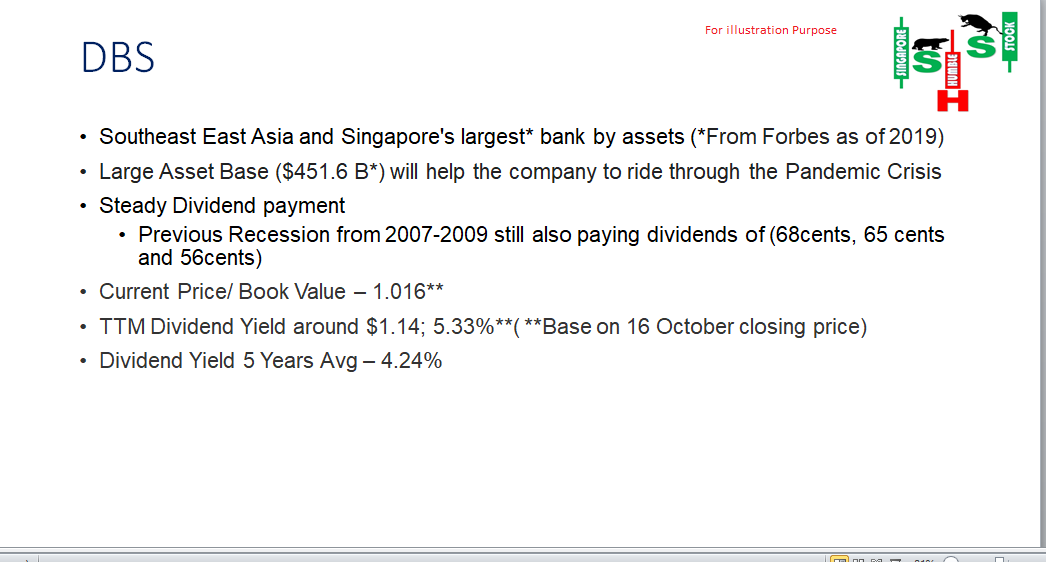

DBS has hit an ALL TIME HIGH (ATH) and given such a climate its in, it deserves a clap! Hitting all time high also means that it has hit our second target of $31.80. The move in DBS is also helping to sustain the gain in our STI as DBS is part of the STI component stock. We’re glad that DBS is moving the way we want it to since our alert at $30.55 before the breakout but here’s a few things to take note of and not get overly excited.

- Its Q3 results are coming out on 5th Nov before market opens. As we always preach, its a gamble to play over results especially if you’re trading the stock. If you saw what happen to IFast after results you will know what we mean. Despite a good set of numbers, the stock got sold down. Could that happen to DBS? will the results live up to the analyst? Who knows? Will the market like the results? So playing over results does carry more risk in our opinion.

- On the chart, if DBS starts showing weakness closing with a weak bar, that might be a sign of profit taking and for those traders, it might be a sign to come out.

- DBS might be running ahead of results as most banks overseas are reporting good results so sentiments and expectations are building up.

So with these points, do take note when trading DBS! Our next upside target is in the message!

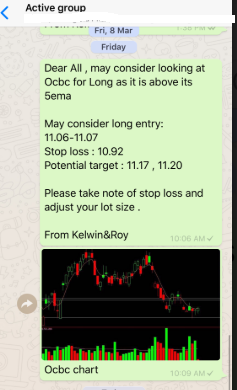

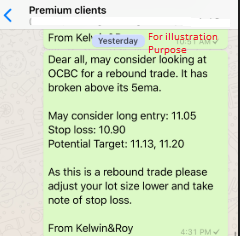

Don’t want to miss out on another trade alert? Want to know what stock we’re looking at next?

Then JOIN our growing community and see how you can receive such trade alert sent to your phone.

Yours

Humbly

Kelwin&Roy