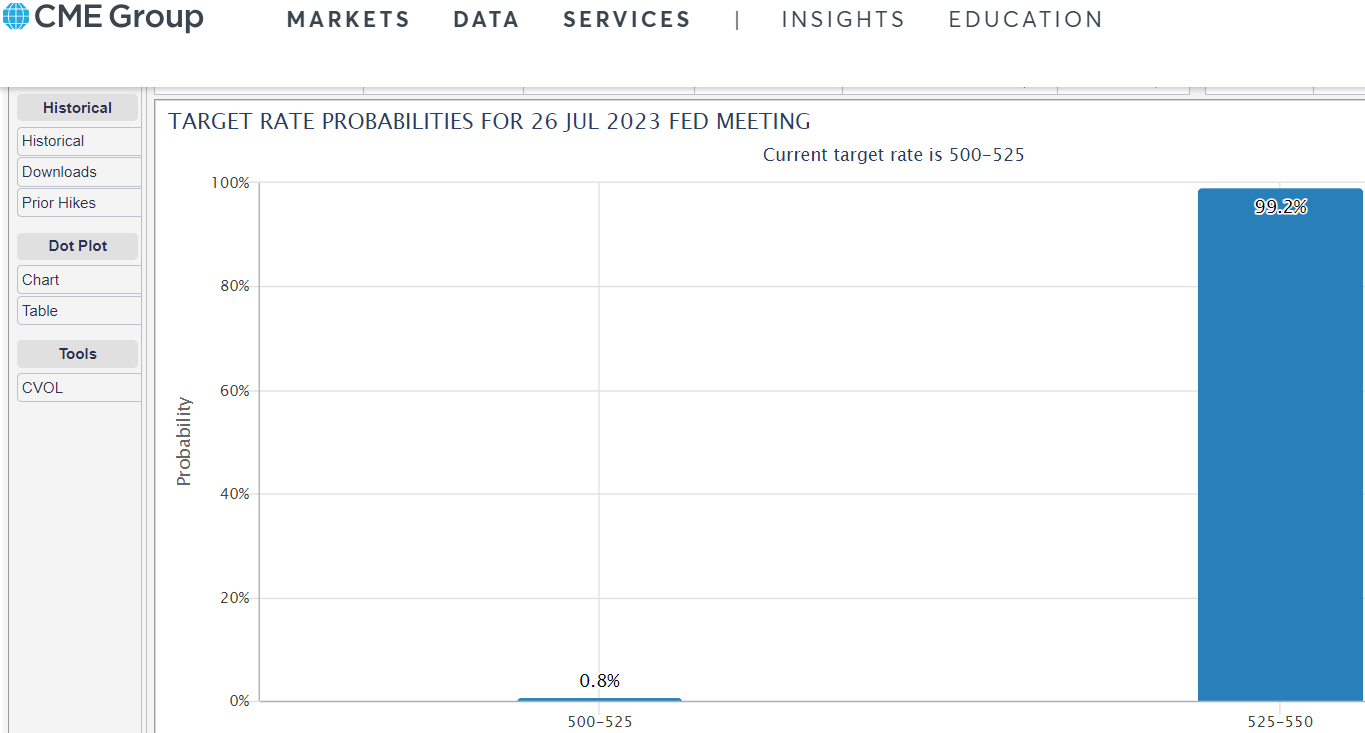

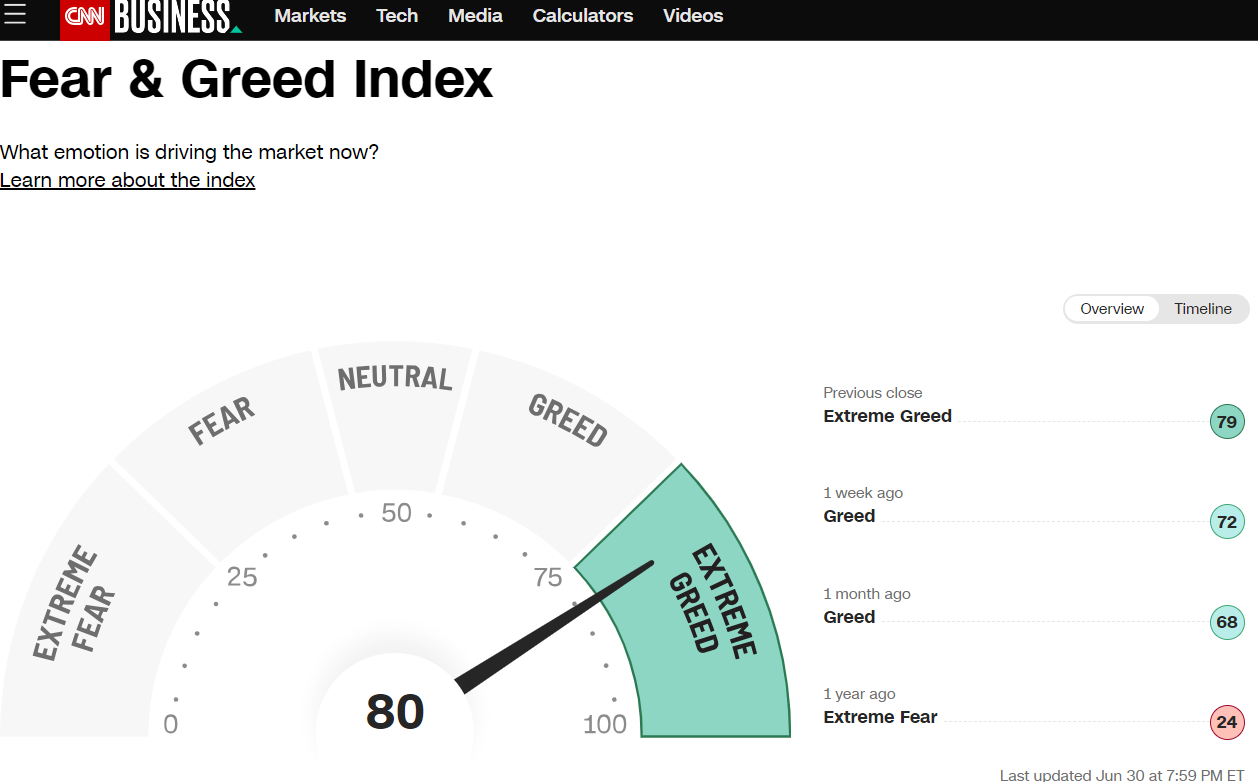

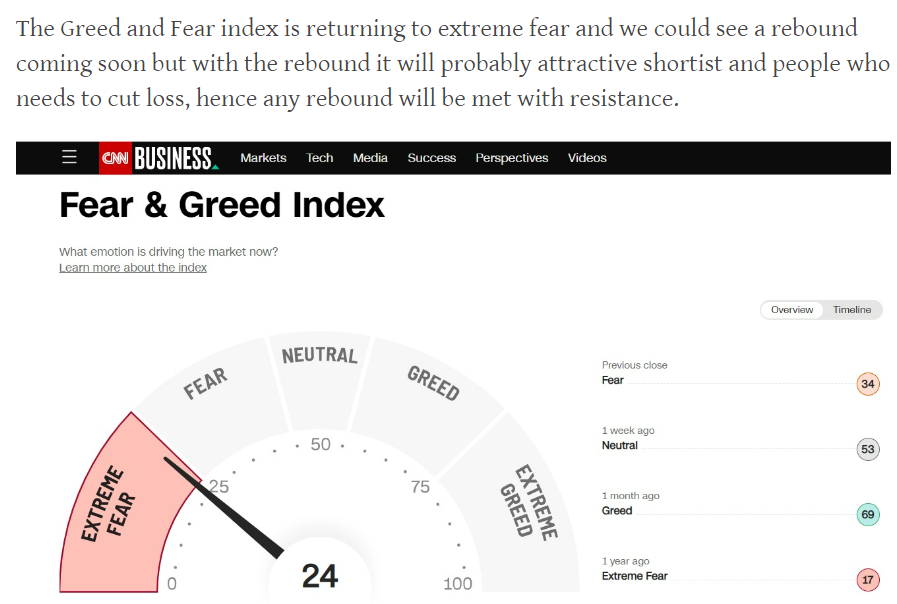

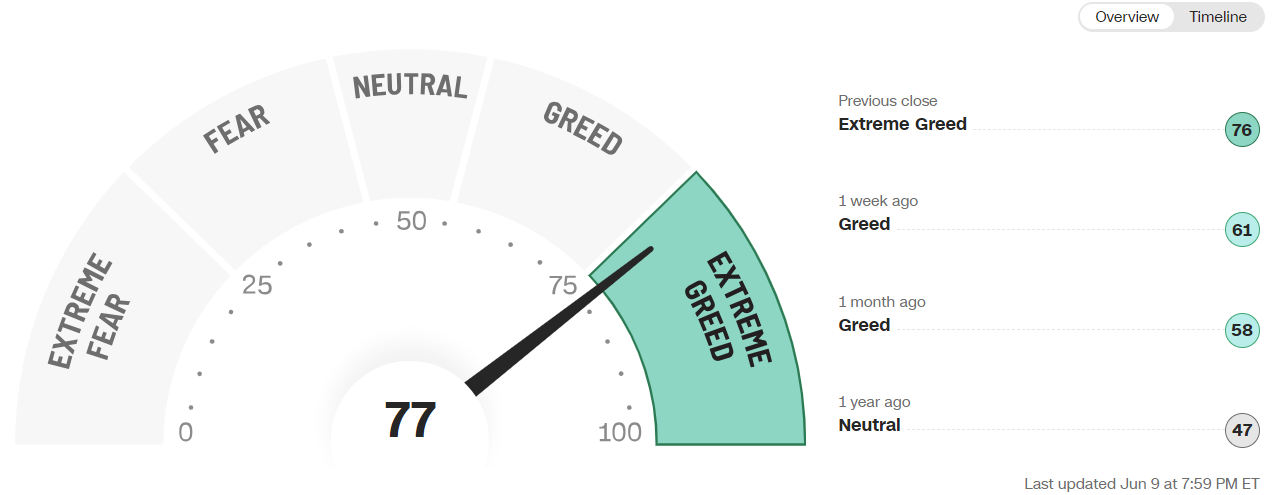

As early as Mid July we’ve been sounding the bell to be careful especially in the US markets when the greed & fear index was at the extreme greed, emotions were raising and investors were rushing in for the fear of missing the next rally. Ever since then, the S&P500 has pulled back about 5% and the Nasdaq about 8%. Market sentiments continue to be weak especially for AUG-SEPT which is seasonally weaker therefore such a pullback is no surprise to us.

Of course time in the market is better than timing the market but as an educated investor we want to do some studies and make the best of what knowledge we have.

We did a simple study for one year for the greed & fear index vs the S&P500. Can you spot anything on the chart??We have highlighted that whenever the Greed&fear is below 50 or swings towards the fear to extreme fear do you notice that market is kind of near or at the bottom?? And what happens next? Its for ur own interpretation. =) but from the looks of it, the bottom usually is near. So for now, market might have a bit more room to go down BUT we can never know where the bottom is and therefore it is important to do a dollar cost average!

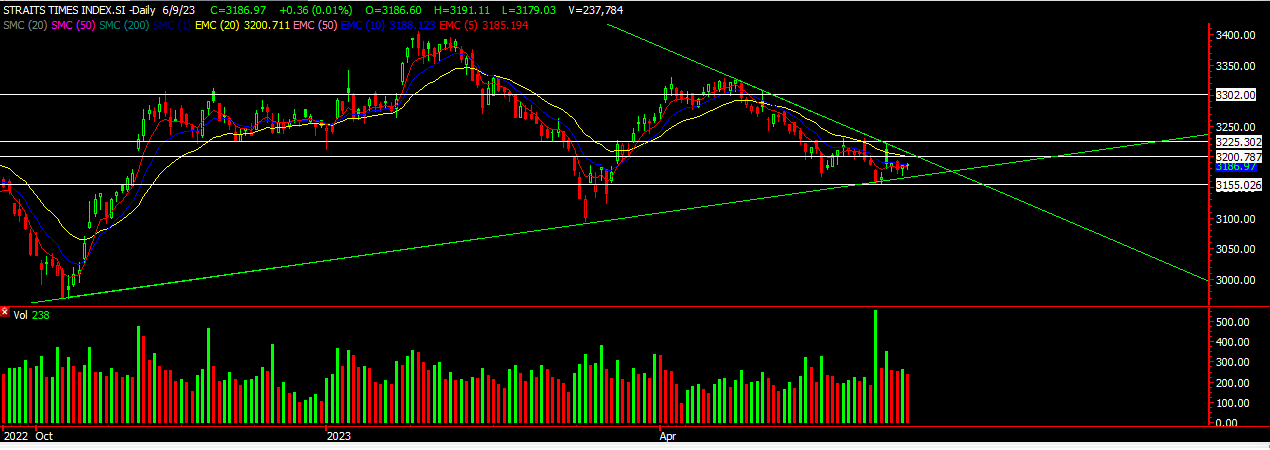

STI

Chart Source: DZH 20aug 2023

The Straits Times Index came off for the week but more than we expected! As world wide sentiments continue to dampen, Singapore market being so small will naturally be affected. We still could see more downside to 3130 levels before we see some meaning rebound. Over there we probably go for a rebound trade as bargain hunters will start coming out. Bank stocks like OCBC is on our radar for a rebound.

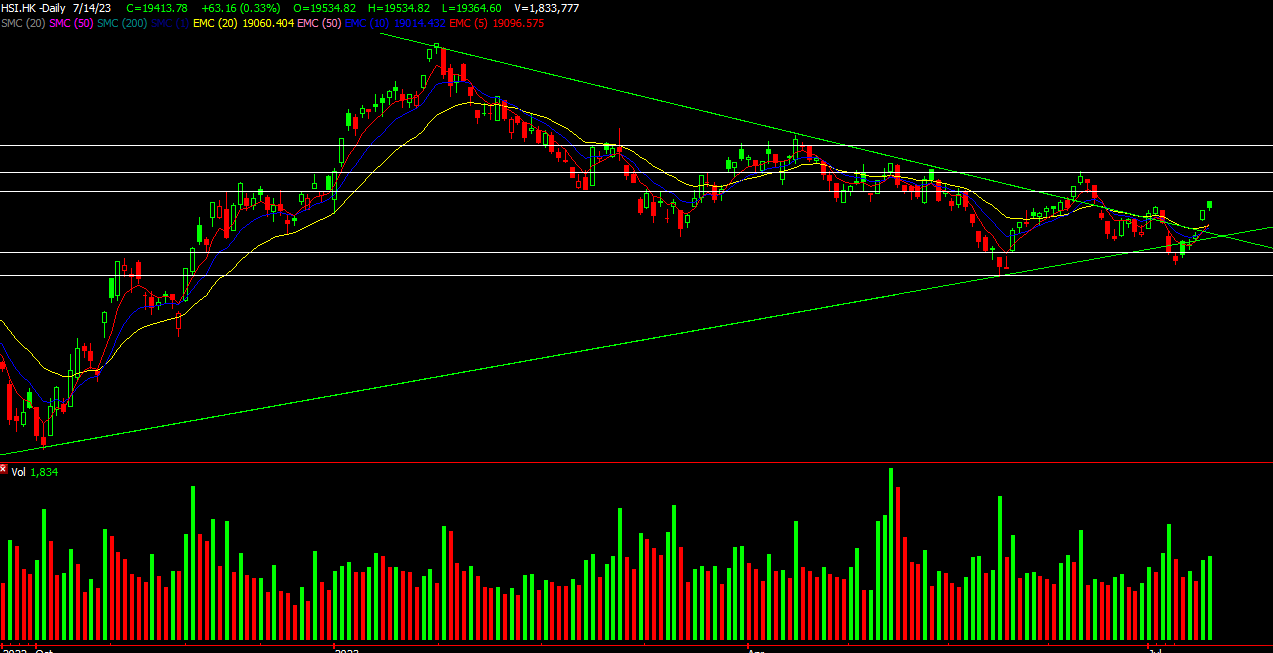

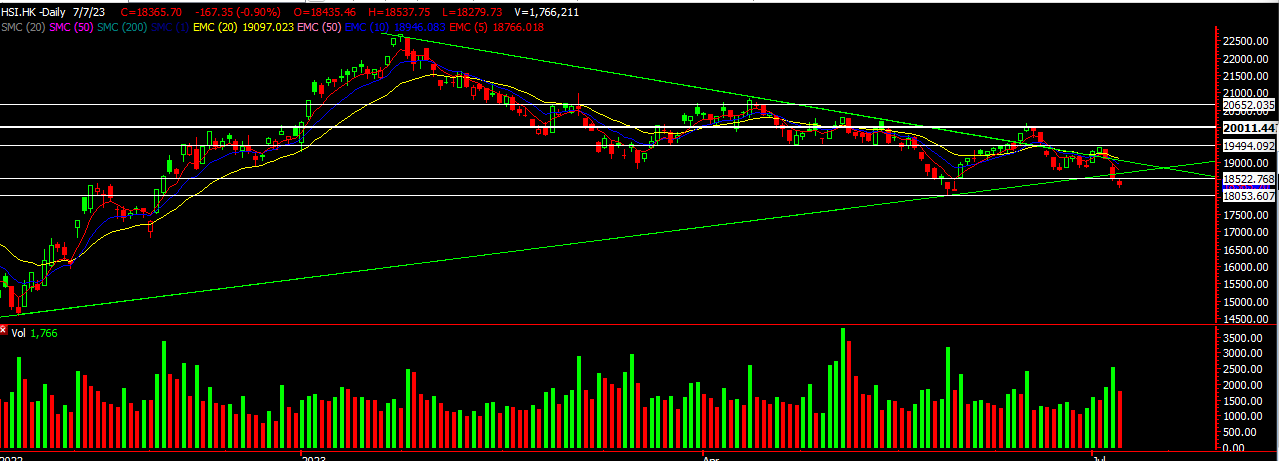

HSI

HSI saw a disappointing close affected by negative sentiments and a gloomy forecast of the China’s economy. Property sector in China continues to slow down with china evergrande filing for US bankruptcy adding to the already tough economy. The hang seng index looks like it might go down to 17400 level first. We need to see a rebound if not the structure for a bull case would not be so good. China government also have to come out with something quick if not the index could even sink to as low as 17k. As always, proper allocation into the markets is important and as HK pulls back for those without any position, then take the chance to scale in. BUT if you are fully allocated into the HK market then focus elsewhere and let time heal this market.

To know more about our take on the US and key points to look at to scale in, head over to our FACEBOOK PAGE.

Yours

Humbly

Kelwin & Roy